This Retailer Has A ‘Secret’ Yield Of About 10%… And It’s Not Alone

Every quarter, the board of directors at youth-focused retailer The Buckle (NYSE: BKE) must decide how generous they will be with the company’s cash.#-ad_banner-#

After all, they realize that many of the company’s investors count on dividends to help supplement their income.

But these directors like to tread cautiously. They know that retail spending is hard to predict, and in any given year, sales and profits might not be as strong as the year before. The cautious approach explains why The Buckle is only committed to an $0.80 a share annual dividend — the same payout the company has offered for four straight years.

Indeed, if you go to the leading financial websites, such as Yahoo Finance, you’ll spot that $0.80 a share payout, which translates into a so-so 1.5% dividend yield.

But these websites don’t have their facts straight.

The truth behind The Buckle’s dividend strategy is a lot more compelling.

Let me explain…

Even as this retailer sticks with a conservative dividend policy on a quarterly basis, investors are also treated to special one-time annual dividends that really change the game. The Buckle paid out a special $2.30 a share special dividend in late 2011 and another one-time $4.50 a share dividend in late 2012. The trailing 12-month yield, including that special payment, works out to be roughly 10%.

And The Buckle isn’t alone. There are others my colleague Amy Calistri has uncovered. She calls them her “Hidden High Yielders,” and she has found them with yields upward of 11%. Check out her special report on the subject here.

How can a company afford to be so generous with these one-time payouts? For The Buckle, credit goes to sound financial management. Though the retailer has only boosted sales at an 8% average annual pace over the past four years, it manages to squeeze out ever-high profits from each dollar of sales. Thanks to savvy merchandising, which means fewer markdowns, this retailer’s operating margins have risen from 15% in fiscal (January) 2007 to 23% in fiscal 2013.

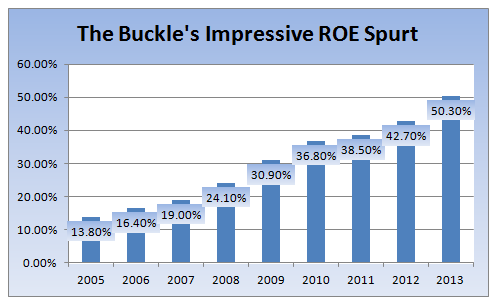

Another impressive stat: The Buckle generates a very high rate of return on equity. In fact, this financial metric has risen for eight straight years. That’s something that few firms can say.

What’s The Buckle’s secret? A healthy mix of name-brand apparel and private-label goods. The former draws store traffic, yet generates mediocre profit margins. Private-label goods, which are usually at more attractive price-points, deliver great margins, thanks to their low-cost sourcing.

Meanwhile, can The Buckle keep rewarding shareholders with these special dividends? Management has yet to comment on plans for the coming periods, but if history is any guide, then more special treats lie ahead.

Action to Take –> Be mindful that the board of directors may decide to skip the special payments, though. That was the case for many of these hidden high yielders in 2008 and would likely be the case the next time the economy slumps. That said, these special dividends are a great way to boost your income.

This article originally appeared on InvestingAnswers.com:

This Retailer Has A ‘Secret’ Yield Of About 10%… And It’s Not Alone

P.S. — Companies like The Buckle toil in a wide range of industries but share one common trait. They generate a combination of small fixed dividend payments and robust special dividends, and taken together, these dividends often add up to dividend yields of as much as 11%. Amy Calistri has issued a special report on these Hidden High Yielders. Find out more here.