Forget IPOs: Here’s My Latest “Market Hack” Pick…

Recently I told readers about why most investors would be better off staying far, far away from IPOs like Lyft (Nasdaq: LYFT). Since then, we’ve seen two other much-hyped companies — Pinterest (NYSE: PINS) and Zoom (Nasdaq: ZM) — go public.

If you missed that piece, I encourage you to go back and read it in full.

But rather than spend any more time making my case for why these IPOs can be major distractions for individual investors (and may even be the sign of the beginning of the bull market’s end), I’d rather tell you about a stock you should consider buying instead. In fact, it’s one of the most recent additions to my Maximum Profit portfolio.

I normally don’t make a habit of revealing my premium newsletter picks. But I will make an exception today, if only to prove that there are plenty of stocks out there that have big-time potential outside of the latest risky IPO.

My Latest Maximum Profit Pick

Founded in 2007, Zendesk (NYSE: ZEN) provides software-as-a-service (SaaS) products that help organizations and customers build relationships.

#-ad_banner-#Since the company went public in 2014, it’s been on an incredible growth trajectory. That first year as a publicly traded company the firm reported sales of $127 million. Last year, it had total revenue of $598.7 million. In other words, it’s grown sales at a compound average growth rate of 47% in the last four years. And it’s projected to increase sales another 34% this year.

It is worth noting that the company hasn’t yet reported a profit, but that’s expected to change this year — a pattern that’s not unusual for high-growth companies. (Remember, Amazon (Nasdaq: AMZN) didn’t report a profit for its first six years as a publicly traded company.)

A better number to look at is the firm’s cash flow. As I’ve talked about repeatedly, cash flow is what I refer to as “the most important number in investing.” It’s also why it’s one of the pillers of the market “hack” system we follow in Maximum Profit.

Cash flow is the one number that I believe most accurately depicts a business’s economic health. It’s the lifeblood of a business. It tells us exactly how much money the firm is actually making. Cash that can be used to invest back into the business or return to shareholders.

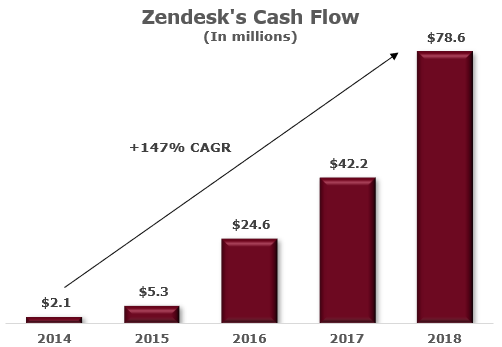

And this number tells me that Zendesk’s business is not only strong but growing. Just look at its cash flow since it began trading in 2014:

As you can see, the firm has done a remarkable job at growing cash flow, going from just $2.1 million in 2014 to $78.6 million last year. That puts Zendesk in the top 16% of firms growing cash flow.

Thanks to Zendesk’s portfolio of products that seamlessly integrate with each other, and the ease of implementing and operating these products, the company’s growth projections are on a high trajectory.

The company is one of the few SaaS firms that offers a suite of products that work together to address every aspect of the customer service experience. Everything from self-service to telephone calls, to live chat, to email and messaging.

Businesses are realizing that their customer service departments can be a real growth driver for sales. A study showed that companies that are focusing on improving customer experience are growing revenue five times faster than those who have left it as a low priority. And consumers aren’t just expecting excellent customer service, they are demanding it.

Action To Take

If you’re in the business of helping other companies easily improve and grow revenue, they’ll be knocking down your door. And Zendesk’s suite of products does just that, which is why it’s seen its customer list grow from just 40,000 customers in 2014 to more than 136,600 paid customer accounts at the end of 2018.

Now I’ve talked up the company quite a bit, but there are a couple risks you should consider before investing… This fast-growing company has created lofty expectations in terms of sales and customer growth. If it has a bad quarter, or if earnings come in lower than expected, shares will take a hit. Also, the company operates in a highly competitive environment.

That said, I made Zendesk the most recent addition to the Maximum Profit portfolio just a few days ago. Our market “hack” system gave it a score of 86 (out of 100), which puts it in line with other stocks we’ve owned in the past that went on to deliver double-digit returns in a matter of weeks — and in some cases, triple-digit gains in just a few months. If you’d like to learn more about how our system “hacks” the market to deliver gains like this, go here right now.