Is This Contrarian Indicator The Light At The End Of The Tunnel?

Right now, it’s grim out there…

Outside of inflation at 40-year highs, the economy is slowing. More people are losing their jobs. And for those who work, paychecks aren’t keeping up with higher prices. More and more people are putting everyday purchases on credit cards. Many folks are taking on part-time work just to make ends meet.

The war in Eastern Europe is devastating the families and lives of the Ukrainian and Russian people. It’s also crimping the lives and economies of European countries.

Home prices have leveled off and have even begun to fall slightly. The cost to buy a home has more than doubled from a year ago — the average 30-year fixed-rate mortgage rate is darn near 7%.

In the markets, folks have seen retirement accounts and brokerage accounts tumble. All three major U.S. indexes have revisited their June lows and are firmly in bear market territory. The S&P 500 is down 23% this year.

It isn’t pretty. And there’s plenty of concern to go around.

Look Out Below?

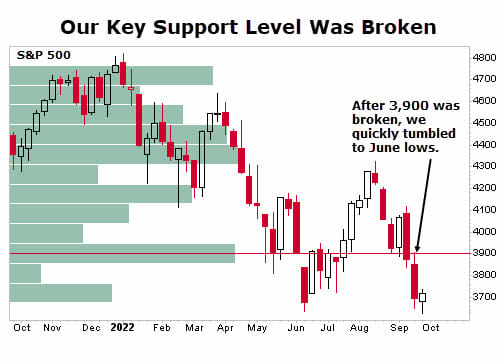

In just a minute, I want to share a potential little bright spot of information. In fact, it could signal light at the end of the tunnel. But first, I want to check in on price volume levels for the S&P 500.

As a refresher, volume profiles show us trading volume at various price points and provide basic support and resistance levels. The longer the bar, the more action takes place, which means you can typically expect those levels to hold. The shorter the bar, the less volume there is. You’ll see prices move quickly through those levels since fewer buyers and sellers are willing to make a deal.

By closely watching price volume for the S&P (as well as a couple of other technical indicators), I’ve been warning readers that the rally we had back in July and August wasn’t likely to hold.

So let’s back check in to see what happened…

Back in August, when the brief rally in the S&P 500 began to show signs of weakness, I said that 3,900 would be the key level of support to watch. It didn’t take long for that level to be broken. Once that happened, I repeatedly warned that the market would surely retest the June lows. Well, that’s exactly what happened.

We immediately fell to that June low (and even closed below it). I said it would be interesting to see if the bulls defended that June low level (around 3,715). But right now, the S&P sits at 3,585 as we go to press.

That’s a little concerning. I’ve said that if we fall below that June low, there isn’t much support for a long way down. So, it could turn into a brutal selloff.

The S&P 500 has essentially eviscerated two years’ worth of gains at current levels. In other words, your return would be zero if you invested in the S&P 500 in January 2021. Sure, we have a few months left to hit the “official” two-year mark, which means we also have a few more months where your initial investment could be worth less.

I know all that sounds a little dark and pessimistic. So today, I want to offer a glimmer of hope…

Sentiment Shows Light At The End Of The Tunnel

A widely-followed indicator may suggest that individual investors are about ready to throw in the towel. And that could be a good thing.

That’s because this is a contrarian indicator. So this kind of capitulation could set the stage for future gains.

The latest American Association of Individual Investors (“AAII”) sentiment survey revealed a rare spike in bearishness. The percentage of individual investors describing their six-month outlook for stocks as “bearish” hit its highest level since 2009.

More than 60% of respondents are bearish about the next six months. For reference, that figure is more than double the historical average and only the fifth time that more than 60% of respondents have been bearish in 35 years of the survey.

The survey results probably aren’t surprising for many feeling the pinch from inflation.

This past weekend, I paid $21 for a glass of wine at the airport. Sure, alcohol and food are always more expensive at the airport. But $21 to go along with a $20 cheeseburger? One hundred bucks for my wife and me to have a couple of burgers and drinks.

No wonder consumers are reeling and bearish on the economy.

However, most might be surprised about what has historically happened the last time we saw such bearishness. According to AAII, historically, the S&P 500 index has gone on to realize above-average returns during the six- and 12-month periods following a bearish reading of this caliber.

In each of the previous four instances, one-year returns for the S&P 500 were 22.4%, 31.5%, 7.4%, and 56.9%. Those are some darn good returns. And it could provide a beacon of light for many folks to get them get through this storm.

Of course, I have to throw in the classic finance disclaimer “past performance is not indicative of future results.” And the near-term headwinds are still blowing strong. All eyes will be on the Fed, inflation data, and consumer spending.

Closing Thoughts

Despite the uncertainty and economic headwinds, I want to encourage you to keep your head in the game. There is a light at the end of the tunnel.

It could be foolish to try and steal some profits in this market, but as I’ve said previously, the key to winning will be singles and doubles. And we can’t hit singles and doubles if we don’t step up to the plate and swing.

Make sure you have a healthy position in cash — enough to sleep at night but also be ready to strike when an opportunity presents itself. Have stop-loss levels in place when you take a position so that you can feel comfortable taking swings in this market here and there.

Again, don’t be greedy. Don’t hesitate to pull profits quickly if you find yourself with a nice gain, and of course, don’t forget to cut those losses short.

P.S. In my latest report, I uncover an “off the radar” investment that’s developing one of the most disruptive technologies we’ve seen in years…

I’m talking about flying cars. That’s right, we’re talking about a total revolution that could change the face of our way of life forever. It may sound like science fiction… but it’s coming sooner than you think.

The best part is that one of my top picks for this emerging technology is being totally ignored by most analysts right now, which means we have a unique opportunity to get in before the crowd catches on. Go here to learn all about it right now.