7 Large-Cap Stock Funds Trading At Discounts

Remember the elation when the Dow Jones Industrial Average first hit 20,000? It happened in January 2017, not that long ago really. Since then, the venerable benchmark blew through 21,000, 22,000, 23,000, 24,000, and 25,000. After a powerful run like that, you can expect many stocks to be overvalued.

| —Recommended Link— |

| The Only Pot Stock Worth Owning This summer, Canada will completely legalize cannabis for medical and recreational use — sparking an $8 BILLION industry. Our experts have their sights on a company that’s been granted a virtual monopoly by the Canadian government – a moat that would make Warren Buffett jealous. Get in early on this exceptional triple-digit opportunity before the law goes into effect. Click here to learn more. |

And indeed, many are. The S&P 500 is currently trading at 15.6 times forward earnings. While not excessive, that’s a sizeable premium to the historical 10-year average of 14.5. According to Morningstar, the average U.S. stock is priced at 102% of its fair value — and that’s after the October swoon.

Nobody goes to a car dealership (or anywhere else) looking to pay 2% above sticker price.

Not only do current valuations limit the upside, but as we’ve seen, stocks priced for perfection can be punished when they fail to live up to the market’s expectations. Fortunately, not everything is expensive. There is an entire asset class that has been left behind in recent years — merely jogging while everyone else sprinted ahead.

#-ad_banner-#I’m talking about large-cap value stocks. Ever since we emerged from the 2009 recession, growth stocks like Apple (Nasdaq: AAPL) have been favored over value stocks such as Wal-Mart (NYSE: WMT). Over the past year alone, large-cap growth has outperformed large-cap value 17.7% to 2.8%, a margin of six to one.

But we may be entering a period where these defensive blue-chips gain the upper hand. Not only are they less expensive (priced at 2.1 times book value versus 5.8 times for growth), but they also offer substantially higher dividends. Plus, value stocks are known to prove their mettle in choppy markets.

You could probably sink some money into reliable, all-weather businesses like Pfizer (NYSE: PFE) and do just fine. The pharmaceutical maker generates buckets of cash flows that support an above-average 3.1% dividend yield. The stock is also trading at a decent discount to Morningstar’s fair value estimate of $47.

But what if I told you there was a way to invest in PFE for just $35.89 per share. How? Well, it’s one of the top holdings in the Boulder Growth & Income Fund (NYSE: BIF), a closed-end fund which is currently trading at a wide 17.3% discount to the net asset value (NAV) of its holdings.

So anyone who buys this fund is investing in every stock in the portfolio (including Pfizer) at just 83 cents on the dollar. And with a focus on large-cap value, many of these stocks were underpriced to begin with.

Take Caterpillar (NYSE: CAT), which recently closed at $126 per share. That’s already a hefty 19% discount to the analyst community’s consensus target price of $156. But a stake in BIF means you’re paying even less, applying one discount on top of another.

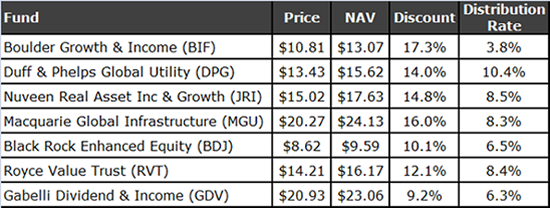

But BIF isn’t the only fund sporting a wide discount. Here are a few with large-cap-value-biased portfolios and discounted prices to NAV.

These funds offer double-digit discounts on stocks that are, for the most part, among the market’s better bargains.

I should point out that discounts on closed-end funds (premiums, too, for that matter) can persist for months, or even years. So it’s often more instructive to look at the current discount in relation to its historical average. When a fund that normally trades at a 5% to 6% discount suddenly slides to a 10% to 12% discount, it might represent a buying opportunity.

The discount on Royce Value Trust (NYSE: RVT), for instance, has widened to 12.1%, versus a 52-week average of 8.7%. The fund targets mostly smaller and mid-sized businesses such as Jacobs Engineering Group (NYSE: NEC) and Reliance Steel & Aluminum (NYSE: RS). If there is one corner of the market that is even cheaper than large-cap value, it’s small-cap value.

| —Recommended Link— |

| The Most Profitable Stock-Picking Tool of the last 92 years Less risk… Beats the markets by 15x…What more could you ask for? Come see the proprietary system that led to 24,513% gains. |

Lead portfolio manager Chuck Royce specifically looks for mispriced securities trading at a reasonable margin of safety. He’s been doing it longer than anyone, with a track record of outperforming the Russell 2000 over the past 20- and 30-year periods.

The fund has chalked up an 11.1% average annual total return over that time frame, much of which comes from a quarterly dividend distribution of $0.30 per share. That gives the fund a yield of over 8% at current prices, which is one reason I’ve got it on my watch list as a potential future addition to the portfolio of my premium newsletter, The Daily Paycheck.

But keep in mind, the stocks in the table above haven’t been fully researched and shouldn’t necessarily be considered actual portfolio recommendations. They simply meet certain screening criteria and are worthy of closer evaluation. If I find a strong recommendation, my subscribers will be the first to hear about it.

In the meantime, feel free to look through these ideas and see if anything catches your eye and do your homework before buying. If large-cap value stocks come back into favor, you’ll be glad you did.

P.S. Imagine… YOU, cashing a check every day for the rest of your life, thanks to a portfolio full of safe, reliable dividend payers. Sound crazy? It’s possible with The Daily Paycheck. To learn more, go here.