Why Small-Caps Are Worth A Look Right Now

Small-cap stocks have had a rough go at it over the last couple of months, to say the least. But that’s not unusual during tumultuous markets.

Small caps usually get hit harder since these are still small, relatively unproven companies. But they typically surge higher, faster than the overall market when things turn around.

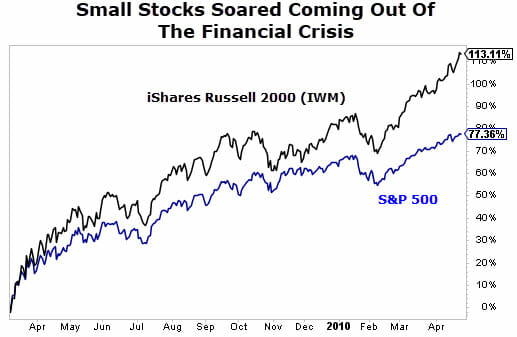

For instance, during the financial crisis, the iShares Russell 2000 ETF (NYSE: IWM) — an ETF that tracks small-cap companies — tumbled more than 50% in the last five months before the market bottom in March 2009. The S&P 500 fell about 40% over the same time frame.

But coming out of the financial crisis, those same small caps surged more than 113% over the next year, crushing the S&P 500’s 77% return…

Small-Cap Stocks Can Pay Off Big-Time

Once again, during this latest bear market, we saw small-cap stocks fall harder and faster than the overall market. But if history is any guide, many of these stocks could quickly climb back to new highs.

I know I spend most of my time pounding the table about why individual investors should purchase “wonderful companies at fair prices”. This usually means well-known (large-cap) stocks like Apple, American Express, Starbucks, and more.

Don’t get me wrong. Stocks like this definitely deserve a place in your portfolio.

But once you have these core holdings in place, there’s nothing wrong with keeping some cash on hand to take a “home run” swing occasionally. And the best way to do that is with small-cap stocks.

Just one or two of these home runs a year can make all the difference in your portfolio. Your core holdings should make it a lot less painful when you “strike out” (and believe me, you will).

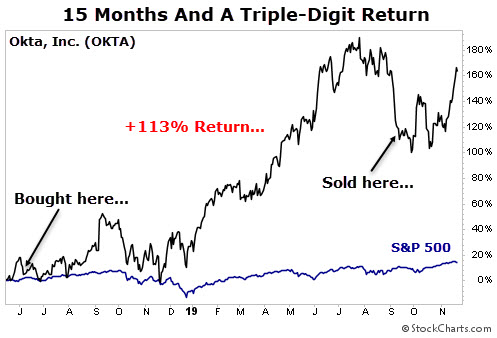

For example, my readers and I made a trade with Okta, Inc. (Nasdaq: OKTA), a small-cap cybersecurity outfit. This smaller company didn’t turn a profit or reward shareholders with increasing dividends (it still doesn’t). It’s purely a growth stock that operates in a high-growth space.

We held Okta for just over a year. And during that span we greatly outperformed the broader market:

How You Can Play Small-Caps Today

If you’re interested in putting some dry powder to work, there are a few ways to go. The iShares Russell 2000 ETF (NYSE: IWM) makes sense, of course, and I wouldn’t fault anybody who chose that route.

My advice: Look for individual names in high-growth areas (like cybersecurity with our OKTA example above) that are likely to see higher demand in any environment, thanks to the powerful trends working in their favor.

As far as specifit names goes, one to consider is Paratek Pharmaceuticals (Nasdaq: PRTK). This is a small biopharmaceutical company that had a big 2019. It launched Nuzyra, an antibiotic for the treatment of adults with pneumonia, and Seysara (through its partner Almirall), which treats acne.

Nuzyra pulled in $11.5 million in 2019 and continues to show strong demand. Interestingly enough, many folks who come down with coronavirus also get pneumonia, which is commonly treated with older generic antibiotics that have both resistance and efficacy deficiencies. In other words, these old antibiotics have been around so long that our bodies have grown immune to them so they’re not as effective at fighting the bacteria.

However, Nuzyra, being a new antibiotic to the scene doesn’t have those issues, which could be huge in helping fight secondary bacterial infections from Covid-19. Management is aggressively pursuing partnerships through the government to ensure patients have access to Nuzyra, as we battle this pandemic.

My second piece of advice would be to treat these as potentially shorter-term opportunities. Have a target profit in mind and set a stop-loss set so that you can get out quickly if things get too painful. Doing both of these will help recycle capital quickly. This is good, because it allows you to move on to other trades.

P.S. My colleague Nathan Slaughter just wrapped up an emergency briefing, unveiling what investors need to know to survive (and thrive) during the Covid-19 pandemic.

In fact, he’s found 320%… 256%… even 760% gains… from REGULAR stocks, in 24 hours or less. He calls them “Predator” trades — and he’s developed a simple 6-part profit screen to detect these big trade events before they happen.