A Safe, High-Yield Way To Play The Housing Boom

When I looked up our home value estimate on Zillow the other day, I noticed that it had dropped a bit.

How could this be? The market is red-hot!

The rational part of my brain soon kicked in and I calmed down. I reminded myself that while the local market here in Austin is arguably the hottest market in the country, like all residential real estate, this stuff is seasonal.

And while Zillow’s platform is great, its algorithmically driven estimates are just that, estimates. So for perspective, I looked at how much it had gained compared to a year ago. I’ll give you a guess… it was still more. A lot more.

Chances are, you’re in a similar boat. Because according to the Federal Reserve, U.S. households are swimming in new wealth.

Record Household Wealth

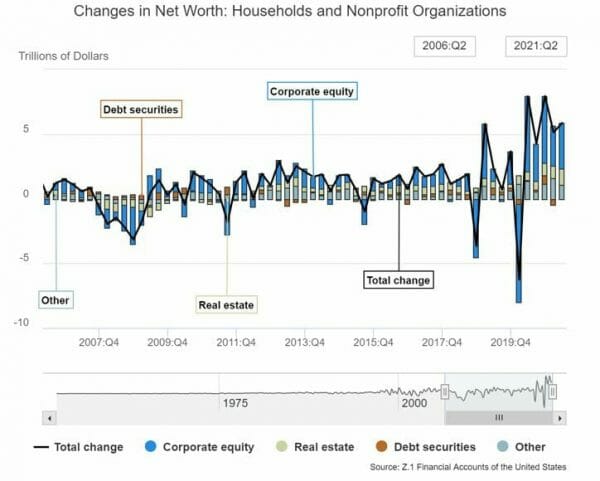

According to the central bank, U.S. household net worth rose by $5.85 trillion in the second quarter. That’s a staggering increase of 19.6% from a year ago and pushes household wealth to a record $141.7 trillion.

Source: Federal Reserve

The majority of that gain came from a little place you may be familiar with… the stock market.

U.S. households gained $3.5 trillion in wealth from the market, as all of the major indices have eclipsed their pre-covid highs… and then some.

The other major contributor to that wealth gain: surging real estate prices. About $1.2 trillion of the increase came from real estate, with home equity rising to 67.7%, the highest level since 2008.

Flush with equity (and cash), combined with near-record low interest rates, there’s arguably never been a better time for people to buy a new home (or refinance their existing home).

And while income-minded investors may be frustrated by the Fed’s insistence on keeping short-term rates near zero, there is a way we can profit from a wave of home-buying activity without investing directly in the homebuilders…

A Safer Way To Profit From Home Sales

If you’ve ever bought a new home, then you know that the closing process can be a bit of a headache. Part of that headache entails a stack of paperwork, along with fees that must be paid such as title insurance and escrow fees.

Have you ever found yourself sitting at the table signing all those documents during the closing period and thought about what a beautiful business this must be for the company providing this service?

I know I have… And as it turns out, if you’re a homeowner, there’s a one in three chance you did business with Fidelity National Financial (NYSE: FNF).

FNF is the No. 1 provider of title insurance and escrow services. Here’s what my colleague Nathan Slaughter had to say about FNF in a recent update to his High-Yield Investing premium readers:

Between title premiums, escrow fees, and investment income, this well-positioned business is taking in $3.9 billion in quarterly revenue. And it’s a lean and efficient organization, maintaining the highest profit margins in the industry for 19 consecutive years.

FNF closed 568,000 title orders last quarter, a healthy increase of nearly 50% from a year ago. And with margins expanding by 430 basis points, adjusted pre-tax profits in this key segment zoomed 80% to record levels. Earnings of $2.06 per share were enough to cover the $0.36 dividend more than five times over.

Nathan told his premium readers about FNF back in March of last year. As you may recall, the world was looking rather… complicated at the time. But it turned out to be perfect timing.

As Nathan predicted, home-buying activity surged, helping fuel a massive rebound in FNF shares…

Action To Take

If you can’t beat ‘em, join ‘em. Whenever the title for a home changes hands, you’re going to need title insurance. There will likely be some sort of escrow arrangement, too.

Think of FNF as a way to piggyback on the housing boom. And while Nathan and his subscribers are enjoying a yield-on-cost of 6% (and a gain of 120%) thanks to the fantastic timing, investors who get in now can still do well with this name.

The 3.4% yield the stock pays right now is solid. But this surging, fee-based business, is setting the table for even more income. FNF just announced an 11% increase on the dividend to $0.40 per share, and there is a strong chance investors will get more in the future.

Plus, as Nathan pointed out to his premium readers, a recent acquisition has allowed FNF to branch out into annuities, life insurance, and asset management. This will help diversify the revenue stream and provide a natural hedge against rising rates.

If you’re looking for more picks that throw off year after year of strong returns and high income, then check this out…

Nathan just released a report covering 5 of his absolute favorite “bulletproof” income payers for any kind of market. Each one of them has a proven ability to weather whatever the market throws at it… over the course of decades. And through it all, they reward investors with dividends that rise each year — on top of some serious price appreciation.

You won’t hear about these securities in the mainstream financial media. But if you want to build serious wealth over time, then you’re going to want these income payers in your corner.