Should You Sell? Here Are 3 Ways To Know When It’s Time…

When you buy a stock, many investors are tempted to think that the hard part is over.

Nothing could be further from the truth.

How do I know? Well, aside from having studied investor psychology, I’ve seen it firsthand in my former days as a financial advisor.

For many of us, we can purchase shares of a company without giving it much thought. (Sometimes it’s as simple as liking the company and its prospects). But when it comes time to sell that stock, the execution can be difficult. If it’s trading at a loss, we “hope” it climbs back up just so we can break even on the trade. And if it’s a big winner, we might be afraid of selling and losing out on future gains.

The emotional toll it takes can be overwhelming. It can paralyze into taking no action.

Of course, in a perfect world, we could buy stocks and hold them “forever.” But as I’ve said before, for the vast majority of investors, buy-and-hold investing is a fallacy. The truth is, most of us simply don’t have the time, patience, or bankroll to sit on a holding for 20 years.

Besides, if the past couple of years have taught us anything, it’s that nobody really knows what the future holds. Every company goes through ups and downs. And during those down cycles, we don’t know how long it will be until the firm turns it around — or even if it will turn things around.

How “Buy And Hold” Can End In Disaster

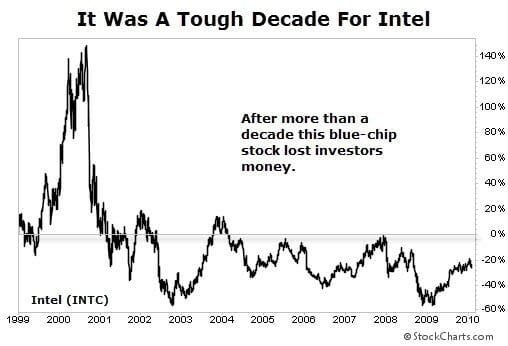

Just ask anyone who invested in Intel (Nasdaq: INTC) back in 1999. A lot of investors probably thought they could buy this “safe”, solid blue-chip and hold it for years. Surely they’d come out ahead with little worry at all.

Yet, after more than a decade you can see how well the “buy and hold” strategy performed:

That’s a long time to have your money in a stock that went nowhere. And in this case, you would have still lost money.

More importantly, that’s a lot of time lost… We can make up a 15%, 20%, or 30% loss, but we can’t make up for time.

So how do you know when it’s the right time to sell a holding? Well, there are no perfect cookie-cutter answers here. Everyone’s situation is different. But here are a few tips that will help you know when it’s good to sell or take some profits.

3 Tips To Help You Decide When To Sell

1) Investment Thesis Changes

Do you remember why you bought the stock in the first place? Was it growing sales or earnings at a fast clip? Was it trading for cheap, with a lofty dividend, or thick margins? Does it dominate its market and gush cash flow? Typically, you buy a stock because you like it for one of these reasons.

Periodically check in with your holdings and remind yourself why you bought the stock and if those reasons hold true today. If you find that the firm’s fundamentals are deteriorating, figure out why. Is it a short-term problem or something that will persist longer? Are you willing to ride it out, or would you rather book your gains and put your money to work elsewhere?

One thing to remember is that you can always buy the stock back (assuming it hasn’t been acquired or gone bankrupt). Sometimes investors will sell a stock and then never go back to it because they’re mentally anchored to their original entry price. They see a stock they bought for $40, now trading for $150, and think it’s now too pricey because at one point they got it for a fraction of that.

Imagine if you thought about other things the same way. Take real estate for example. Say you bought a house for $100,000 eight years ago, sell it for $350,000, making a tidy profit. But now when you look for a similar house, you think they are all overpriced because you bought that same house for $100,000 years ago.

My point is, don’t get anchored to a price. The price is just a number. Understand what the value of the company is, and is the price reflecting the value, or is it reflecting a discounted or inflated value? As Warren Buffett ways, “Price is what you pay. Value is what you get.”

2) Hits A Stop Loss

I’m a big fan of using stop losses or trailing stops. This helps take some of the emotion out of the difficult sell process. Of course, using stop losses and executing on your stop losses are two very different stories. Many might “use” a stop loss, but not actually follow it and sell when it’s triggered.

But I digress…

Stop losses can be a wonderful tool that most investors should utilize. Of course, we have to use careful judgment when we have a black swan event like Covid-19 that crushes nearly every stock in the market in a quick amount of time.

But outside of these rare events, stop losses are a great tool to understand and employ. You can adjust your stop loss depending on your risk tolerance and the volatility of the stock. For example, on a small-cap stock that sees wild swings, you might use a 25%-30% stop loss (and smaller position size) than you might with a larger blue-chip stock like Intel (Nasdaq: INTC).

If you’re wondering where you can find the volatility of a stock, look up its beta. Beta is a measure of volatility, or risk, compared to the market as a whole. Beta is most commonly used in portfolio management, but you can find an individual stock’s beta on sites like Yahoo! Finance. A beta of 1 means it is as volatile as the overall market. A value greater than 1 means the stock is theoretically more volatile, while less than 1 is less volatile than the market.

As an example, Intel has a beta of 0.5. So it’s 50% less volatile than the market. A small-cap biotech like Paratek Pharmaceuticals (Nasdaq: PRTK), on the other hand, has a beta of 1.5. This means it’s 50% more volatile than the market.

3) The Stock’s Valuations Are Trading At Rich Premiums

This last tip is the one of the more obvious reasons. It can be a bit tricky to base a sell decision on valuation metrics alone. If the company backs up the lofty valuations with outstanding sales and earnings when it reports next, then those valuations might not seem so lofty.

But if you’re not feeling overly confident about the stock’s prospects, then it’s okay to book your profits (or cut your losses), or even trim back on the position a little. In other words, it’s okay to take some profits off the table.

After all, if we’re not constantly injecting cash into our brokerage account, then we need to raise cash somehow. Taking profits, or rebalancing the portfolio, is a great way to do that.

P.S. My colleague Nathan Slaughter just released a shocking report about the next big wave of profits in energy…

According to his research, the “mother of all oil booms” is just around the corner. And one little-known Texas company is set to unlock nearly a billion barrels of oil… and unleash a surge of mega-profits for investors who get in early.