How To Get A Special Holiday “Bonus” Dividend This Year…

A little over a week ago, I wrote about the virtues of investing in businesses that have, by nature, a recurring base of built-in revenue.

Businesses like this are an income investor’s dream.

It’s hard to beat knowing that the dollar amounts won’t deviate too much from one month to the next. In other words, fixed payments rather than variable. As we all know, product sales (be it home décor or auto parts) can be choppy from quarter to quarter as demand fluctuates. By contrast, recurring income tends to be quite smooth and consistent, leveling out all the ups and downs.

What more could an income investor ask for?

Well, I gotta tell ya… There’s something even better than that.

You see, companies will occasionally pay investors a limited, one-time dividend that’s often much larger then their regular dividend. I’m talking 10 to 20 times larger in some cases.

Yet they go unreported each quarter. And no, I’m not talking about some secret way of cooking the books or rewarding a select group of insiders. These extra payments are dished out openly and uniformly to all shareholders.

There’s no special trick or complicated system to capturing these dividends — you just have to know where to look…

It’s Special Dividend Season…

I’m talking about special dividends.

These distributions aren’t typically reflected in the yields you see quoted on popular financial sites like Yahoo or Morningstar. So most investors have to be “in-the-know” to be able to find companies that are in the habit of paying these outsized one-time payments.

Longtime readers know that I’m a big fan of special dividends. I last spoke about them back in August. And I look for them each month as part of my regular screen for dividend increases over at my premium newsletter, High-Yield Investing.

It’s one of the fun parts of my job. Think of it as an idea generator, giving us a list of companies posting outsized double-digit increases, and reliable dividend-payers that have been steadily growing payouts for a decade or more. And then, of course, we find the occasional stock that is set to reward investors with a special one-time bonus.

By definition, these one-time payments are rather unpredictable, so we don’t know from month-to-month which companies will be featured. But I’ve always got my eyes open for intriguing situations.

So why am I telling you about all of this?

Well, December is usually the busiest time of year for special dividends, as many companies like to reward stockholders with supplemental year-end distributions.

Think of it as a holiday bonus.

And over the past few weeks, I’ve been combing the markets for any and all special dividend announcements. And I’ve compiled a list of my favorite special dividend payers into one report – including a full writeup on my favorite.

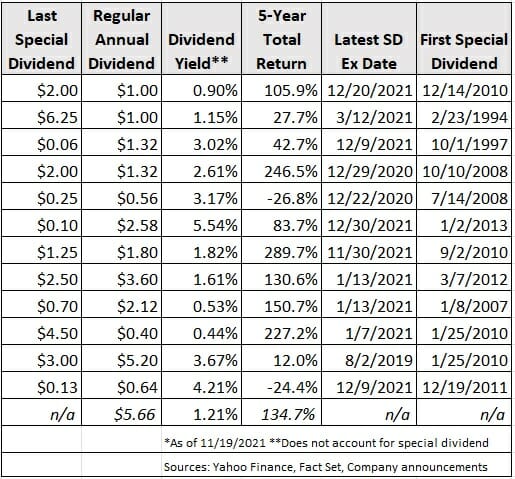

Now, I can’t share the names of all of the picks in this table out of fairness to my High-Yield Investing subscribers. I will touch on a few names, however, just to give you an idea. But for now, just take a look at the outsized payments we’re talking about here…

Now, before I tell you how you can get the full report, including all of the names and ticker symbols (including a full writeup on my favorite), let’s take a look at a couple of standouts…

Buckle Inc. (NYSE: BKE) is a clothing retailer operating 443 locations across the country, known for its denim fashions and trendy footwear.

As you might imagine, the Covid pandemic presented a lot of challenges for clothing retailers. But BKE has managed to navigate the pandemic better than many of its peers, delivering quarterly revenue growth of 27% and earnings per share growth of 49%. The company has managed to grow its e-commerce operations substantially, while delivering operating margins of around 25%.

It’s no wonder then that the stock has risen by about 60% year-to-date.

Last year, it handed out a special distribution of $2 per share. Given the craziness and uncertainty surrounding the pandemic, I wouldn’t blame you for thinking the apparel retailer might skip out this year. But once again, shareholders got a sizeable bonus.

And this year, management has just approved a whopping $5.65 per share. And that’s on top of an increase in the quarterly dividend from $0.33 to $0.35.

The special dividend comes out to roughly 10% of the stock’s recent prices around $50. The stock has popped considerably since the announcement, and I’d expect to see a bit of a drop after the ex-dividend date.

But BKE is hardly the only attractive name on this list. One is a specialty insurance company that likes to gift-wrap year-end underwriting profits for investors. Like clockwork, the insurer makes supplemental payments every December … $2.00 per share in 2015 and 2016, $1.75 in 2017, and $1.00 per share in 2018, 2019 and 2020. And it looks like investors will be treated to an even more generous $2.00 again later this year.

So while the quoted yield of around 1.0% is hardly compelling, that figure dramatically understates what stockholders are really receiving. Aside from ordinary dividends (which have risen for 45 straight years), investors have been treated to nearly $23.60 per share in cumulative special payments since 2012.

Not surprisingly, the stock has attracted plenty of buying interest. While it’s lagged the S&P over the past five years, it has delivered a market-crushing total return in excess of 2,000% since 2001.

How To Get My Top Pick…

I could go into more details about the names on this list, but we simply don’t have the space to cover everything.

But the point is, it clearly pays to keep track of these special dividend payers. And that’s why I just unveiled a new, updated list of special dividend payers that will tell you everything you need to know, including the details on my favorite pick of the bunch…

If you look up the stock right now, you’ll see a healthy yield of around 4%. But the company also supplements that base distribution with a special variable dividend payable at the end of the fiscal year. The bigger the profits that year, the bigger the gift.

This time around, shareholders will be treated to a regular quarterly dividend of $0.16 per share, as well as a gift-wrapped bonus of $0.13, for a total distribution of $0.29 per share.

Just in time for Christmas.

That variable payment bumps the annual payout to $0.77 per share in 2021 – which lifts the yield to around 5%. But to be eligible for the payment, you must purchase on or before the ex-dividend date of December 9. Or else you’ll have to wait until next year.

Go here now to learn how to get the details on this pick and gain access to the full report.