I’m Betting Big On The Market’s Hottest Trend

There’s a lot of ways to make money in the market. You can buy a solid blue-chip stock and hold for the long run… get in on a hot new IPO… invest in high-dividend payers for the income… dabble in options… the list goes on.

But one of the absolute best ways to make good money is to find a strong trend and go “all in.”

Yes, I know that the unwritten rules of investing say you should be “diversified”.

But I somewhat disagree with the strategy. After all, if something isn’t working… why would I either A) continue to hold it, or B) buy it because it’s “cheap” and I need to diversify my portfolio?

Take the energy sector for example…

All That Time And Nothing To Show For It

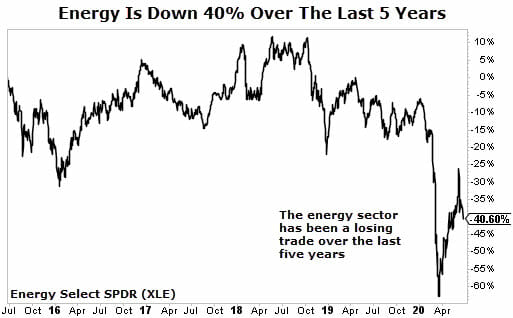

A lot of folks held the Energy Select Sector SPDR Fund (NYSE: XLE) in their portfolio over the last five years, heck even 10 years. And a lot of them did it to be “diversified”.

Well, I’m sorry to say if that’s you, then you already know you haven’t made a dime. Over the last 10 years, this energy ETF has produced a whopping -4.6% loss. Over the last five years it’s done even worse:

I hate to pick on energy. This sector provided my Maximum Profit readers and I with some tidy profits in the past. In fact, leading up to the sector’s peak in June 2014, we were heavily allocated in the energy sector. That’s the exact opposite of diversified, of course. And it turned out to be the right call.

The fracking boom was a hot trend, and we booked some handsome gains. For example, we made 28.6% in eight months on MPLX LP (NYSE: MPLX). Then we made 62% from oil and gas transportation firm American Railcar Industries (ARII) in just over a year. We also booked multiple profits on Phillips 66 (NYSE: PSX) and Sasol (NYSE: SSL).

At one point, roughly 60% of the portfolio was dedicated to energy and energy-related stocks. We didn’t worry about diversification. The system simply spotted a trend with strong momentum and we hopped on board and yanked profits out left and right.

The Big Trend In Today’s Market

As the saying goes, money flows where it’s treated best. And right now, that’s software companies. More specifically, software companies that utilize the software-as-a-service (SaaS) business model.

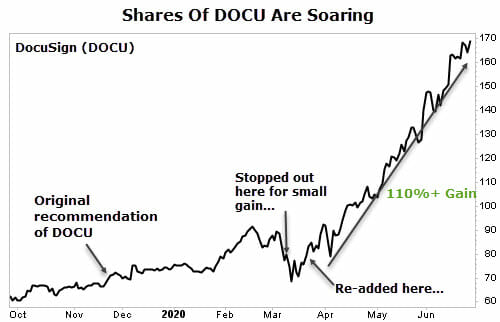

I touched on this wonderful business model in my original write-up of DocuSign (Nasdaq: DOCU). This is a SaaS company that’s changing the way we sign contracts and documents. Shares are also up more than 110% since it was re-added to the portfolio just three months ago:

SaaS companies are such a hot commodity right now for many reasons… The capital efficiency of the business model, the ease of installing and using the software, and of course the work from home movement. It’s a beautiful business.

The majority of SaaS companies offer their products as a subscription service. This means they simply “rent” their software out to customers and in return generate recurring revenue. The software is hosted on the vendor’s servers, not the customer’s, which means the customer accesses the software from “the cloud.”

This eliminates the need for the customer to buy and maintain expensive hardware (servers) and hire an army of information technology employees to maintain it. It also cuts out the large upfront expense to install the software.

Imagine if companies still operated under the legacy perpetual license business model during this pandemic as businesses shifted their workforce to operate from home. It would have been a nightmare.

These software companies have become the hottest sector in the market because their product (software) can grow rapidly without requiring massive amounts of capital — like new buildings and equipment. This allows them to enjoy thick margins and generate enormous amounts of cash flow.

Action To Take

The coronavirus pandemic has only highlighted the relative ease with which companies can continue doing business from anywhere in the world. And that’s thanks in large part to SaaS companies.

This week my system has flagged two more companies operating in this white-hot sector. And while I can’t share the names of those picks with you today, I want to encourage you to think about the larger lesson here.

In short, diversification can sometimes be overrated. Focus on your best ideas first and foremost. After all, that’s where you’ll make the most money. And right now, I think software (and SaaS) should be at or near the top of your list.

Another massive trend you need to know about is with what we’ve been calling the “briefcase pharmacy”…

If we’ve learned anything at all from this pandemic, it’s that research and development in biotechnology is paramount. Millions or lives (and billions of dollars) are at stake. And the “briefcase pharmacy” could be the solution to deliver personalized, on-demand treatments that could completely upend traditional medicine as we know it.

And we’ve found a biotech-focused software firm that’s indispensable to this effort. If our research is correct, then you’re going to be hearing a lot more about this idea in the weeks, months, and years to come. And this company could be the one to make it all happen…

This could easily be the biggest trend of the next year or more — but you should learn about it now (and how you can profit) before it’s too late.

Go here now to get the details in this special presentation.