The Shocking Truth About High Yields In This Market May Surprise You…

Sometimes, I don’t like telling acquaintances what I do for a living.

Don’t get me wrong, I like my job. And I certainly enjoy the market. It’s just that sometimes when my wife and I are out with a group, I’ll meet someone (usually my age or younger) who wants to know my thoughts on Bitcoin. Or Gamestop. Or… whatever the latest fad is they heard about on Reddit or Twitter.

I appreciate the interest, but honestly, sometimes I want to lose it.

When we get back to the car, I’ll tell my wife, “These people want to be rich, but they won’t do what it takes. They should stop messing around and just keep it simple. But they don’t want to hear that.”

She’ll politely nod her head, and tell me, “I guess if it was easy, everyone would do it.”

She’s right, of course. But the thing is that it’s not as difficult as most people make it out to be. The biggest part is time, patience, and discipline — qualities that have nothing to do with the market on its face.

The truth is that there are plenty of solid picks out there that will create long-term wealth. The only question is whether you’re willing to ignore the noise created by Wall Street.

To discuss this, I turned to my colleague Nathan Slaughter. He just released an amazing new report showing how just a simple group of 5 “Bulletproof” income payers could be all you need to create true, lasting wealth. We also the state of yields in the market, and his former career as a high-powered financial advisor in the exchange below…

You got your start managing money for wealthy clients at one of the big brokerage houses. What was that like, and what led you to make the switch to writing about the market instead?

Well, as you may know, I got my start working for AXA/Equitable Advisors, one of the world’s largest financial planning firms. Then, I moved over to Raymond James Morgan Keegan, where I managed millions in portfolio assets.

Well, as you may know, I got my start working for AXA/Equitable Advisors, one of the world’s largest financial planning firms. Then, I moved over to Raymond James Morgan Keegan, where I managed millions in portfolio assets.

I’ll tell you one of the reasons I left by sharing a little story…

Every once in a while, I’d field a random call from one of our clients. They’d want to buy a big block of shares in one stock or another.

Understand, I didn’t do cold-calling. My job was to advise our wealthy clients. But those little phone calls would lead to a $100 commission check just for helping facilitate the order.

You know what my old boss told me? “Don’t get too accustomed to those big commission checks.”

Turns out, he was right. Even back then (in the early 2000s), online trading was becoming a real threat to full-service brokers. Think about it… why pay $100 just to buy or sell a stock when an internet site could process the same order for $10?

That’s the way of business. Adapt or die.

We began steering clients away from transaction-based accounts toward fee-based platforms that charged fixed annual fees (maybe 1% to 2% of assets). That was just fine for our wealthier clients (and our business), but many investors were willing to forgo the personalized advice in favor of saving thousands each year in fees.

Not that I blame them. At all.

Today, of course, all the big online brokerages charge zero fees for trading. These companies rake in far more money from margin loans and net interest earned on clients’ idle cash.

On a personal level, I’m glad I left the brokerage business behind long ago to eventually take the reins of High-Yield Investing. It allows me to speak directly to investors who want to take charge of their portfolio, and I can help them by offering my analysis and picks – in a much more rewarding way than I was with my wealthy clients back in the day.

In a world where cryptocurrencies and “meme stocks” get all the headlines, why do you think income stocks are still important?

One benefit to being in this game for a long time is that you see fads come and go in the market. Whether it’s cryptos, meme stocks, whatever… they all promise the same thing: a fast, easy score.

Now, I don’t mind a little gambling now and then. But I believe gambling belongs in a casino. For most of my readers, this is their financial future we’re talking about.

That’s why I’ll keep saying this for as long as it takes: If you truly want to build long-term wealth, then the stocks you own in the “core” or your portfolio MUST have a yield attached to it.

The studies are clear on this… dividends make up for more than half of the market’s total return over the long haul.

What would you say to those who point out that the yield on the S&P 500 is now only 1.35%?

It’s understandable, up to a point. After all, we’ve had an incredible rally since the Covid-19 pandemic hit and the market sold off. So yields are naturally depressed (as prices go up, yields go down).

But don’t be deceived. There are plenty of high yields out there. You just have to know where to look – and that’s where my team and I come in…

I just wrote a whole piece about this. In this world, 2% is above-average and 3% can be considered somewhat generous – more than double the market norm. But I’m not settling for that…

I’m not saying you should do something irresponsible. If you see a stock yielding 10% in this market, something is probably wrong…

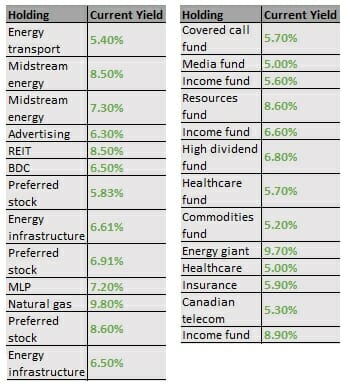

Just take a look at this table. Over at High-Yield Investing, we have more than two dozen holdings in our portfolio that pay above 5.0% — right now.

The really beautiful thing for our subscribers is that we’re actually earning even more than this. These are just the yields they pay right now. Some of these are positions we added last year when the market was in chaos and people thought the world was ending.

So not only are we earning sky-high yields, but we’re sitting on more than a few triple-digit gains, too.

But the point is, there are plenty of high-quality picks out there that yield more than 5%. In fact, some of them are downright “bulletproof”.

You’ve made it a personal mission to dispel the notion that the high yields are all gone. Why is it so important?

It’s one of the biggest myths about income investing right now. Everybody thinks yields are too low. And they are. But this table is proof that the yields are out there.

And this is why I’m trying to tell every investor who will listen right now a simple message.

Income investing still works. Compound interest is magical. The sooner you start investing in a solid group of income payers, the sooner you’ll reach financial independence.

Don’t feel overwhelmed by the thousands of stocks, mutual funds, closed-end funds, exchange-traded funds, REITs, and other investment vehicles out there. You can make yourself crazy (or worse, paralyzed by inaction) trying to evaluate them all to find the best options.

You can start with just a handful of income payers and go from there. In fact, I’ve identified a set of five income payers who have proven themselves to be so strong, so reliable, and so generous… that I believe they can be counted on, no matter what happens with the economy.

You can start with just a handful of income payers and go from there. In fact, I’ve identified a set of five income payers who have proven themselves to be so strong, so reliable, and so generous… that I believe they can be counted on, no matter what happens with the economy.

Each of them yields over 5% right now. And each one of them has provided us with fantastic long-term returns over at High-Yield Investing. And I have little doubt that they’ll continue to do so for years to come.

I want to thank Nathan for joining us today.

As he mentioned, Nathan has a brand-new report out about these 5 “Bulletproof Buys” that allow you to keep it simple – while building serious wealth in the process. In fact, with these high-yield stocks, you may never have to worry about what the market is doing again!