What To Make Of The Latest Inflation Numbers… And How To Earn 9.6% Beating It

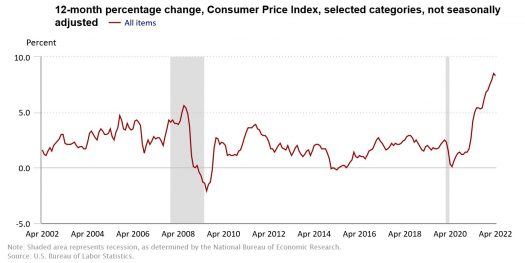

We got a fresh reading on inflation Wednesday.

In case you didn’t see the headlines, I’ll give you the good part first: prices seemed to rise at a slightly slower pace in April compared to March.

The bad: Prices still rose by 8.3% last month, compared to 8.5% in March. Projections from economists were were looking for an increase of 8.1%.

Source: Bureau of Labor Statistics

Now for the ugly: The market doesn’t seem too happy about the result. The S&P 500 closed down by about 1.6% on Thursday, after showing positive results earlier in the day. The Dow Jones Industrial Average was down by nearly a percent. And the troubles for tech stocks continue, as the tech-heavy Nasdaq was down by more than 3%.

Why This Matters

By now, we all know everything is more expensive than it was a year ago: gasoline, used cars, food, I could go on…

The point is, it’s too early to know if the inflation rate has peaked. Much of the deceleration came from energy prices, which have been volatile over the past few months, thanks to the Russian invasion of Ukraine. And food, in particular, saw some troubling increases on a month-to-month basis.

What’s more, core inflation, which is the Federal Reserve’s preferred measure because it excludes volatile food and energy prices, rose 0.6% in March. That compares to 0.3% last March, and it’s also higher than the 0.4% pace that economists had expected.

Another glimmer of hope… on Thursday, the Bureau of Labor Statistics reported that the Producer Price Index (PPI) rose by 0.5% on a month-over-month basis in April, compared with 1.4% in the previous month. The year-over-year measure was 11% in April, compared with 11.2% in March. Since PPI measures wholesale prices and is considered a leading indicator of inflation, it’s an encouraging sign that inflation may be peaking (although it was still higher than the estimate, which called for 10.7%).

The big concern is that at some point, American consumers will grow tired of paying higher prices and begin to curb spending. (In fact, my colleague Jimmy Butts thinks this already beginning to happen…) And since consumer spending is the engine of the U.S. economy, this could drag down economic growth – and possibly lead to recession (or even “stagflation”).

The Federal Reserve is determined to not let prices get out of control, however. The central bank has a mandate limit inflation to about 2% over the long-term. That’s why the Federal Open Market Committee hiked the benchmark rate by 50 basis points last week, rather than the usual 25 basis points. And with a two hikes (for a total of 75 basis points) under its belt so far this year, expect to see more increases in the months ahead, starting in June.

In fact, according to Reuters as of a few days ago, the futures market was signaling a 75% probability of a rate hike of 75 basis points, despite Jerome Powell seemingly taking that off the table in recent remarks. The futures market is also anticipating more than 200 bps of hikes for 2022 in total, bringing the benchmark rate to 2.85%.

A New Rate For This Unique Inflation-Beating Bond

Coincidentally, on May 1 the Treasury Department announced the new rate for Series I Savings Bonds. If you missed where my colleague Jimmy Butts discussed these unique vehicles for beating inflation, you can go here.

As a refresher, I Bonds were launched in 1998. Like other Treasury bonds, the U.S. government directly issues and backs these investments. Rates are pegged to the Consumer Price Index and are reset every six months, on May 1 and November 1.

For the new I Bonds, the announced rate was a whopping 4.81%, or 9.62% annualized. That’s a new record.

Remember, you can put up to $10,000 into these bonds per investor (so $20,000 if you’re married). As mentioned previously, it may have been a better plan to purchase the I Bonds before the end of April. That way, you would be sure to lock in a rate of 8.4% for the next year.

We said this because the while it seems like inflation will run hot for the rest of this year, the truth is we just can’t predict what it will be in six months. Still, 4.81% locked in for six months isn’t bad. And the November rate is still likely to be high.

Regardless, as Jimmy said in his rundown of I Bonds, they are “as close to a ‘free lunch’ as you’ll get in the investment world. “

If you haven’t already put some cash into I Bonds, you may want to consider it now. You can purchase them directly through TreasuryDirect.gov.

In the meantime, if you’re looking for income, wouldn’t you rather collect 12 dividend checks per year than four?

As it turns out, there are dozens of monthly payers out there — you just have to know where to look…

For the first time, my colleague Nathan Slaughter has compiled a list of 12 favorites into a special report — one for every month of the year.

These 12 securities not only provide steady, predictable monthly income but also well-rounded exposure to most major asset classes. A portfolio split equally among these 12 investments would generate 144 monthly payments a year! And remember, most of these payouts continue to rise…