Get Ready For Another Oil Boom… And We’ve Found The Perfect Target

Right now, media headlines and talking heads on TV are bombarding investors with talk about the new Omicron variant of Covid.

In addition, investors are growing increasingly concerned about inflation – how high it will go, how long it will last, and whether the Federal Reserve can adequately contain it. Oh yeah, and doing it without spooking the market by tapering asset purchases or raising interest rates too fast and too soon would be nice.

Trying to rationally assess the implications in an environment like this can be a challenge. But I sense an opportunity in all of this mess, particularly in the energy sector.

So for some perspective, I turned to my colleague Nathan Slaughter.

For those who aren’t familiar, Nathan has been an astute follower of the energy and resource sectors for years. Back when energy prices fell through the floor in the Spring of last year, he correctly called the bottom (almost to the day), and led his premium subscribers to several triple-digit winners.

Below, I get his thoughts on the Omicron variant, the recent dip in oil prices, and his latest research, detailing the a mega-wave of M&A activity in the Permian and how to profit…

Nathan, you recently made the case that the recent panic over Omicron and the ensuing decline in oil prices are way overblown. Can you briefly tell us why?

Well, it all boils down to this… So far, based on what we know, Omicron seems to have relatively mild health symptoms compared to other variants.

Well, it all boils down to this… So far, based on what we know, Omicron seems to have relatively mild health symptoms compared to other variants.

Time will tell, of course, whether that holds true. But this simply isn’t getting the same attention as politicians talking about travel restrictions, new testing requirements, and what have you.

The fact is, we’ve learned a lot about how to deal with this pandemic. In the meantime, I saw one analysis showing that a crude oil pullback of this magnitude essentially prices in a complete halt to all global air travel for three months.

Obviously, grounded flights and less travel, in general, would bite into oil consumption. But I just don’t see this happening on a wide scale. That means the selloff is overdone (analysts at Goldman have said this, too) — and that means we have an opportunity to buy the dip, so to speak.

With the advent of EVs and increasingly competitive alternative technologies like wind and solar, is the oil patch still worth considering for investors?

Absolutely. Of course, we all know that the calls for “greener” technologies are growing louder by the day. And I’m actually a fan of lithium, for example. But as I’ve stated previously, the world isn’t going to suddenly stop on a dime and stop using oil and natural gas, either.

All of the smart players in the energy space know what the future holds. And they’re preparing for it. Part of that effort includes investing in more capital-efficient projects and a focus on returning excess cash to shareholders in the form of buybacks and dividends instead of recklessly pumping that money right back into the ground. The result is that some of the big boys can remain profitable with oil prices at $40, or even $30 per barrel.

Naturally, they still want to add to production as well as replace assets as they deplete. So many of the oil majors are leaving the significant exploration projects to the smaller players. And if one of them makes a major find, they’ll simply come along and scoop them up. It’s usually a better deal for everyone, including shareholders.

So if oil and natural gas aren’t going away anytime soon, where is the major area of opportunity for investors?

Look no further than West Texas. About 4.8 million barrels of oil were pulled out of the Permian Basin in a single day. One single day. That’s more than the early wildcatters could have dreamed of in a year.

By itself, this one hotspot accounts for more than one-third of the nation’s total oil output. It recently surpassed Saudi Arabia’s famed Ghawar field last year as the most productive oilfield on the planet.

And it’s not about to run dry anytime soon.

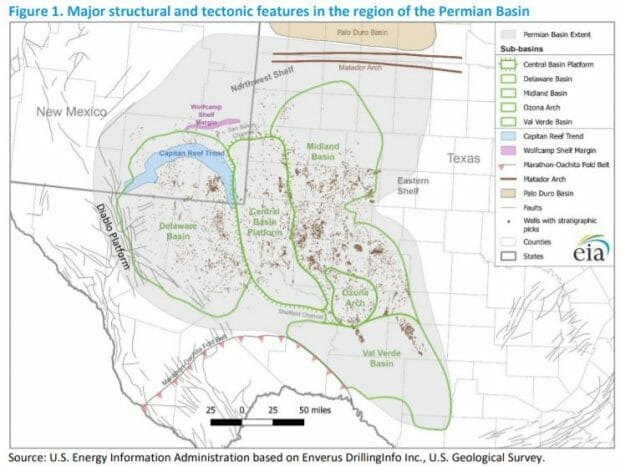

For a quick primer, the Permian Basin straddles the border of Texas and New Mexico and occupies about 75,000 square miles. It’s comprised of about 7,000 smaller fields, some of which are stacked one on top of another.

There are two primary hunting grounds, the Delaware Basin and the Midland Basin, each of which contains tens of thousands of active wells.

The untapped potential is almost incalculable. The US Geological Society estimates that there are still 46 billion barrels of recoverable oil reserves and 281 trillion cubic feet of natural gas still waiting underground.

Source: EIA

You’ve been telling your premium readers that we’re about to see a massive wave of takeover activity in this space. Why is that?

Remember what I said about the oil giants learning their lesson? It’s paying off… Higher oil and gas prices (along with widening refinery margins and strengthening demand) have enriched all of the integrated energy giants.

This group is expected to post a massive $29 billion in combined free cash flow this quarter – the fattest bottom line in 13 years. At this pace, they will haul in nearly $120 billion in annual profits. So let’s just say the coffers are once again full.

That’s replenished (E&P) budgets and spurred drilling activity just about everywhere. But the Permian Basin has seen the fastest ramp-up, because of its low breakeven levels and superior well economics.

As I write, about half of the active oil drilling rigs in the entire country are clustered in the Permian region. That’s no accident.

But remember, for the larger players, it’s often easier just to gobble up a smaller player that has active rigs and acreage in the Permian.

Add it all up, and you have the perfect recipe for a massive wave of deals.

Tell me about the deals you’re seeing right now. How can our readers profit?

Pioneer (NYSE: PXD), ConocoPhillips (NYSE: COP), Callon Petroleum (NYSE: CPE)… these are just a few of the names that have already scooped up smaller players and valuable acreage in this region. There are plenty of other potential buyers being lured by the lofty returns, too. Private equity groups… College endowments… You name it.

According to Enervus, M&A deal volume for the entire oil & gas sector has topped $51 billion over the past six months alone. And the Permian is right in the epicenter: All of the top-five deals by dollar involved assets in the Permian.

This wave of consolidation has been underway for well over a decade. And now, the race is back on. Of course, with every deal, there is one less Permian takeover remaining.

But I think I’ve found the next one…

It’s a smaller company that’s sitting on 80,000 prime acres in the heart of the Permian. They’re already producing 32,000 barrels per day, and the initial production rates from its newer wells are nothing short of eye-popping.

Between steadily paying down debt, a host of new drilling targets already identified, not to mention a superior free cash flow yield… it’s the perfect target for potential suitors. Plus, in the meantime, this name is so undervalued right now that it’s likely to pop from even a modest recovery in oil prices.

I think it’s only a matter of time before a larger suitor comes knocking, which could give shareholders an overnight windfall.

Editor’s Note: Nathan and his team have just released a full report about the wave of activity in West Texas – and how to profit…

Simply put, we’re talking about billions of dollars in M&A activity, creating the “mother of all oil booms”. And we’ve found the perfect stock to profit, with triple-digit upside…