How You Can Catch The Market’s Biggest Fish

Investing takes patience.

I was reminded of this over the Thanksgiving break as I impatiently waited for that derby-winning fish to bite. As I sat there bobbing in the boat trying to stay warm in the sub-30 degree temperatures in the panhandle of northern Idaho, I realized that fishing is similar to investing in the stock market.

| —Sponsored Link— |

| Will This Be The Apple Of Cannabis? As of July 2018, Marijuana will be fully legal in Canada and cannabis stocks are starting to fire back up as a result. But which will emerge as the giants of industry and which will be flash in the pan stocks that are left behind in the bubble? Read this special report to learn more. |

You only hear about the big catches, just as you similarly hear only about how an investor made a killing on XYZ stock. What you don’t hear about is all the time in between… whether it’s catching that big fish or how long it took to finally bag that big winner (and how many losers it took to get there).

To bag the derby-winning fish, you have to put in your time. The same goes for investing. Yes, you might get lucky and bag a big winner with your first couple of picks — and your confidence will swell — but eventually you will have a humbling experience.

#-ad_banner-#We’re always looking for that edge in investing… trying to find ways to separate ourselves from the average investor in order to generate above-average returns. And one way to do that is to adjust our mindset to the long term.

That’s where patience comes into play. If you can’t be patient, the quest to land the big one — be it fish or winning stock — is going to be frustrating.

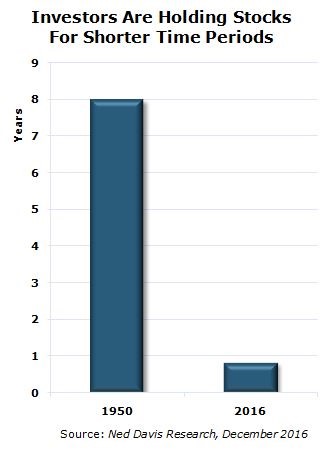

And investors these days are more impatient than ever. During the 1950s investors on average held stocks for eight years… today it’s declined to just 8.3 months.

Most investors are so concerned with short-term price movements that they’re quickly trading in and out of stocks. They have no patience. And that simple fact can give us a major competitive advantage in the stock market.

When it comes to investing, time is our friend. If your outlook on a business is short-sighted, you can’t take full advantage of owning a successful business. I’m referring to the compounding effect as share prices increase, reinvesting dividends and share buybacks. With a short-term time frame, nearly all of these become negligible.

Think about it like this. Had an average “8.3-month investor” referenced above bought one of our longest-tenured stocks, Cisco (Nasdaq: CSCO), when my Top Stock Advisor readers added it in December 2011, they would have sold it eight months later for a respectable 9% return. But they would have missed out on the 116% return we’re sitting on today.

As American essayist Ralph Waldo Emerson advised in the 1800s, “Adopt the pace of nature: her secret is patience.” That’s true whether it comes to fishing or investing.

By simply having a longer outlook on the stocks you invest in, you immediately gain an edge over most of your peers. And the strategy of my Top Stock Advisor premium newsletter is to exploit this competitive advantage. As longtime readers know, I state ad nauseam that the longer you hold an investment, the better your chances of generating market-beating returns.

One more thing to remember in your pursuit of finding that big fish: Don’t let that feeling of “missing out” cause you to haphazardly chase stocks. There will always be a great opportunity out there. It just might take a little time to find it. Gaining a firm grasp on this simple concept will make investing in the stock market much more enjoyable.

The Next Derby-Winning Fish

If you missed out on those 116% gains on Cisco I mentioned earlier, don’t worry — there’s another big fish on the way.

The pick I’m recommending to my Top Stock Advisor readers this week is disrupting the stodgy property and casualty insurance industry. But the company doesn’t actually provide insurance and compete with the big insurance companies of the world. Instead, it provides a crucial service to these companies.

You see, despite all of the advances in technology and software that nearly every business utilizes today, many insurers haven’t kept up with the times. They continue to rely on clunky, decades-old legacy systems that lack sophistication. These outdated systems often lead to overpayment on claims and customer attrition.

But the tides are beginning to turn. Insurance companies are finally realizing that they can greatly improve operational efficiencies, data integrity and policyholder engagement by implementing modern software systems. And my pick this week has emerged as the global leader in helping insurance companies replace their legacy systems.

The company has rapidly expanded its customer base to over 300, including the world’s largest property and casualty firm, State Farm. Other clients include names such as Nationwide and Zurich Financial Services. In total, it has roughly four times the number of customer of its nearest competitor.

This newly minted industry leader’s revenue has nearly doubled over the last 12 months. In fact, it’s grown revenue by double digits in almost every year of its existence. And despite a recent price cut on lower than expected, but still exceptional earnings, seven analysts still rate the stock a “buy,” with a target price of about 20% over current prices.

The selloff gives us an even better entry price than I anticipated. This is a company that should continue to swallow up market share and penetrate its addressable market, and is on pace to grow sales by double digits and earnings per share by triple digits.

Let Me Be Your Fishing Guide

Now, I can’t reveal the name of this insurance industry titan in the making here — it just wouldn’t be fair to my paid subscribers. But what I can tell you is that this company, and potential gains that come with it, is just the tip of the iceberg for my Top Stock Advisor portfolio. Right now, we’re sitting on returns of 78%, 123%, even 144% on some of the most reliable, long-term investments you can make. And the gains just keep piling up.

But what’s got me really excited is our newly-released report: The Top 10 Stocks For 2018. While nothing is certain, we’re convinced — based on our cumulative decades of experience and expertise — that these stocks are your best bet for building wealth in 2018 and beyond.

You’ll find all the details of every one of our 10 picks in this brand-new report. And we’d like to share it, with absolutely no risk to you. All we ask is that you try a 90-day, no obligation trial membership to our monthly service, Top Stock Advisor, just to see if you like it (even if you don’t you can keep the report as a free gift). You can follow this link to learn more.