The High Yields Are Still Out There (Here’s Proof…)

The S&P 500 actually had a couple of “down” days last week. Ordinarily, that wouldn’t really be news.

But considering losing days for the benchmark index have been rare since mid-June, I find it noteworthy.

Until last Tuesday, U.S. stocks had gained ground nine times in the previous ten trading sessions. That winning streak carried the S&P into the holiday weekend with a new record high of 4,355.

Traders returned from their Independence Day cookouts and fireworks shows with a bit less enthusiasm… The “delta” variant of Covid, which is already making its way through Europe and other countries could be partially to blame.

Or perhaps traders are growing increasingly worried about the Fed’s agenda. The latest batch of economic reports shows continued healing. But it also gives the central bank further reason to begin weaning the patient off its potent monetary medicine.

As I told my High-Yield Investing readers back in May, interest rate tightening and/or tapering of the Fed’s asset purchasing programs could be right around the corner. The simple act of telegraphing such a policy shift would likely induce a few rounds of heavy selling, which is why Fed chief Jerome Powell chooses his words very carefully.

And we haven’t even gotten around to talking about inflation concerns. I’ll spare you the highlights of those worries, which I’ve already covered in detail (here and here).

But I’m not writing this to talk about doom and gloom. Quite the opposite, in fact.

The High Yields Are Still Out There…

My longtime readers know that I like to point this out often, but it needs to be said right now…

The high yields are out there, you just need to know where to find them…

Case in point, most of our High-Yield Investing holdings remain at or near record highs. In fact, the portfolio has rebounded 111.3% off the lows from March 2020. It’s hard to complain about a rally like that. Although, this powerful advance has made rich yields rarer and more elusive than ever. As we all know, rising share prices drive yields in the opposite direction.

I’ve grown accustomed to saying the S&P 500 has a yield of “around” 2.0%. But we can’t even round up to that level anymore. Today’s yield? Just 1.34%. In this world, 2% is above-average and 3% can be considered somewhat generous – more than double the market norm.

In the past, I used to occasionally get emails from my premium subscribers who were annoyed with me for recommending a stock that “only” yielded, say, 5%.

That’s not really happening in this environment. We’ve all become accustomed to the new reality for income-seekers.

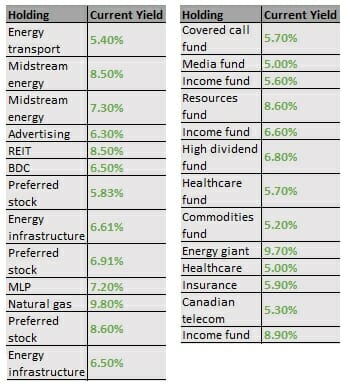

That’s why I’m pleased to report that more than two dozen of my carefully-vetted portfolio holdings (26 to be exact) boast lofty payouts above 5.0%. Quite a few of these offer bountiful yields of 6% to 7%, or more — on top of the capital gains we’ve been locking down.

Closing Thoughts

What you see in the table above is a broad range of income sources. Some come from areas that income investors are familiar with… while others come from names that most investors may not even know exist.

Yet all of them provide mouth-watering yields that are increasingly rare in this market.

Needless to say, it takes some digging to uncover income like this.

Usually, it means venturing beyond the boundaries of the S&P 500. Outside of Wall Street’s glaring spotlight, many of these hidden spots also offer more attractive valuations too. But here’s what excites me most… With few exceptions, the income stream on these holdings isn’t set in stone – but continues to climb higher and higher.

The point is, don’t be discouraged when you see stories about the “average” yields the market has to offer.

Over at High-Yield Investing, we’re not interested in “average,” anyway. It’s right there in the name.

The yields are out there, but only if you’re willing to find them. And that’s why my team and I are here to help.

If you’re interested in finding the highest, safest yields on the market, then I invite you to learn more about my premium service right here.