Why There’s Still Time To Get In On The Cybersecurity Megatrend…

Buying a home is part of the American dream. Finding the perfect house with the proverbial white picket fence. A place to raise a family and grow old together. For most, it’s the most significant purchase we’ll ever make, and we squirrel away thousands, even hundreds of thousands of dollars for that down payment.

The days leading up to closing are a mixed bag of excitement and anxiety. But you’ve done your due diligence on the property and feel comfortable with your decision. So, what could go wrong?

For this Colorado couple, everything…

As if the hurdles you go through just to buy a house weren’t enough, these days you must stay on the lookout for modern-day thieves, lurking in the shadows ready to steal your life savings.

James and Candace Butcher found their dream house last year. A place to be closer to their son, and watch their grandchildren grow. They had a sizeable chunk of change — roughly $272,000 — to use as a down payment on their new home.

Just one more day and the house was theirs. They could begin making it their own. But over the next 24 hours, their dreams turned into a nightmare. Not only did they not get the home, but their entire life savings was gone.

You see, cybercriminals hacked into the title company’s servers and obtained financial information relating to the house purchase. They then sent a bogus email to the homebuyers impersonating a title company employee. The email was a “final” closing disclosure, telling the couple to wire funds in the amount of $272,535.96 to close on the property.

They obliged…

The money disappeared. Buying the house was no longer a possibility, and they had to live in their son’s basement as they tried to figure out what to do next.

The money was never recovered.

Fighting Cybercrime Is A Big (And Growing) Business

The Butcher’s aren’t the first, nor will they be the last, victims of this type of fraud. According to the FBI’s 2020 Internet crime report, more than $213 million was diverted from real estate transactions and wired to criminally controlled accounts.

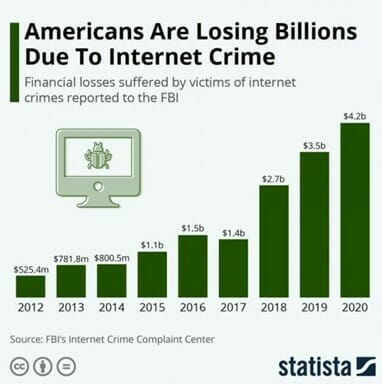

According to a recent FBI report, Americans were scammed out of nearly $4.2 billion last year, with the agency seeing a staggering 69% increase in complaints compared with 2019. The most common frauds were phishing scams, non-payment/non-delivery scams, and extortion, while the costliest scams came from compromised emails, romance, and investments.

Source: Statista

The infographic above was recently shared by my colleague Brad Briggs in this article. In that piece, he made an excellent point, which is that investors shouldn’t make the mistake of thinking they’ve missed the boat on this trend…

Cyber theft is the fastest-growing crime in the United States. According to a report by Cybersecurity Ventures, global cybercrime costs are estimated to hit $6 trillion this year, up from $3 trillion in 2015. To put that $6 trillion figure into perspective, if cybercrime was measured as a country, then it would be the world’s third-largest economy after the U.S. and China.

The global cybersecurity market was valued at $167 billion in 2020, according to Grand View Research, and is expected to register a compound annual growth rate of nearly 11% from 2021 to 2028.

How We Can Profit

So while this is an unfortunate aspect of the world we live in, the good news is that companies in the business of protecting the internet and our data will should continue to do very well for investors.

My readers and I have traded in the cybersecurity space many times in the past, often with great success. For example, over at Maximum Profit, we nearly doubled our money on shares of the cloud security firm CrowdStrike (Nasdaq: CRWD) back in February.

In 2019, we booked a 41% return from the cybersecurity company Okta, Inc. (Nasdaq: OKTA) in just seven months. The same year, we also made a quick 39% gain on CyberArk Software (Nasdaq: CYBR), another company in the cybersecurity space.

And while we are primarily focused on trading in that premium service, the truth is that this has also been a key area of focus over at Top Stock Advisor, my other premium service. So these are also names to watch for long-term investors.

Editor’s Note: The world’s richest billionaires — Musk, Bezos, and Branson… are in a FIERCE competition, battling it out in what media is calling the “billionaire space race”…

Each one of these guys plan to dominate the $2.5 trillion space industry — but ONE may have already won the race, thanks to a new technology that’s hovering above the earth as we speak. And the good news is that you and I can profit from it…