High Yields Are Still Out There… (Here’s What You Could Be Earning)

$48,117. That’s the increase in my High-Yield Investing portfolio over the past 12 months. In the October 2020 issue, the balance stood at $106,250. As I’m writing this, we’re looking at a value of $151,373. That’s a 12-month return of about 45%.

The market has provided a nice tailwind over this time frame, with the benchmark S&P 500 gaining 35.7%. I’m happy to say we’ve matched that return and then some — outrunning the market by nearly 1,000 basis points.

That won’t always be the case. Considering we don’t invest in growth stocks like Apple or Google (and have a sizeable allocation of municipal bonds, preferreds, and other fixed-income securities), the S&P 500 isn’t the best yardstick to measure our performance. In fact, only five of my 45 active holdings are S&P members.

The yield on this popular basket of stocks has sunk to 1.25%. So out of necessity, I must look outside its borders for high-yield portfolio candidates. That generally means small/mid-cap territory, where richer payouts of 4% or higher are more plentiful.

Your average investor has never heard of the stocks, funds, and other securities we talk about in High-Yield Investing. They don’t get a lot of coverage in the mainstream financial media. But that’s fine with me. While behemoths like Wal-Mart are closely scrutinized by Wall Street analysts, smaller businesses are less followed and more lightly traded – a combination that leaves many quality stocks trading at steep discounts to fair value.

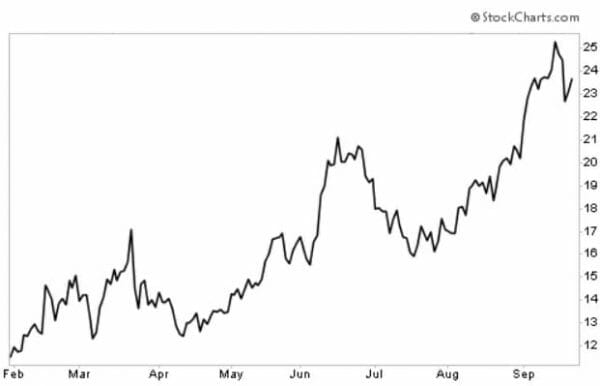

Coincidentally, the aforementioned October 2020 issue was a clarion call for investing in small caps. Since then, this overlooked corner of the market has shined. At the same time, a long-overdue rotation into value has also worked in our favor and bolstered performance. At the intersection of these trends lies stocks like the global shipping company I profiled, which has doubled since we pounced on it last January.

I’ve already recycled some of these gains, which have given our High-Yield Investing portfolio greater income-producing capacity. For illustrative purposes, let’s suppose I deposited the entire $154,367 in a one-year bank CD paying the national average of 0.17%. At that rate, we would earn about $262 per year – or a whopping $22 per month. Add another zero to the principal, and even then we would earn just $220 per month… barely enough for a trip to the grocery store.

Our mission is to help your money work harder. How much harder? Well, for the first time I’ve decided to assemble that information in a spreadsheet. Here are the total dividend distributions (or “paychecks”) we can expect to receive over the next 30 days.

Holding |

# shares |

Expected Div. or Int. Payment |

Total Distribution |

|---|---|---|---|

| Energy midstream | 272 |

$0.27 |

$73.44 |

| Commercial REIT | 40 |

$0.24 |

$9.60 |

| Energy MLP | 89 |

$0.45 |

$40.05 |

| Big Pharma | 75 |

$0.39 |

$29.25 |

| Energy giant | 50 |

$0.43 |

$21.50 |

| Ag mortgage company | 50 |

$0.88 |

$44.00 |

| Datacenter REIT | 25 |

$1.27 |

$31.75 |

| BDC | 115 |

$0.21 |

$24.15 |

| Casino REIT | 100 |

$0.33 |

$33.00 |

| Mortgage insurer | 50 |

$0.36 |

$18.00 |

| Fast-food conglomerate | 60 |

$0.53 |

$31.80 |

| Hotel preferred stock | 100 |

$0.41 |

$41.00 |

| Mortgage REIT | 100 |

$0.62 |

$62.00 |

| Energy/MLP fund | 150 |

$0.18 |

$27.00 |

| Shipping preferred stock | 186 |

$0.55 |

$102.30 |

| Oil & gas midstream | 75 |

$0.94 |

$70.50 |

| Covered call fund | 100 |

$0.13 |

$13.00 |

| Dividend fund | 150 |

$0.11 |

$16.50 |

| Real asset fund | 100 |

$0.10 |

$10.00 |

| Enhanced income fund | 300 |

$0.05 |

$15.00 |

| Premium dividend fund | 142 |

$0.10 |

$14.20 |

| Healthcare fund | 100 |

$0.11 |

$11.00 |

| Muni bond fund | 150 |

$0.05 |

$7.50 |

| Commodities fund | 300 |

$0.04 |

$12.00 |

| Emerging markets fund | 45 |

$0.64 |

$28.80 |

| Utilities fund | 100 |

$0.12 |

$12.00 |

| Canadian telecom | 100 |

$0.72 |

$72.00 |

Total |

$871.34 |

I don’t bring all this up to brag. The point is that even in this historically low-yield environment, we will still collect a healthy $871 next month. That’s roughly 40 times more than the income from a bank CD.

The average retired worker collects a $1,553.68 check each month from Social Security, according to the Social Security Administration. So that’s already 50% more each month right there, for a total of $2,424.68. That could get the job done in retirement, depending on your situation.

But the good news is this… When most of my High-Yield Investing readers retire, they’re sitting on a bigger portfolio than $154,367.

Let’s say you add a zero back on to our portfolio size again. At $1.54 million, you’re looking at $8,710 per month. That’s more than enough for most of us.

Regardless of where you’re at, this should be proof-positive that you don’t necessarily need to reach for risky “growth” stocks to make up for lost time. A stable of quality dividend payers can make you rich over time.

And that’s where my latest report comes in…

I’ve handpicked 5 of my absolute favorite dividend payers for a very special purpose. Each one of these is what I consider to be “bulletproof” – meaning you can build your portfolio around them, sleep well at night, and watch the income roll in year after year.