How The Fed Caused The Banking Crisis (Continued) – And Why Stocks Could Rally…

Yesterday, I wrote about the ongoing fallout from the banking fiasco. After briefly summarizing what happened, I gave my take on why it happened and whether we should be concerned as individual investors.

In that piece, I mentioned the Fed’s part in this whole situation and also stated my concern about the central bank’s balance sheet.

Today, I want to elaborate on those concerns, because (as I said back then) this is an important issue that hardly ever gets attention in the mainstream financial media.

All About The Balance Sheet

I’ve talked a number of times about the Fed’s balance sheet and its effects on the market. For instance, in January 2022, I sounded the alarm on the market in an interview with my colleague Brad Briggs. I pointed to the reduction of the Fed’s balance sheet — known as Quantitative Tightening, or “QT” — as a primary culprit that wasn’t getting enough attention.

In May 2022, I reiterated the tight line the Fed was walking and my concern for stocks and the economy.

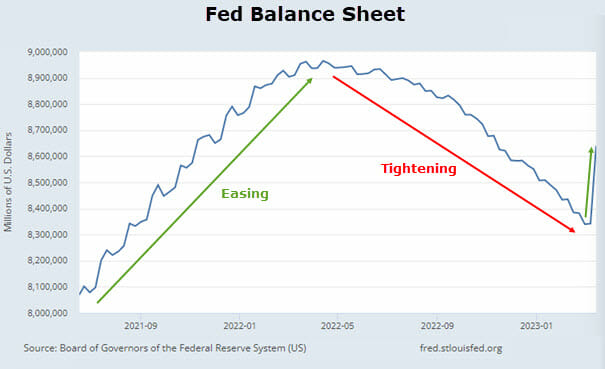

When the Fed finally started to reduce its balance sheet in April last year, stocks tumbled. The Fed kept reducing its balance sheet throughout 2022 and into 2023.

But then Silicon Valley Bank collapsed.

The Fed stepped in to provide liquidity and help calm consumer nerves, but to do so, it had to beef up its balance sheet again.

As you can see in the chart, the Fed’s rescue plan essentially erased the past four months of balance-sheet trimming.

Why Is This Important?

I won’t get into the nitty-gritty of it all, but here’s what you need to know…

We had the highest inflation in 40 years. Inflation is good, but high inflation and hyperinflation are terrible. Just Google Argentina’s economy if you want an example.

To fight inflation, the Fed went to its bag of tricks and started increasing interest rates and draining the excess liquidity it had pumped into the system through its quantitative easing/printing money policy. This slows growth as borrowing money becomes more expensive and liquidity dries up, which is supposed to help bring inflation back down.

This is all fine and dandy and works well in theory.

Unfortunately, we don’t live in theory. We live in the real world. In the real world, the Fed cranked interest rates higher than many banks thought it would. For example, executives believed the Fed would raise rates by 0.75 percentage points in 2022 — thus investing in longer dated bonds. Instead, the Fed raised them nearly six times as much, by 4.25 percentage points.

Now their portfolio of safe government bonds is sitting on massive unrealized losses because they didn’t think rates would climb this fast. Also, all bank executives know what happens to bond prices when interest rates rise. Bond yields and prices are inverted, which means as yields go up, prices go down. That’s something you learn in Finance 101.

Those unrealized losses aren’t a big deal so long as you have liquidity (aka cash). But the Fed is also reducing liquidity because it’s no longer buying Treasuries and Mortgage-Backed Securities, which banks would exchange for cash.

This all comes amidst a time when businesses were burning money at a fast pace, trying to catch up on inventory, keep employees by boosting wages, and battling inflation of goods and products. Meanwhile, their borrowing costs are also increasing.

The perfect storm.

All it takes is a little panic (which we saw with Silicon Valley Bank), and the ripple effects can become disastrous. It could bring the financial system and the economy to a grinding halt.

The central bank has one way to avoid this outcome… provide liquidity to the financial system by increasing its balance sheet. Which they’ve already started doing.

Here’s Why Stocks Could Rally

Historically, when liquidity is reintroduced to the financial system, it helps stabilize asset prices, and stocks would go on a tear…

Just look at the Covid-19 pandemic as the most recent example. The Fed more than doubled its balance sheet from $4 trillion in February 2020 to a peak of $9 trillion in April 2022. Over that time, the S&P 500 rallied 58%.

During the great financial crisis — between September 2008 to January 2015 — the Fed’s balance sheet swelled from $900 billion to more than $4.5 trillion. During the same period, the S&P 500 rose 102%.

Now, I don’t think the Fed will increase its balance sheet by that much this time as it’s still fighting inflation. But the good news is that even a temporary bump in liquidity could provide a nice little rally in stocks. It will take some time for confidence to rebuild and fears to subside, but if the Fed stays on this path, I’d expect stocks to rally.

P.S. If you’re looking for game-changing investment ideas with serious upside, then you should check out my investment predictions for 2023…

This report is full of research that challenges the conventional wisdom. And while we don’t have a crystal ball, many of our past predictions have come true, allowing investors the chance to rake in gains of 622%, 823%, and even 1,168%.

From the U.S. dollar to driverless trucks to breakthrough cancer treatments and more… If you’re looking for some “home-run” ideas for your portfolio, then I can’t think of a better place to start.