How “Dividend Capture” Works — Plus: A Better Way To Do It…

Let’s say you’re looking for more income. Aren’t we all?

Maybe you’ve heard the term “dividend capture” before and are thinking about trying it. A traditional dividend strategy is pretty simple, and if done correctly, it could be an easy way to dramatically increase income on your existing dividend-payers. Knowing the basics makes it easy to see how it can make an already attractive high-yield stock even more attractive.

It works like this: You buy a dividend-paying stock right before it’s about to go ex-dividend. Hold it for at least 61 days so the income qualifies for the lowest possible dividend tax rate. Then, sell it and use the money to buy another stock that’s about to go ex-dividend.

With the right timing, investors could even grab huge special payouts when a company puts in a strong performance or is restructuring.

There’s just one problem with the traditional strategy, though. Once the stock goes ex-dividend, the share price typically drops by at least the dividend amount. Some stocks fall even more after offering large payouts, and there are no guarantees they will recover. When that happens, you could end up losing more from the lower share price than you made in the dividend.

Fortunately, there’s a better way to execute this strategy…

How Dividend Capture Works

While there is no surefire way to mitigate the entire risk of the dividend-capture strategy, investors can alleviate some of it by rotating in and out of stocks.

Here’s what to do: Pair two stocks that pay quarterly dividends at different intervals and hold onto each for the minimum required 61 days to get the reduced dividend tax rate. By doing so, you’ll squeeze out two extra payments a year with the same investment capital.

Let’s say Stock A and Stock B each sell for $100 per share and pay a 10% dividend yield. Each stock delivers a total annual payment of $10 a share, equating to a dividend payment of $2.50 per quarter.

By rotating in and out of the two stocks, you can capture six tax-advantaged quarterly dividends instead of four (that’s 50% more dividend payments) each year, or $15 a share instead of $10. In other words, you can increase your yield from 10% to 15% by rotating in and out of these two stocks.

Here’s an example of how it might work. Say you buy Stock A before it goes ex-dividend at the end of December and sell it at the end of February. You pocket $2.50 a share from Stock A. You then use the money you get from selling Stock A to buy Stock B before it goes ex-dividend at the beginning of March and sell it at the end of April. You pocket $2.50 per share from Stock B.

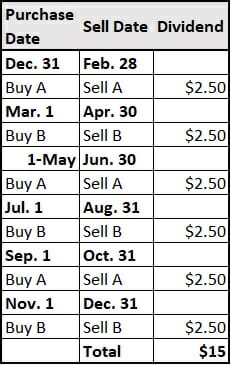

You rotate in and out of these two stocks six times, buying one just before it goes ex-dividend, holding it for the minimum required 61 days, selling it after you’ve pocketed the dividend, and using the funds to buy back the other one, as shown in the table below:

Action to Take

Remember: While this strategy can boost already impressive yields, it’s not risk-free. There’s no guarantee that the extra income will cover any falls in the share price.

That said, using a dividend capture strategy is one of the simplest ways you can boost your income stream throughout the year.

Pay close attention to the overall market and the stock’s underlying fundamentals before you buy. When a pullback comes in the future, it could be the perfect opportunity to pick up great dividend payers at a discount. And with this dividend-capture strategy, your effective yield will be even higher.

Editor’s Note: Instead of trying to trade your way in and out of income stocks, we strongly suggest you check out this instead…

Our colleague Nathan Slaughter just released a report covering 5 of his absolute favorite “bulletproof” income payers for any market. Each one of them has a proven ability to weather whatever the market throws at it… over decades. And through it all, they reward investors with rising dividends each year — on top of some serious price appreciation.

You won’t hear about these securities in the mainstream financial media. But if you want to build serious wealth over time, you will want these income payers in your corner.