3 Small-Cap Growth Stocks Trading For A Bargain

It’s hard to predict whether a stock will do well. Many investors simply follow the trend: buying high in order to sell even higher.

This momentum strategy is a valid one. Like a freight train, a moving stock is hard to stop — there must be a very good reason for a high-momentum stock to stop in its tracks and head in the opposite direction.

This is a strategy that can be surprisingly difficult to execute, though. Fundamentally, good stock analysis is still required. You cannot simply buy the hottest ticket out there on the expectation that it will continue moving — not if you take investing seriously. A big picture, too, can change on a dime: the world out there is unpredictable, and nobody can know whether bad news is coming. And psychologically, it might be difficult to keep buying an uptrend when the market trades at fresh all-time highs amid a barrage of macroeconomic worries.

Another strategy is to look for bargains. Those stocks might not be the market’s darlings and might not have the trend-related wind at their backs, but it should not necessarily mean that they have no potential. A real bargain — a fundamentally strong stock facing temporary issues — is bound to reward a courageous investor.

Not every bargain is worth buying, of course. Many stocks are down (and cheap) for a reason. But valuations matter — at some point, a bargain can become irresistible.

| —Recommended Link— |

| One Teacher In South Carolina Just Collected a $4,416 Check |

Let’s Hunt For Some Bargain Growth Stocks

Today’s stock screen is all about bargains.

But first, since my job over at Game-Changing Stocks is to find the best growth stocks on the market above all else, we’re going to have start by limiting our target size to small-cap stocks with market capitalizations between $500 million and $2 billion.

Then, we need to weed out stocks that are too expensive.

This time, I used a price-to-sales metric. I deemed as too expensive companies whose shares are more expensive than five times sales; on the flip side, I eliminated from consideration stocks that trade under two times sales (too cheap). It’s unlikely that in this market a growth stock — which typically demands a valuation premium — will sell for much less than two times revenue. Why did I use “2” as a cutoff? Because the S&P 500 — which is a mix of growth and value stocks — trades at about 2.2 times last year’s (2018) revenue.

To further weed out slow-growing “bargains,” I set my next parameters quite high: only those companies that have posted 30%-plus growth in revenue AND net income made the cut.

The Results

The results contained a couple of surprises.

First, even though the final list consisted of 14 companies, only three of those weren’t classified as a bank or a financial institution. We’ll only focus on the remaining three today.

Second, out of those three, two companies should be quite familiar to Game-Changing Stocks readers. Here are the results…

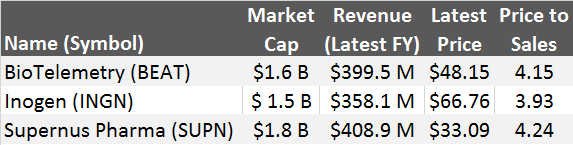

Data as of Friday, June 28, 2019

1. BioTelemetry (Nasdaq: BEAT) does look like a bargain after dropping 20% in the first half of the year (and up only 6.4% year-over-year).

1. BioTelemetry (Nasdaq: BEAT) does look like a bargain after dropping 20% in the first half of the year (and up only 6.4% year-over-year).

It is also my favorite of the three.

This medical technology company is focused on cardiac diagnosis and monitoring. It’s because of BEAT’s expertise in remote monitoring of cardiac arrhythmias and heart rhythm disorders that it is able to partner up with Apple (Nasdaq: AAPL) to find a way to combine the iPhone, Apple Watch and BEAT’s ePatch to screen for heart rhythm abnormalities in the general population.

This potential for direct-to-consumer application sets BEAT apart from similar companies and, if it pans out, will mean another growth avenue for the company.

Of course, as with any health-care company, BEAT depends on insurance coverage for reimbursement of its services. But this is a risk that most of its peers carry as well. BioTelemetry is one of the largest, fastest-growing and most profitable remote-monitoring health companies in the market. I see significant upside to the shares from their current level.

2. Inogen (Nasdaq: INGN), a portable oxygen device company, has been under significant selling pressure partially because of short-sellers’ allegations that the company misrepresents its market and projected growth. A couple of the company’s latest quarterly reports have been weak as well.

2. Inogen (Nasdaq: INGN), a portable oxygen device company, has been under significant selling pressure partially because of short-sellers’ allegations that the company misrepresents its market and projected growth. A couple of the company’s latest quarterly reports have been weak as well.

On the other hand, the stock is now much cheaper than it was a year ago (down 64% over the past 12 months). Of course, its P/E does not point to a true bargain: trading at about 32 times next year’s earnings, the stock can get cheaper still. But if the company returns to growth — and it can potentially deliver a long-term double-digit earnings growth — then its stock will recover. At current levels, though, it’s not sufficiently cheap to present a buying opportunity — I rate it a “Hold” at this time.

3. The only biotech on the list, Supernus Pharmaceutical (Nasdaq: SUPN) looks like a bargain as well. The company specializes in products for the treatment of central nervous system diseases. Its neurology portfolio consists of Oxtellar XR and Trokendi XR, both for epilepsy. The company’s pipeline includes product candidates for impulsive aggression and for attention deficit hyperactivity disorder (ADHD).

3. The only biotech on the list, Supernus Pharmaceutical (Nasdaq: SUPN) looks like a bargain as well. The company specializes in products for the treatment of central nervous system diseases. Its neurology portfolio consists of Oxtellar XR and Trokendi XR, both for epilepsy. The company’s pipeline includes product candidates for impulsive aggression and for attention deficit hyperactivity disorder (ADHD).

I want to do more research to see why the stock has not recovered from its recent slump as the market rallied (SUPN is down 43% over the past year vs the S&P 500’s positive 8.3% return). I also want to look into whether its neurology portfolio carries competitive promise.

Still, the company stands out from much of the small-biotech crowd: it’s profitable, fast-growing and has a strong balance sheet.

Meanwhile, the stock is outright cheap.

This year (2019), it’s likely to earn $2.36 per share, and next year it’s expected to make as much as $2.74 per share. Expected to grow at a pace of about 30% pace in the near future, SUPN is a company to watch.

Action To Take

As always, remember that when we do these stock screens, the purpose is to use them as a springboard for ideas. If we find a standout in the results, then we need to do further research to know whether it’s truly worthy of our portfolio or not.

In the meantime, if you’re looking for even more growth stock ideas, then I invite you to check out my latest report, where we cover four major breakthroughs about to take place in the next few months. Smart investors will want to get in now, because the four stocks behind them could easily post triple-digit gains. Check out the report here.