Warning: Earnings Are About To Get Ugly

As a child, I wanted to be a weatherman. I knew more than any ten-year-old should about barometric pressure and relative humidity and spent countless hours in the winter staring at the radar praying for snow (understand, it’s a rarity in my home state of Louisiana).

Back then, one of our local network meteorologists never predicted any of the white stuff, even when his colleagues assured kids that several inches were coming and schools would be closed the next day. I hated that guy. But my ski gloves and sled never got much use — he was right 99% of the time.

Of course, you can’t really blame the weatherman for the forecast. They are simply the messengers. Please keep that in mind when I tell you the stock market forecast appears rather stormy right now.

I’d much prefer to say that conditions look lovely — but honestly, you might want to keep an umbrella handy the next few weeks.

Here’s what’s got me worried.

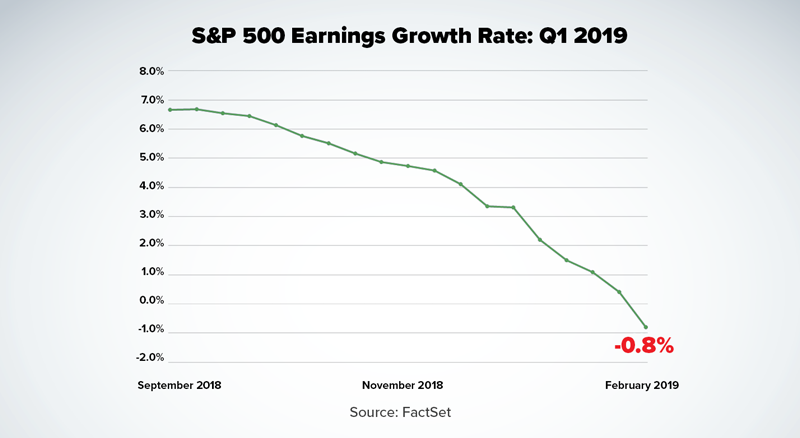

This chart shows the change in S&P first-quarter earnings estimates over the past 18 weeks. Back in September, analysts were anticipating a decent 6.7% increase. By December 31, that projection had been cut in half to 3.3%. And the outlook has deteriorated even faster since then.

According to FactSet, all eleven market sectors experienced downward earnings revisions in January, with most being far steeper than the 10-year average for the first month of a quarter.

As it stands today, first-quarter earnings are now expected to show a decline of 0.8%. If so, it would be the first quarterly decrease in nearly three years.

Not every analyst will be right about every stock they follow. Some companies will undoubtedly surprise to the upside. But in the aggregate, there is a unanimous assessment that earnings growth is about to come to a screeching halt.

Keep in mind, we’ve just had five straight quarters of double-digit growth, so investors are accustomed to seeing rising profits. We might not see much reaction when the final numbers are posted, because the market adjusts its assumptions ahead of time.

Well, that period of adjustment is right now.

Action To Take

I’m a bit wary of profit-taking in the near-term. Fortunately, the S&P earnings decline is being distorted by a few (less than 10) large companies such as Apple (Nasdaq: AAPL). Many others are doing just fine. And the long-range forecast calls for earnings to expand 5% for the full-year 2019 — lapping a strong 2018 that was aided by tax reform.

In any case, I pay far more attention to my individual holdings than the broader market. And you should, too.

Thankfully, most of my holdings over at The Daily Paycheck continue to meet or exceed expectations. That’s largely because we’ve done extensive research on our picks before we even consider pulling the trigger. But it doesn’t stop there: we keep constant tabs on our portfolio, updating subscribers on any changes or important developments.

To learn how to gain access to our entire portfolio of dividend payers, go here now.