Is The “Rolls Royce” Of Semiconductors The Next Trillion-Dollar Company?

Recently, I learned that another global tech giant is making a big investment in my backyard.

Global electronics giant Samsung will build a giant advanced chipmaking plant in Taylor, TX, which is a small, rural community just 30 miles outside of Austin.

All told, the project will cost about $17 billion (yes, with a ‘b’) and create about 1,800 jobs. The campus will cover roughly 1,200 acres and is expected to be complete by 2024.

If that sounds like a big deal, it’s because it is. Think of it as a long-term strategic investment. We’re already in a global chip shortage, and demand is only going to increase from here on out.

The global chip giants are scrambling to alleviate the current situation as well as prepare for the future. And just about every large company that needs chips, from Ford to Apple, are looking for ways to bring design and/or production in-house to meet their growing needs.

The Biden administration is getting in on the act, too, with the Senate recently approving $52 billion in subsidies for new chip plants (although the legislation is still pending in the House as of this writing).

But that’s not what I want to focus on today. Instead, I want to turn your attention to a company that has perhaps benefited from the growing demand for advanced chips more than any other…

The Gold Standard Of The Industry

I’m talking about Nvidia (Nasdaq: NVDA).

I’ll be honest with you. This is a stock I’ve completely missed the boat on up to this point. I’ve followed it casually for years, only to watch it climb all the way up to an $800 billion market cap.

But as we’ve pointed out time and time again, you shouldn’t let that prevent you from jumping on while you still can. In my opinion, this will be a trillion-dollar company in the not-too-distant future.

Let me explain…

You’ve probably heard of Nvidia by now. But my colleague Jimmy Butts recently wrote an excellent profile on the company, and I felt compelled to share some of the more compelling details with you.

As you may know, NVDA makes graphic processing units (or “GPUs”). And they’re the gold standard of the industry.

As Jimmy points out, gamers love them. They’re also used in cryptocurrency mining. And scientific computing. And artificial intelligence. And autonomous vehicles. Augmented reality, virtual reality… you get the idea.

Just about any major tech trend you can think of, Nvidia products are typically used in some form or another, and they’re considered the Rolls Royce of semiconductors.

Here’s more from Jimmy:

Being the top dog has its privileges. One of those is outstanding sales growth…

Just five years ago the company generated $5 billion in sales. Last year, the number swelled to more than $16.6 billion, a 27.2% compounded annual growth rate. And the company is on track to tack on $25.8 billion in revenue this year.

The company pulled in more than $4.3 billion in net income last year and has grown its bottom line at a nearly 50% average annual clip over the last five years.

Cash flow is just as impressive… Last year it generated $5.8 billion in cash from operations. Through the first six months of this year, it’s already made $4.6 billion. That’s an 84% improvement over this same period a year ago. NVDA is on track to finish out the year with more than $10.7 billion in cash flow, which would represent an 85% improvement over 2020.

Action To Take

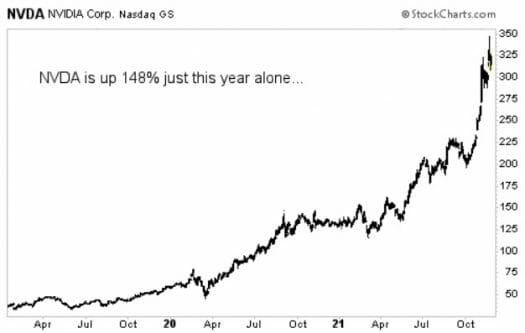

As Jimmy points out, NVDA’s top-of-the-line products and stellar financials have been massive tailwinds, pushing shares to new highs.

My advice: Don’t let the chart or the rich valuation scare you away. NVDA sits at the cross-section of just about every important innovative trend in the marketplace today. It will likely be a trillion-dollar company someday, but it may be a volatile path to get there. If you can stomach the ride, this is a stock you will want to own for the long haul – and possibly buy on any major dip.

P.S. As chief investment strategist of Velocity Trader, my colleague Jim Fink has devised trading methodologies that reap market-beating gains, regardless of economic ups and downs, or Covid, or geopolitical crisis, or whatever else you can think of…

Jim has put together a new presentation that shows smart investors how to use his strategy to make massive investment gains in a short amount of time. Click here now for access.