The End Of Crypto? What The FTX Scandal Means For Investors…

The cryptocurrency world is currently on fire… and not in a good way. As in burning to the ground fire.

And it’s all thanks to a crypto exchange that suddenly went from being worth $32 billion to zero (and into bankruptcy) in one week.

It’s one of the most incredible stories I’ve come across in my investing career. A lot of people are calling it an “Enron” moment for cryptocurrency. Anytime you draw comparisons with Enron, it can’t be good.

If you haven’t followed along, here’s the semi-quick rundown on this unbelievable story…

How Sam Bankman-Fried Duped Everyone

We will start with Sam. Sam Bankman-Fried created a cryptocurrency marketplace (like Coinbase) called FTX. In two short years, FTX grew to the second-largest cryptocurrency exchange in the world, behind only Binance.

At its peak, FTX was worth $32 billion.

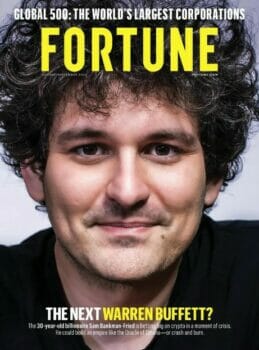

Sam was propped up on a pedestal as some altruist brainiac for creating FTX. He was on the cover of Fortune magazine as “the next Warren Buffett”. He was routinely on CNBC. At one point, he even said he could buy Goldman Sachs.

I don’t single this out to pick on Fortune. Because the truth is, he fooled just about everyone. He had major investors, from venture capital firm Sequoia Capital to Tom Brady to the Ontario Teacher’s Pension. FTX even purchased the naming rights to the Miami Heat’s basketball arena.

But in one week, everything unraveled….

Rumors began swirling that FTX didn’t have the assets to back up its customers’ deposits. Unsure if the rumors were true — and because we’ve already seen major upheavals from the likes of Voyager Digital — consumers went to withdraw their funds from FTX.

Sam, via Twitter, claimed everything was fine and that FTX had plenty of liquidity. He said that the rumors were coming from a competitor, Binance. But FTX didn’t have the money. Many people who went to withdraw have yet to receive any money.

$10 billion worth of customer deposits evaporated. Meanwhile, Sam fled the country while his Bernie Madoff-sized fraudulent company crumbled.

As more details emerge, the story becomes even more utterly bizarre. If you’re curious, you can read the salacious details elsewhere. The point is that the collapse of FTX is shaking the confidence of the cryptocurrency world. So the big question on everyone’s mind is “how do we move forward?”…

What Happens To Crypto Going Forward?

The biggest question many people are asking is, is this the end of cryptocurrency?

In my opinion, no.

But it will surely shake the confidence and trust of investors for years. Just like after the financial crisis, a lot of people lost trust in the banks. Same thing will happen here. We will likely see many more bankruptcies from crypto start-ups, and I would guess that most of these “alt-coins,” or these coins with ridiculous names like Dogecoin, will all go to zero.

The “crypto winter” is going to be long and cold. But I don’t believe this will be the end of cryptocurrency. I believe Bitcoin and Ethereum will survive.

The FTX debacle is big, and it will set the crypto world back, but cryptocurrency will survive.

Part of my belief stems from the fact that crypto already went through this. Mt. Gox was a bitcoin exchange that handled over 70% of bitcoin transactions worldwide. It filed for bankruptcy in 2014.

The only difference is that the crypto world has grown dramatically since 2014. More money invested. More money lost.

Instead of the $460 million Mt. Gox collapse, we are dealing with billions of dollars in the case of FTX. Similar collapse, just on a bigger scale.

Action To Take

The ripple effects from FTX seem to be pretty widespread (this story is still unfolding).

One small company (that I’ve never talked about) to avoid, or sell, is Silvergate Capital (NYSE: SI). They have ties to this FTX mess, and it isn’t looking good. If you own any cryptocurrency on Robinhood Markets (Nasdaq: HOOD), I would look to cash out and move your money away from that platform.

Yes, Bitcoin and Ethereum are the largest cryptos with the most demonstrated use cases. I believe they will survive. But if you have any lunch money in any cryptocurrency and don’t like volatility, I would get to the sidelines. Better to let the dust settle and come back later.

Why am I recommending this if I believe cryptocurrency, and these two cryptos, in particular, will be fine? The biggest and main reason is opportunity cost. Yes, I believe these will be fine in the long term, and I will absolutely look to get back in.

But I wouldn’t be surprised if Bitcoin and Ethereum flounder for some time. Because when people lose a lot of money, they don’t forget easily. It takes a long time to rebuild that trust. And even when it’s rebuilt, they will run for the exits as soon as the boat shakes, which translates into major volatility.

So, any money invested here is essentially dead money that could be put to better use elsewhere.

In the meantime, a furious competition is taking place to see who will take the top spot in the private space race. And investors have an opportunity to cash in…

My latest report tells readers all about Elon Musk’s secretive project and what it could mean for the future of this burgeoning industry. And even though it is “off limits” to regular investors, we’ve uncovered a “silent partner” that’s tradeable right now and gets you in on the ground floor…