What I Learned By Missing Out On A Triple-Digit Winner

I remember it vividly… It was the summer of 2016 and I was looking into buying shares of this semiconductor company. It was trading for around $50 a share. I thought the company was a little on the pricey side, but it had considerable momentum behind it — shares were up 42% halfway through the year compared to the S&P 500’s 3%.

I put the stock on the back burner and went about my business. Occasionally, I would come back to it and check the price. And every time I looked, shares had continued to climb higher. By the end of 2016, shares were trading for around $100 per share. The stock returned 227% that year.

At $100 a share, I definitely wasn’t going to buy it. After all, it was just trading at half that price six months ago. I believed its best days were behind it and I missed the proverbial boat on this one.

But here’s the thing. I was doing something called “price anchoring”. It’s a dangerous tendency we have that many of us fall victim to when trading or investing in stocks. I was depending too heavily on the initial price of the stock. And once it shot past that price, I couldn’t bring myself to even consider investing in it.

The stock that I’m referring to is Nvidia (Nasdaq: NVDA), and today it trades for north of $400 a share…

The Dangers Of Price Anchoring

This anchoring bias happens all the time, whether it’s purchasing a house, a vehicle, or something as simple as a watch.

Letting this common bias affect our trading can be devastating to our portfolio. If we get stuck at a certain price it will cause us to miss out on future gains. It could also cause you to hold onto the stock too long if the trade turns south. (Think of waiting for it to get back to your entry price as that’s what you believe it’s “worth”.)

When it comes to investing, we must follow this simple truism: do more of what’s working and do less of what’s not.

Of course, this is easier said than done. By doing more of what’s working means buying companies after they’ve rallied (beyond our anchor price). It means buying assets that have gone up a lot. And that feels wrong.

But history tells us differently. It tells us that following the trend is one of the smartest bets you can make when investing. It means buying something after it has hit new highs. While many folks shy away from stocks that have reached new 52-week highs (thinking they’ve missed the boat), we want to do the exact opposite. We want our stocks to create new highs.

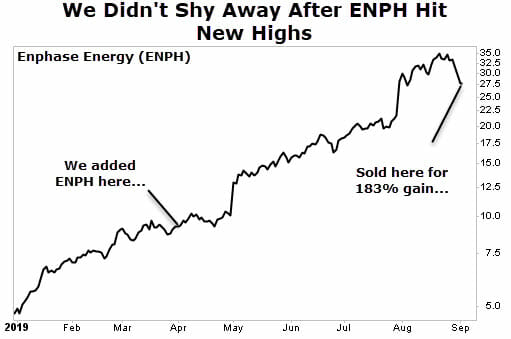

Take a former portfolio holding of ours over at Maximum Profit, Enphase Energy (Nasdaq: ENPH), for example. We added the stock in April last year after the stock had already gained 116% on the year. Most investors likely wouldn’t have gone near the stock after a run-up like that.

But instead of shying away, or anchoring our price at $5… $6… $7 a share, we went ahead and added the stock to our portfolio (at just under $10 a share).. And it paid off handsomely, to the tune of 183% in just five months.

Closing Thoughts

To most, it might seem crazy to buy something after it’s already rallied double, even triple digits. But once you leave that anchoring bias behind, you’ll see how this can cause you to miss out on the biggest gains of your life.

You have to take emotion out of it, and realize that big gains can lead to more big gains. Do that, and you will no longer hesitate to pull the trigger on that next hot stock.

And if you don’t, then you’ll be like I was back in 2016… wishing you would have pulled the trigger on NVDA at $50 a share, or even $100 a share.

Editor’s Note: My colleague Dr. Stephen Leeb and his research staff have discovered a shocking truth…

They’ve found a hidden technology flaw that threatens to bring America’s wireless network to its knees. And it couldn’t come at a worse time — as companies (and the federal government) gear up to deploy 5G technology across the country. And make no mistake: the 5G rollout is a top priority, so it’s essential that this gets fixed, pronto.

Thankfully, there is one little-known company that could have the solution. Add it all up, and it could be one of the best tech opportunities of a all time. Go here now to read our exclusive report.