This Rising Dividend Stock Has Paid Off For 55 Years

In this low interest rate environment, investors have turned to high-yielding blue-chips as a source of retirement income. This five-part series will outline what I believe to be the top five dividend aristocrat stocks, most suitable for a retiree’s portfolio.

In my first article on dividend aristocrat stocks, I described why the international health, hygiene and paper company giant, Kimberly-Clark (NYSE: KMB), makes a great defensive play.

#-ad_banner-#For my second pick, I want to turn your attention to a dividend champion with a long history of solid growth that dates from 1892.

Originally, this company was the first to sell electric fans in the United States. But, with surging demand during World War I, its product line expanded to include sewing machines, drills and power tools.

Today, Emerson Electric (NYSE: EMR) is one of the largest conglomerates in the United States, as measured by its global workforce of more than 133,000 people across more than 150 countries.

This multinational powerhouse now designs and supplies a wide range of products and technologies for industrial, commercial and consumer markets across the globe, including electrical appliances, motors and power tools.

Solid revenue, dividend growth expected

In 2011, Emerson’s total revenue topped $24.2 billion. Management expects global demand to drive revenue and earnings higher in the coming years — the five-year growth rate is projected at 11.4%, better than the projected 10.5% five-year growth of the S&P 500.

In addition to solid growth, the company offers an appealing forward dividend yield of about 3.1%. In comparison, the average stock on the S&P 500 yields just 1.9%.

Investors need not worry about this dividend going away anytime soon; Emerson has been paying a dividend for 55 years straight.

The company also has a reasonable payout ratio of about 45%. The payout ratio — calculated by comparing dividends paid to earnings generated — is an important metric for forecasting dividend sustainability. In comparison, a ratio of 80% or higher shows a company may be making dividend payouts it can’t afford for long.

What’s driving emerson’s growth?

Helping support Emerson’s growth — and sustained dividend — is the current strength in of its process management segment. Emerson caters to clients in the growing food and beverage industry, as well the energy sector, by offering innovative products that improve efficiency through automation. For example, Emerson was recently commissioned by one of Russia’s largest oil and gas companies to provide reliable oil rig automation equipment to monitor year-round oil operations in rugged conditions where temperatures dip below -47 degrees Fahrenheit.

In the coming year, Emerson expects demand for similar products to remain strong, due to rising energy prices.

Also driving growth are two recent acquisitions that should help the company further edge out competitors. In mid-March, Emerson announced the strategic acquisition of privately held power-supply-equipment company Avtron Loadbank. The acquisition should help Emerson expand its range of power management solutions and products.

But they weren’t done. In early April, Emerson announced the acquisition of Johnson Controls’ (NYSE: JCI) marine container and boiler business unit. Although Emerson previously offered refrigeration and cooling solutions to a variety of residential and commercial customers, it did not have a foothold in the transportation sector.

But they weren’t done. In early April, Emerson announced the acquisition of Johnson Controls’ (NYSE: JCI) marine container and boiler business unit. Although Emerson previously offered refrigeration and cooling solutions to a variety of residential and commercial customers, it did not have a foothold in the transportation sector.

The acquisition should help Emerson expand its refrigeration and cooling market into the marine transportation market since Johnson’s equipment is currently in over 650,000 marine containers. Expansion into the marine market could be an important coup for Emerson. In 2011, 16% of overall revenue came from sales of climate control technologies.

Through continued acquisitions and product developments, the multinational corporation will likely see further expansion. Such growth could result in future revenue, earnings and dividend increases.

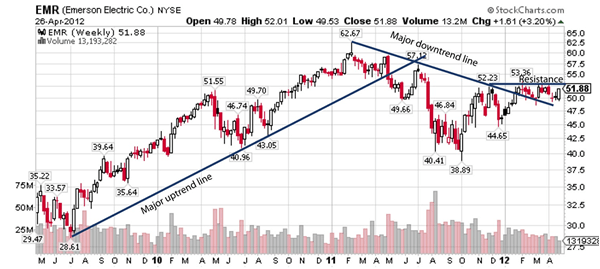

A look At Emerson’s chart

From a technical perspective, Emerson’s chart appears strong and may be at an important junction, providing a potentially good time to get in on the stock.

As shown in the chart below, the stock rose steadily off the June 2009 low of $28.61 to the early January 2011 high of $62.67. Through this rising share price, a major uptrend line formed.

This uptrend line was broken — and a major downtrend line formed — as the stock sank to its late September 2011 low of $38.89.

However, in early 2012, shares bullishly rose above the downtrend line. The stock now appears to be consolidating in the low $50 range.

There is resistance — which can be thought of as a ceiling temporarily capping the share price — at this low $50 level. However, if the stock can bullishly break through this resistance, it would likely move higher and could even test its 2011 $62.67 high. From current levels, this would mark capital returns of greater than 20% to add to the 3% plus forward yield.

A fundamentally strong outlook

From a fundamental perspective, Emerson has a strong growth outlook.

On Tuesday, May 1, Emerson reported second-quarter 2012 results. Due to increased orders for commercial and residential solutions, revenue increased 7.2% to $5.9 billion, compared wtih the year-earlier period.

On this strength, analysts expect full-year 2012 revenue will increase 3.7% to $25.1 billion, up from $24.2 billion in 2011. With continued global demand, analysts estimate 2013 revenue could rise a further 6.7% to $26.8 billion.

The earnings picture is similar.

On strong global orders, especially for commercial and residential goods, earnings per share (EPS) rose 1% to $0.74 compared with the second quarter of 2011.

For the full 2012 year, analysts project EPS could rise nearly 8% to $3.50, up from $3.25 in 2011. Earnings are then expected to increase an additional 14% — to $3.98 per share — by 2013.

Action to Take –> The technical and fundamental outlook indicates that Emerson is likely a stable long-term dividend growth opportunity. The company has been rewarding investors for many years and should continue to do so for many more years to come.