Here’s Why Facebook’s Bad Week Probably Spells A Buying Opportunity…

This is just not Facebook’s week.

On Tuesday morning, a former project manager at the company turned whistleblower sat down with Congress to give her testimony.

Among her accusations are that the social media giant puts “profits over people” by allowing and/or enabling misinformation and division. What’s more, she alleges that the company actively promotes to children despite knowing the deleterious effects of social media on young people, especially young women.

“The documents Haugen released unearthed several explosive revelations about the company’s tactics in the pursuit of growth, including bids to market its products directly to children, documents underscoring the severity of the platform’s public health misinformation crisis and internal research that found its Instagram platform is destructive to young girls’ mental health.”

As if that weren’t bad enough, then the company’s entire suite of apps went offline for about six hours – Facebook, WhatsApp, Messenger, Instagram, Occulus, you name it. The culprit, according to the company, was an issue with the “backbone routers that coordinate network traffic between our data centers caused issues that interrupted this communication.”

Shares of FB fell 5% on Tuesday, and are down about 12% from their previous high in early September.

The Bigger Picture

Now, I’m not savvy enough to fully understand what happened with the outage. And I’m not plugged into Washington, so I don’t know whether these hearings will actually lead to anything. But seeing as how Congress can barely get anything done, my guess is no.

There’s a lot of talk about Facebook being the next “Big Tobacco”. The implication is that you have a giant company, actively harming the public, knowing about it, and lying about it.

While my personal take is a little more nuanced than that, I’ll stay out of such arguments. Our job, after all, is to point you to opportunities to profit.

So here’s what I do know…

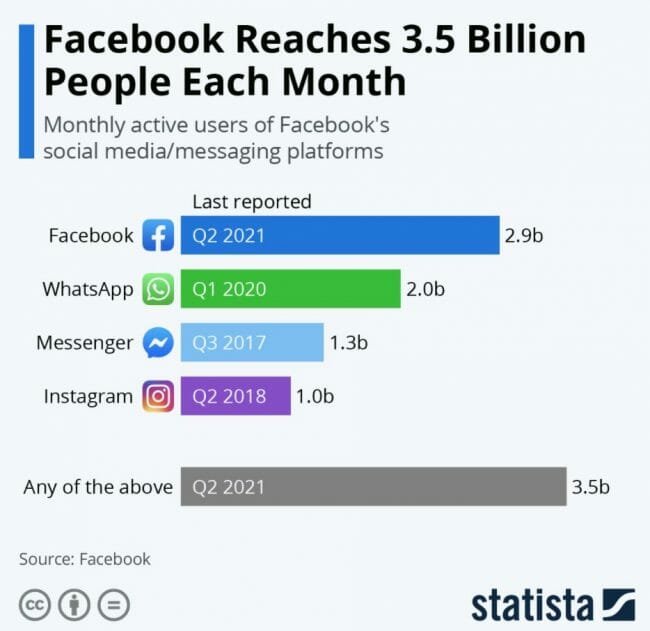

Facebook is giant. Its reach is undeniable. In the graphic below, you can see the latest available information on how many people use each of Facebook’s apps.

Source: Statista

Here’s what I also know…

As my colleague Jimmy Butts, Chief Strategist of Top Stock Adviser, likes to say, Facebook is a “no brainer” stock. Yet many investors seem to write it off, thinking that there isn’t any growth happening, or that they simply missed their chance.

Here’s what he had to say the last time he updated his subscribers on the company’s Q2 numbers:

“When we talk about the large tech companies on the market, we often end up talking about these large sales numbers so much that we can become numb to just how impressive they are. It’s not easy for a trillion-dollar company to really move the sales needle. Yet, Facebook continues to do so.

The company is on pace to generate more than $118 billion in sales this year, which would represent a 37% increase from the $86 billion it made in 2020.

For its second quarter, Facebook pulled in more than $29 billion in revenue with earnings per share of $3.61. Both topped analyst expectations.

Facebook’s $29 billion in quarterly revenue was a staggering 55.6% increase over the same period a year ago. It also pulled in more than $13.2 billion in cash flow, giving it a cash flow return on invested capital of 36.5%.”

Since adding Facebook to the Top Stock Advisor portfolio in 2016, the stock has delivered our premium subscribers a massive 180% return. That handily beats the S&P’s 106%.

Action To Take

Just look at how much of that has come in the last couple of years. It’s remarkable. Yet every time Facebook comes under scrutiny, it gets discarded. But it usually ends up being a buying opportunity. And by the way, when the company publishes Q3 results on Monday, October 25th, you can probably expect more of the same… blow-out numbers.

As I write this, Jimmy is already updating his Top Stock Advisor readers on the situation with Facebook. But I’ve already confirmed the gist of what he’s going to say.

As Jimmy told me, “Yup, still a buy.”

Editor’s Note: Jimmy and his team just released a shocking report about Elon Musk’s latest venture… and how it could make you a killing…

If you haven’t heard of Starlink yet, you will. It’s Musk’s secretive satellite project, housed within SpaceX. And after extensive beta testing, the billionaire entrepreneur is about to go “live” with it soon. But even though SpaceX (and Starlink) is “off limits” to regular investors, we’ve uncovered a “backdoor” way that gets you in on the ground floor… ahead of other investors.