5 Small Cap Growth Stocks With Big-Time Momentum

A body in motion tends to stay in motion. Unless, of course, an external force is applied.

Add “stock market advisor” to Isaac Newton’s resume, right along with astronomer, physicist and mathematician. Similar to physics, Newton’s first law of motion also works in investments. Kind of. While there is no physical force that moves them, stocks, much like physical objects, tend to continue moving in the same direction until something around them (or about them) changes.

No one — including Newton — can or could with a high degree of certainty predict this afternoon’s breaking news or tomorrow’s big earnings upset. What investors can do, however, is follow the trend.

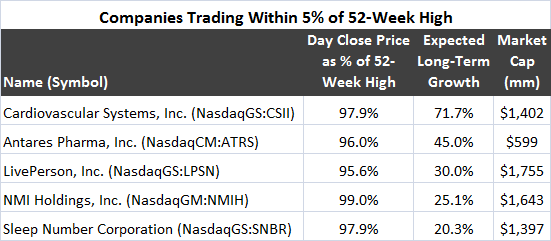

That’s why I recently set out with a goal to investigate stocks that are moving higher. To do this, I screened all U.S.-listed small-cap stocks (those with market capitalizations less than $2 billion but larger than $500 million) that have closed within 5% of their 52-week high.

To make this screen more relevant to the goals of my Game-Changing Stocks premium newsletter, I also wanted to screen for future — expected — growth. Because this metric is based on analysts’ assessments, I also looked for stocks that were covered by five or more analysts. That’s because the more analysts that cover a company, the higher can be our confidence in the average expectations.

The Results

Turns out that only 25 stocks made it through these screens. Among these 25 companies, I then selected the top companies with the strongest expected growth.

(But before we get into those companies, there’s one more discovery from today’s screen that I want to share. It turns out that, out of today’s list of 25 companies, four already belong to our Game-Changing Stocks portfolio. This tells me we’re doing something right with our research and selection process. And our recent string of winners proves it.)

Now, let’s take a look at five of the standouts.

Data as of 3/7/19

Sitting right in the middle of this esteemed group, LivePerson (Nasdaq: LPSN), a technology company transforming the way customers communicate with brands (and vice versa), is trading not only near its 52-week high but also near its all-time highs. And since I added the stock to our Game-Changing Stocks portfolio on December 21, and we’re already up more than 60%.

LPSN is strong for good reasons: its services are increasingly needed as more and more companies and brands move their marketing and selling efforts online; the company’s execution has been great, and it has been developing new ways of bringing customer communications into the 21st century. LPSN has dubbed its approach “conversational commerce.”

These new, artificial-intelligence-based efforts have been successful by most measures. Just this past year, as demand for AI continued to grow, the share of automated messaging in LPSN’s conversations jumped to 50% at year-end 2018, from only 25% at the start of the year. With the recent introduction of Maven, a patent-pending conversational commerce AI engine, we have strong reason to believe LPSN should continue capitalizing on this important trend.

Based in St. Paul, MN, Cardiovascular Systems (Nasdaq: CSII) is a medical technology company focused on complex peripheral and coronary artery disease. This market is still underserved by medical technology companies — the companies that aim to reduce the still-high number of coronary-disease related deaths and complications in the United States. CSII’s micro-invasive devices treat a broad range of plaque types in leg arteries both above and below the knee, and its coronary business is based on a similar technology.

While the market for medical catherization is a relatively mature one, CSII is a stock to keep an eye on because of its patent-protected innovation and a robust clinical study program.

Antares Pharma (Nasdaq: ATRS), the smallest company in the top five, is a specialty pharmaceutical company developing and manufacturing proprietary delivery technology methods (such as self-injection systems for its partner pharmaceutical and biotech companies). This company’s expected growth makes it potentially attractive in terms of valuation, although ATRS depends on its partner companies for much of its future potential.

The only financial company on this list, NMI Holding (Nasdaq: NMIH), a mortgage insurance company, doesn’t look attractive from the point of view of its game-changing potential, although it does address a large market.

On the other hand, mattress company Sleep Number Corp (Nasdaq: SNBR) is a true innovator. Founded in 1987 and headquartered in Minneapolis it now has about 580 stores in 50 states. The adjustability of a bed, whether it’s a gimmick or a real thing, has changed the way we think about the mattress, and SNBR is likely to continue benefitting from the industry transformation.

Closing Thoughts

Keep in mind that while stock screens are valuable, there is no substitute for thorough research. If you see a name on this list that catches your eye, be sure to look into it further before you buy the stock.

And while some of the stocks in this screen might be winners, there’s a group of picks I’m even more excited about… Each year we release a report with big, bold predictions for the coming year. Some of them are controversial — but they all have triple-digit-plus potential for investors as we head into 2019. You can find it all in my latest report: 9 Game-Changing Investment Predictions for 2019.