Ask The Expert: The Dow’s Over 14,000, But Is It Time To Invest?

Editor’s note: Each week, one of our investing experts answers a reader’s question in a Q&A column at our sister site, InvestingAnswers.com. It’s all part of our mission to help consumers build and protect their wealth through education. This week’s question will be answered by Christian Hudspeth…

Question: Hello. I sat on the sidelines after the market took its plunge in 2008. Now I’m seeing the stock market above 14,000, which is much better than a few years ago. Have I missed the boat? Or should I start investing? Paul, Austin

Answer: The stock market has been doing very well lately. Just a few days ago, the Dow Jones Industrial Average racked up 10 straight days of gains (and 10 straight days of hitting new all-time highs).

For the record, that’s the longest winning streak since 1996 (when the economy was booming) and the first time we’ve seen the Dow over 14,000 since late 2007. The Dow isn’t the only index — the S&P 500 has been just points away from hitting its all-time high, too.

But with all-time highs comes all-time uncertainty about what the market will do next.

So, is it time to stay on the sidelines? Or is it time to invest?

I’d say a little of both. Let me explain why.

#-ad_banner-#I’m not going to pretend I know what the market will do next. There are plenty of very intelligent analysts from Goldman Sachs, CNBC and others who will make good arguments why the market is “doomed” or ready to take off.

But regardless of what any of them say, it’s most important to know this: The biggest mistake in investing, especially toward retirement, is to not invest at all.

Case in point: The S&P 500 index reached 500 points in March 1995 (an all-time high), but if you took your money out of the market or stopped investing after that point, you’d have missed out on some great future gains; the S&P 500 gained 200% and almost passed the 1,500 mark just five years later.

If you’re unsure of where the market is going next, minimize your risk by slowly investing a fixed portion of your money into the market every month or quarter — using the dollar-cost averaging (DCA) investing method.

That way, rather than attempting to time the market as it moves during the next few months, you’re buying some stock when the market is low and you’re buying some when the market is high.

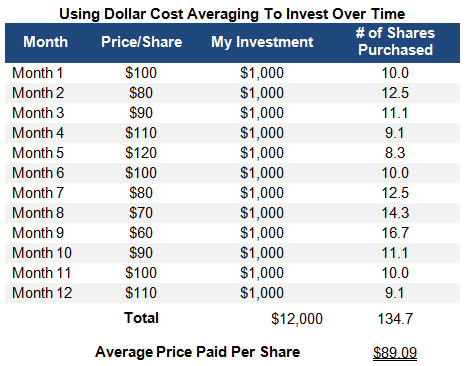

Here’s how dollar-cost averaging works. Let’s say I have $12,000 cash sitting in a money market account and I want to start investing. Because I want to invest a little at a time, I invest $1,000 each month for the next 12 months into an exchange-traded fund (ETF) that tracks the S&P 500 index. Let’s assume the ETF currently trades for $100 per share.

Each month, I’ll keep investing my $1,000, buying shares of that ETF even as it changes price over the year. Let’s say in the first month, shares of the ETF cost $100 each, so my $1,000 will buy 10 shares. Then let’s say in the second month, the ETF falls in value and shares cost $80 each, so my $1,000 can buy 12.5 shares this time because they’re cheaper.

You can see how this will play out in the table below.

As you can see, my $12,000 investment spread out over the months of the year allowed me to buy 134.7 shares of the ETF, and I paid an average price of around $89 per share.

So why does that matter? Put simply, this can magnify your returns if the investment rises in value. For example, if I had invested $12,000 all at once at the beginning of the year, I’d have paid the first month’s $100 per share price. If the ETF’s share price rises to $200, I’d make a profit of $100 per share for a 100% gain.

Not too shabby. But if I bought my shares for $89 each using the dollar-cost averaging method and the ETF’s share price rose to $200, I’d have made a profit of $111 per share for a larger 125% gain.

By the way, if I had decided not to invest at all, I’d have missed out on all those gains…

Action to Take –> If you’re automatically investing each month in a 401(k) plan, you’re already using dollar-cost averaging, so just keep investing in the plan.

If you’re investing outside of a 401(k) plan in an IRA, Roth IRA or other investment account, you may practice DCA by investing a little money at a time into the market. If the market goes down (i.e. becomes cheaper) your money will buy more shares of stock or mutual funds, and if the market goes up, you can be glad that you had money in the market. It’s a win-win.

This article originally appeared on InvestingAnswers.com:

Ask The Expert: The Dow’s Over 14,000, But Is It Time To Invest?

P.S. — To learn more about the best stocks of the year, read our Top 10 Stocks for 2013. One stock has raised its dividend 33 consecutive quarters. Another dominates its market… pays $3.40 in dividends per share each year… and has returned 117% since it went public just over four years ago. In this special presentation, we’ll tell you about all of our just-released picks for 2013 — including several names and ticker symbols — so that you can start profiting today. Click here to learn more.