Want To Earn “Extra” Dividends From Your Stocks? Here’s How…

As markets continue to reach new highs, a lot of us are left wondering how much longer the ride can last.

But hey, let’s face it… we don’t want to get off the ride too soon and miss out on all the fun, either.

So what if I told you there was a way to stay on the ride for a little while longer while also protecting us from unexpected bumps in the process?

Here’s another thought… We all know that income is hard to come by in this market — and that’s why it’s imperative to look beyond the usual methods to get paid. Fortunately, there are several ways to get the job done. And the strategy I’m going to talk about today is one of the best…

As we like to tell readers, yes, you can earn more income than you thought possible. All it takes is an open mind and a willingness to learn.

We’ll spend some time covering some of these ways in the days to come. But today, I want to tell you about one of my favorites. You get to enjoy the upside of this incredible bull market while also protecting yourself and getting paid for it.

What’s not to like about that? Let’s dig in…

The Best Of Both Worlds…

Most investors think of income investing as a passive game. You find a good stock paying a solid dividend, buy it, and wait to get paid.

That’s fine and good, but you could be earning anywhere from three to 20 times more than what a stock yields on paper. And it’s all thanks to one of the simplest options strategies out there: covered calls.

Now, let’s get one thing out of the way. Options can be something of a dirty word among individual investors — but don’t be fooled. Yes, there are a lot of aggressive strategies out there. But there are also options strategies that are geared toward hedging and generating income. And covered calls is one of them.

Now, let’s get one thing out of the way. Options can be something of a dirty word among individual investors — but don’t be fooled. Yes, there are a lot of aggressive strategies out there. But there are also options strategies that are geared toward hedging and generating income. And covered calls is one of them.

Covered calls allow you to increase the amount of income you’re earning while protecting you on the downside. You still get to enjoy some upside in the stock, but the only catch is that your gains may be capped.

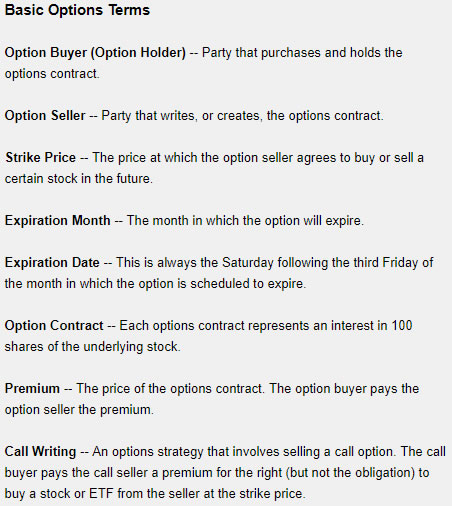

When you sell a call option, you enter into a contract to sell the underlying shares to the option owner at the specified price (called the “strike price”) if the stock reaches this price. In return, you get a cash payment upfront from the option buyer (known as a “premium”). Depending on how many of these contracts you sell, the payments can easily be anywhere from a few hundred dollars to thousands of dollars.

A “covered” call is when you already own the underlying shares. This is much safer than what’s known as “naked” call writing — meaning you don’t own the underlying stock at the time.

If the stock stays below the strike price you specify in the option contract (you get to choose the strike price), then the option expires worthless. That’s good, because it means you can pocket the income and simply move on to another trade. Not only that, but the income you earned effectively reduces your cost basis. And this is why it’s regularly used as a hedging tool — it protects your position.

But if the stock does climb higher, than that’s fine. Not only do you keep the income, but you sell your shares at the strike price. The only risk here is that the stock moves well beyond the strike price and you miss out on the additional upside.

As they say, there are no free lunches. But that’s a pretty good tradeoff if you ask me. In fact, it’s about as close as you’re going to get to a “win-win” when it comes to investing…

A Covered Call Example

Now, covered calls aren’t the only way to earn more income. But like I said, it’s one of my favorites. And the reason I’m bringing this up today is because my colleague Robert Rapier just launched a new service that utilizes this exact strategy. It’s called Rapier’s Income Accelerator.

Robert is already on a roll… he’s made 17 winning trades in a row without a single loss. And he’s just getting started.

So to demonstrate just how powerful this strategy can be, I want to pass along an example he recently gave to readers…

Let’s say you own 100 shares of Hewlett Packard (NYSE: HPE), currently trading at $15.72. The company pays a quarterly dividend of $0.12, for an annual yield of 3.1%. I can enter a contract in which I sell an option that allows someone to purchase my shares of HPE by some future date and at a specific price.

Here is an actual example I looked up as I was answering this. Presently, there is a call option for Hewlett Packard with an expiration date of 9/17/21 and a strike price of $17.00. The premium on this call is $0.65/share, which is more than the total annual dividend of HPE. So, by selling the call, you have more than doubled your effective annual yield. Second, you reduce your cost basis by $0.65, or 4.1%.

If shares are at or above $17.00 at expiration, your shares will be called away. (They could be called earlier if the share price rises above $17.00 before the expiration date.) In other words, you will sell them for $17.00 regardless of the price at the time of expiration.

However, your reward here is the premium, plus two dividends that will be paid between now and then, and a price that is above the current price. The total return for this transaction, if shares are called away, is 14.4% for a holding period of 157 days. The annualized return is 33.5%.

If shares are below $17.00 at expiration, then you keep them and can enter another transaction. Your reward in this case is an annualized yield that was pushed all the way to 12.7%.

Closing Thoughts

Now, keep in mind that Robert shared this example a few days ago — and prices have moved since then. HPE is now trading for about $16.45, so you could sell the $18 calls and earn roughly the same premium from this example.

Either way, this gives you an idea of what’s possible with covered calls. And if you’re looking to earn more income (while still enjoying the upside potential — and lowering your cost basis to boot), then this should be one of the first moves you consider.

Bottom line, don’t be fooled by what you may have heard about options. Sure, a lot of people use options like a casino. But I’ve got news for you… most of those people are buying options, not selling them. So sell them. And as Robert says, don’t gamble at the casino, be the casino.

This just the beginning of what covered calls can do for you. And once you understand the power of this strategy, you may never go back to the same old “buy & hold” approach to dividends ever again.

So if you want to learn more, then I strongly advise you to check out Robert’s new service right now.