Warning: Don’t Let Covid-19 Change The Way You Invest

As the workers file — six feet apart — into the building, they must go through several checkpoints…

At the first checkpoint, they get peppered with questions about how they’re feeling and who they’ve been hanging out with. Next, they are checked to ensure they have the proper personal protective equipment (PPE). And finally, a radar-like gun gets held to their forehead to check their temperature.

Once cleared, they can then be allowed into their place of work and resume their duties.

This is the new normal for employees all around the globe.

Many companies including Amazon and Walmart have implemented these precautions. The goal: try to get back to business-as-usual (or as close to it as possible) while avoiding a Covid-19 breakout.

These sorts of safety measures will likely become the new normal. We’re talking not only large corporations, but sporting events, concerts, theaters, parks, cruise ships, flights, and any other event or place where large groups of people gather. In fact, New York City is installing PPE vending machines in a number of their subway stations.

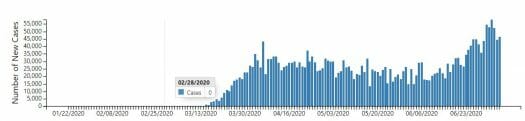

As many states lifted stay-at-home restrictions and folks started to venture out, Covid-19 cases quickly climbed. As of July 6, the United States had more than 2.9 million cases and over 130,000 deaths. Daily new cases in the U.S. topped 44,000 two days in a row at the end of June, which eclipsed the previous high of 43,000 set back on April 6. As you can see in the chart below, total new cases are once again spiking as we begin the month of July…

Source: CDC

While much is still unknown about the coronavirus, scientists have been feverishly working to understand how it spreads and interacts with the human body. Scientific American has a fantastic interactive click-thru that explains exactly how the virus sneaks inside human cells, makes copies of itself, and infiltrates other cells in the body. (Read Inside the Coronavirus.)

Meanwhile, Markets Are Soaring

Meanwhile, since the March lows, all three major indexes — S&P 500, Dow Jones, Nasdaq — have rebounded strongly. The Nasdaq has already reached new all-time highs, while the other two are both up roughly 40% from their lows in March.

It’s been an impressive rally, to say the least.

For the most part, our portfolio holdings over at Top Stock Advisor have benefited greatly from this quick and strong rebound. We booked gains in PayPal (Nasdaq: PYPL) and Thor Industries (NYSE: THO) after both stocks quickly recovered and soared higher than their February highs. We made roughly 300% and 76% on those investments, respectively.

Don’t Let Covid-19 Change The Way You Invest

I haven’t written a lot on the coronavirus because it’s widely covered in the media. But I bring it up today because it’s becoming increasingly clear that the ripple effects will not only be long-lasting, but will it also change the way we live.

How long it will last and how much of this will stick around is anybody’s guess. But it’s here to stay for now. And those changes to our daily lives are providing tailwinds for our most recent portfolio pick over at Top Stock Advisor.

But it’s important to keep in mind that I liked this company long before the coronavirus reared its ugly head. So while the company will benefit from some of the changes that will be implemented from this virus, there’s plenty more to this company than it being a simple “Covid-19” play.

Its products are used by the government, military, corporations, utilities, and even the auto industry. It’s a market leader with very few competitors. It consistently produces solid cash flow, makes shareholders a priority, and should come out of this pandemic even stronger.

The point is, you should not let Covid-19 fundamentally alter the way you pick stocks. Could it change the calculus? Absolutely. Only a fool would deny that. But it would be equally foolish to base all of our investment decisions purely on Covid-19.

As the coronavirus continues to dominate the headlines, it’s worth keeping in mind.

Editor’s Note: Another thing Covid-19 can’t change is innovation. And I’ve found what could be the most lucrative opportunity I’ve come across in years…

I recently spotted something buried deep in the SEC filings of a little-known satellite technology company. And the implications are huge…

It turns out this company paid a measly $26 million for a tech startup it bought in 2019. That’s an amazing price, but it’s just a small fraction of what they received for their $26 million.

Chances to beat Wall Street insiders don’t come along every day. So, it’s critical that you learn about this opportunity before it’s too late.