Are You Positioned To Profit From The Recovery’s Next Phase?

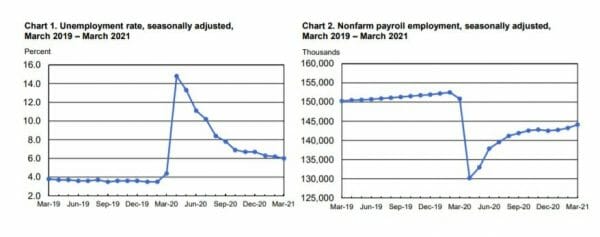

The numbers are in. March was apparently a great month for jobseekers. Economists were looking for net payroll gains of 647,000. The actual figure came in just shy of 1 million at 916,000. Not bad for 31 days. This latest burst of job creation has brought unemployment down to a manageable 6%.

Source: Bureau of Labor Statistics

There’s more work to be done to reach pre-Covid levels below 4%. Still, we’ve already staged an incredible recovery from the quarantine days last April when unemployment peaked near 15%.

Needless to say, nearly all of our portfolio holdings over at High-Yield Investing (either directly or indirectly) benefit from more paychecks being cut. But it’s not just the raw number of “help wanted” signs that has caught my attention – it’s the type of businesses hanging them out.

Hospitality Makes A Comeback

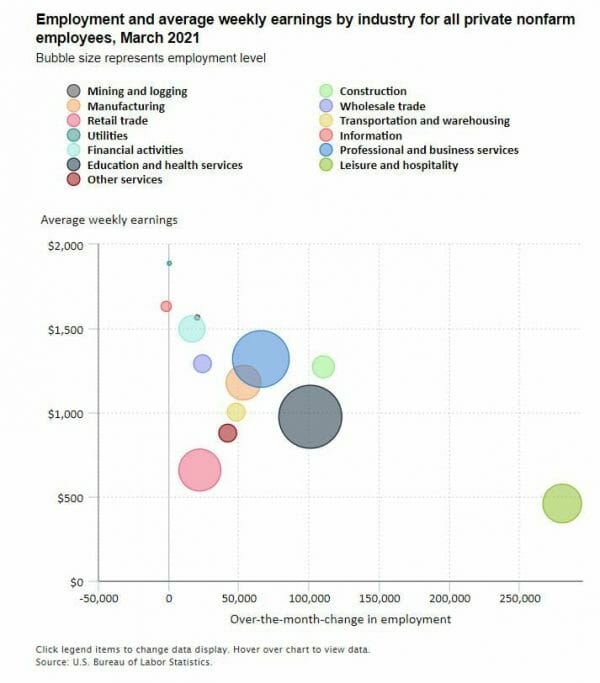

Service sector companies continue to show signs of life. The leisure and hospitality sector (for which I’ve been banging the drum since the beginning of Covid) welcomed 280,000 new workers last month — nearly one-third of the nation’s total.

You can see the change in the chart below (on the x-axis):

Within that broad group, the accommodations industry alone added 40,000. That reaffirms my bullish outlook for hotel owners, which I addressed in this article.

With another round of stimulus checks in the mail and vaccine deployment running smoothly in most states, it’s easy to see why investors are returning to cyclical travel and entertainment stocks.

According to the Transportation Security Agency (TSA), more than 1.4 million passengers were screened at U.S. airports last Monday. I was one of them, returning home from a short business trip to Miami. My experience matches what the numbers are saying — airport traffic has returned in a big way.

We’re still about a million fliers per day below the average levels from 2019. However, 1.4 million passengers is nearly ten times the average number (154,000) who boarded flights daily in 2020.

We’re Set Up To Profit

But this 180-degree market reversal goes far beyond travel. If you’ll recall, the entire dividend-paying universe was out of favor last year. The Russell 1000 Value Index eked out a tepid 1.2% gain, lagging far behind the 17.8% return of the tech-driven S&P 500. Four of the market’s most dividend-friendly areas (financials, energy, utilities and real estate) all posted negative returns.

But with tech faltering (or at least decelerating), these unloved sectors are finally getting some respect. Industries that were ignored last year are suddenly back en vogue.

Just look at some of the market’s biggest winners since January 1. Occidental Petroleum (NYSE: OXY). American Airlines (NYSE: AAL). Capital One (NYSE: COF). Simon Property Group (NYSE: SPG). All were dogs last year.

Closing Thoughts

We never know how long these rotations last. For now, I am enjoying the ride.

Over at High-Yield Investing, our portfolio notched a healthy 15.3% return during the first quarter, easily besting the 5.8% gain of the S&P 500. Much of the credit goes to timely additions we made during the height of the Covid lockdowns (and ensuing market selloff) — our energy pipeline name and our college-focused REIT, to name a few. Our foresight is paying off — many of the names we added are returning where they belong after last year’s deep selloff.

By keeping our heads while others panicked, our portfolio value has climbed to a new all-time high. I hope you have been able to find yourself in a similar position.

That being said, now is not the time for complacency. We could see a correction at any time. And when it happens, I’ll be prepared to profit, yet again.

With that in mind, if you’d like to see how High-Yield Investing can help you pull in double-digit yields — and earn some impressive capital gains to boot — go here to read this report.