Some Easy Ways To Beat Inflation… And The Best One Of Them All

We talk a lot in my premium newsletter about yields. After all, it’s called High-Yield Investing for a reason – it comes with the territory.

Most of the time, I’m referring to nominal yields when we have these discussions. But you could argue that real yields are more important.

What’s the difference? The latter accounts for inflation.

I’ve spent a considerable amount of time talking about the Fed and inflation over the past few months. So I’ll spare you most of the details of what’s going on. Instead, I want to focus on what you can do about it.

And that’s where real yields come into play…

If you earn a nominal rate of 5% and the price of goods and services climbs by 2%, then your purchasing power has really only increased by a net of 3%. And if you earn 5% while inflation eats up 5%, then you really haven’t gained anything at all.

Worse still… Say your portfolio earns 2% and inflation rises 4%. In that scenario, you are actually moving backward and can afford less stuff than when you started.

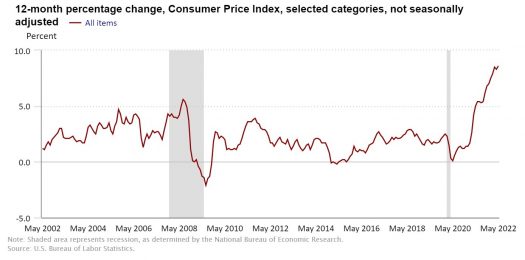

Unfortunately, this isn’t hypothetical. A 10-Year Treasury Bond is currently paying about 3% (a big improvement actually). Meanwhile, the Consumer Price Index is running quite a bit hotter. This benchmark (which tracks the cost of everything from clothes to car insurance to airfare) has risen by 8.6% over the past 12 months.

Incidentally, that’s the sharpest CPI spike in 40 years. It’s also well above the Fed’s stated comfort zone level of 2%. Even if you strip out volatile food and energy, the CPI reading showed a 6% increase.

What You Can Do Right Now

We all know the Fed has no choice but to tighten. We’ll see how much and how fast, but in the meantime, we’ve already seen sustained devaluation in the dollar relative to other currencies. And the rising cost of peanut butter and dishwashers will only further weaken your spending power.

So what can you do to fight back?

For starters, I recommend keeping at least a small portion of your assets denominated in something other than greenbacks (precious metals, for example). Hard assets like land, timber, real estate, and commodities can also be reliable inflation hedges.

Treasury Inflation-Protected Securities (TIPS) are an obvious choice. While the coupon rate attached to these securities is fixed, the principal is not – it’s indexed to the CPI and appreciates in lockstep with inflation. As the principal increases, naturally so do your semi-annual interest payments. And they are backed by the full faith and credit of Uncle Sam.

At maturity, you receive either the original face value of the instrument or the inflation-adjusted principal, whichever is greater. As an added bonus, income and gains are exempt from state income taxes.

I should point out that these securities will likely underperform traditional bonds during deflationary periods (although that risk seems remote right now). Bottom line, these securities will throw off an income stream designed to at least keep pace with inflation.

There’s also the Vanguard Short-Term Inflation-Protected Securities Fund (Nasdaq: VTIP). Full disclosure, I own some of this in my 401(K). But I believe there are better options…

Why You Need To Own Dividend Raisers…

If inflation is most corrosive to fixed income assets, then you’ll want to look at securities whose payout streams aren’t set in stone. Companies like Procter & Gamble (NYSE: PG) and Coca-Cola (NYSE: KO) have the pricing power to pass rising costs along to their customers – keeping dividends moving forward.

Back in 2008, a standard grocery basket filled with 20 household staples including milk, eggs, bacon, butter, and tomatoes would have cost $54. Today, the same items would ring up at around $76. That’s an increase of 40%.

Meanwhile, KO shareholders have seen their dividends rise from $0.19 to $0.44 per share, an increase of 131%. That’s three times the pace of inflation. The annual income from a 1,000-share position would have risen from $760 to $1,760 – a lot of milk and eggs.

So if you owned KO in the past, you’re getting pay raises that more than outpace the rate of inflation. But the unfortunate reality is that you’re getting a yield of less than 3% if you buy today.

The truth is that there aren’t too many yields in the S&P 500 above, say, 4%. You won’t get an income stream like that investing in popular blue chips like KO.

The good news: At last check, the average holding in our portfolio over at High-Yield Investing yields about 7%. The bottom line that you don’t have to settle for the paltry yields offered by CDs, bonds, or most U.S. stocks. But extraordinary yields aren’t found in ordinary places…

So if you’re looking for the best high-yield opportunities the market has to offer, then you should check out my special report…

You’ll learn about 5 “Bulletproof Buys” that have weathered every dip and crash over the last 20 years and STILL hand out massive gains to investors. You’ll also learn more about High-Yield Investing and how to get full access to my premium portfolio.