7 Shipping Stocks Yielding Up To 15%

“I am so happy with the recommendation of GSL-PB from the October 2016 issue. Can you recommend some others with similar characteristics?”

— Guido S.

This email arrived last week. And the timing was fortuitous, since I already had my eye on other opportunities within the shipping sector.

GSL-PB is a preferred stock issued by Global Ship Lease (NYSE: GSL), which owns a fleet of 18 mid-sized containerships. These vessels are leased to established shipping lines under fixed charter contracts.

The fleet currently has a perfect utilization rate of 100%. And just to give you an idea of what these vessels earn at sea, the flagship CMA-CGM Thalassa (a 1,137-foot leviathan equipped to carry more than 11,000 20-foot containers) was booked at a rate of $47,200 per day, while operating costs (mostly crew wages) total just $6,500 per vessel per day.

In September 2016, I was able to scoop up GSL-PB at an attractive price nearly 25% below face value, a discount that has since narrowed to just 3% thanks to improving fundamentals in the mid-size containership industry. The supply/demand balance for shipping along many trade routes has tightened, driving rates upward.

| —Recommended Link— |

| This Will Change Your Life… …more than anything in the past 60 years. More than personal computers… the Internet… smart phones or social media. This incredible investment will be revealed on February 28th at the Fast-Track Millionaire Summit. Free signup for StreetAuthority readers here. |

This Beaten-Down Industry Is Ready For A Comeback

There is a similar improvement taking shape in another segment of the shipping industry. I’m talking about dry bulk shippers, which move cargo such as wheat, soybeans, coal, and fertilizer. According to Bloomberg, more than 85% of the world’s grain makes ocean-crossing transits on carrier ships before reaching its destination.

#-ad_banner-#The industry nearly collapsed in 2015 and 2016 after aggressive shipbuilding orders led to surplus capacity, causing charter rates to plunge. But the vicious storm that wrecked this industry finally appears to be letting up. In fact, the Baltic Dry Index (BDI), which is the best overall gauge of shipping rates for bulk commodities, has risen more than 70% over the past 12 months to a four-year high.

Part of that upturn stems from increased global trade, specifically heavy iron ore shipments from Brazil to China. But the bigger catalyst is the scarcity of available ships for hire. Global shipyards lay nearly dormant during the downturn, so there are few newly-built ships entering service over the next 12 to 24 months.

Hartland Shipping Services reports that the current newbuild order book stands at just 8.2% of the existing fleet in terms of gross tonnage, compared with 52% in late 2008. This ratio hasn’t been below 10% in more than 15 years.

In short, there won’t be enough new vessels to handle the incremental demand, setting the stage for a worldwide dry bulk shipping shortage in 2018 — the first deficit since 2002.

This recovery is still in the early stages, but the market is taking notice. Star Bulk Carriers (Nasdaq: SBLK), for example, has bounced from $9.28 per share in mid-November to $12.20 today. But it would have to rise another 500% to reach pre-crash highs above $70 set back in 2014.

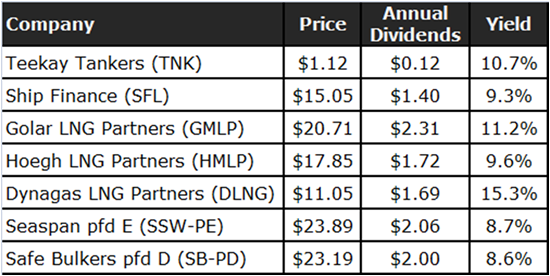

Shipping sector dividends (which had been on thin ice for a while) should be better supported by strengthening cash flows going forward. Today’s stock screen specifically isolates high-yield opportunities from 9% to 15% within the resurgent shipping sector.

The One I’d Buy Today

As always, the stocks in the table above meet certain screening criteria but haven’t yet been fully researched and evaluated. So they shouldn’t necessarily be considered portfolio recommendations. But as many of these beaten-up, underpriced stocks continue to bounce back, the window of double-digit payouts could be closing.

In fact, the last time we reached this point, the industry boomed less than 24 months later.

The reader above specifically asked about preferred stocks similar to GSL-PB. One such option would be the preferred ‘E’ shares of Seaspan (NYSE: SSW-PE), which owns the world’s largest fleet of containerships. The company has assembled a vast fleet of nearly 100 vessels, and these marine workhorses are chartered under multi-year contracts representing $4.7 billion in future revenues.

About two dozen of the firm’s smaller ships are currently being rented under short-term charters at daily rates $3,500 to $4,000 below 2018 broker estimates. That means there is significant re-chartering upside as these old contracts expire and go back on the books at much higher rates.

In the meantime, fleet utilization currently stands at 98%, and the company has already signed lucrative contracts on three new ships that are nearing completion. They will start earning cash the day they enter service.

While the 7.1% yield on SSW common shares is nothing to sneeze at, this preferred stock carries a fixed coupon of 8.25% on the $25 par value. And since it’s trading at a discounted price of $23.89, the annual distributions of $2.06 (paid in January, April, July and October) push the yield up to nearly 9%.

I’ll be looking closely at Seaspan’s upcoming quarterly results and am considering this a solid prospect for my High-Yield Investing portfolio.

This Is Just A Start

The goal of my double-digit stock screen is to identify stocks that might be well-suited for my High-Yield Investing portfolio. But like any quantitative tool, this screen should not be used in isolation. You should also evaluate the fundamental characteristics of every potential investment opportunity. In addition, you should assess how well a particular stock or fund matches your investment needs. And do your own due diligence on a security to decide if it is right for your portfolio.

If I find a real gem within these screens, a stock that can actually maintain this level of yield through the years to come, my High-Yield Investing subscribers will be the first to hear about it.

So if you’d like to join us in our search for the best high yields the market has to offer, then I want to invite you to learn more about High-Yield Investing. You don’t have to settle for the paltry yields offered by most stocks. The high yields are still out there. You just have to know where to look — and my staff and I are here to help you along.

Click here to see how High-Yield Investing can help you pull in 11.2% a year in dividends — and some impressive capital gains to boot.