This Is A Great Market For Growth Investors. Here’s Proof…

The first thing you learn in finance class is that the markets are efficient, meaning that asset prices fully reflect all available information.

This is a simple concept to understand, and it also helps investors read the tea leaves when it comes to the market action: stocks are discounting all available information at any time. Rallies and selloffs, while hard to predict and impossible to time, are just that — the reflections of the market’s ongoing optimism or improving outlook (which underlie the rallies) and deteriorating conditions (which drive the selloffs).

The market is also a great forward-looking mechanism. Because it does reflect all the available information at any time, a rallying market by itself is often a bullish indicator. This is what we have today — not only a more expensive market than a few months ago, but a market that just won’t stop.

| —Recommended Link— |

| If you’re over 18 years old, you can’t be turned down for this program A simple membership form – one that takes 90 seconds or less to fill out – is all it takes to join a plan that pays out up to $12,040 a year in bonus government cash. This opportunity is so obscure, less than 1/10 of 1% of Americans are taking advantage of it. And the next check run is just days away. Here’s how to get in on the action.. |

A Great First Quarter — And Our Holdings Are Leading The Pack

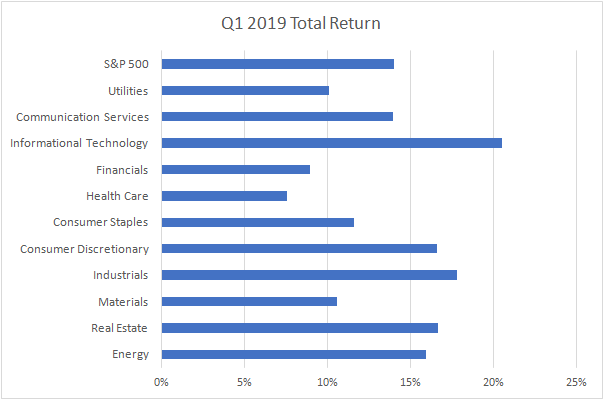

The first-quarter is already in the books. The S&P 500 ended the first three months of the year up 14%, and all market sectors, without exception, were higher.

What was the best-performing sector? You guessed it — information technology, which returned 20.5% during the quarter.

It’s certainly great news for us over at Fast-Track Millionaire — with a significant number of tech stocks the portfolio, we have been well-positioned to take advantage of the sector’s strength. In fact most of the stocks in our Emerging Tech Leaders portfolio were added at the end of January, and have returned, on average, 15% in just two months.

Many of these companies are innovators whose growth outperforms the market by a wide margin. And this is exactly what the market likes about them, such as our cloud-based picks, our two cybersecurity holdings, as well as our Internet of Things pick.

Healthcare, on the other hand, was the weakest-performing sector of the last quarter — returning “only” 7.6%. We have some healthcare exposure over at Fast-Track Millionaire, but again, our have done better.

That’s because our focus is not on healthcare, per se, but on its more narrow — and more promising — biotech subsector. That, of course, is by design… these picks are at the forefront of innovation in everything from cancer treatments to genetic modification. So to be fair, let’s compare these stocks not with the market, and not with the larger but stodgier health care sector, but with the relevant benchmark — the Nasdaq Biotech Index.

Every single biotech in our portfolio except one, which is a recent IPO, has outperformed the Nasdaq Biotechnology Index — which rallied 15% in the quarter — and most did so by a wide margin.

It’s A Good Market For Growth

Now, I bring all this up not to brag, but rather to say that I expect outperformance for our emerging tech and biotech leaders to continue — after all, it’s where the growth is. Every one of these companies has the potential for a big breakthrough.

#-ad_banner-#Stock selection, going forward, will remain my main focus. This said, if the market mood stays positive, that should help significantly. This is why it’s good to see that the markets remain in a bullish mode — and one that rewards growth above all other factors.

One reason to expect the market to stay the course is the change in the Federal Reserve’s tone and outlook. Remember that it was the Fed’s signal that rate-raising was being put on hold that indicated to investors that the worst of the market selloff might be over.

In its last meeting of 2018 (held on December 18 and 19), the Federal Open Market Committee sent a strong message to the markets, keeping rates intact, providing a soothing, more dovish outlook and indicating flexibility in reducing bond holdings. The market listened, and almost immediately started to rebound. It was all uphill from December 24 onward.

Looking ahead, thanks to the March FOMC meeting decision to again hold rates steady, and to still-tame inflation, investors see the “all-clear” sign. Money remains inexpensive, and, with rate hikes taken off the table for the rest of 2019, it is likely to stay this way.

This also means that the fears of a recession might be premature as well.

Over at Fast-Track Millionaire, this means we’re staying the course: taking an occasional gain to book the profits, as well as buying the best high-growth stocks we can find. If you’d like to learn more about what we’re up to and how to join us, simply go here.

P.S. My team and I recently stumbled across something stunning… It’s a “weird” medical breakthrough that could add 40 years (or more) to your life — and millions to your portfolio… Discover all the details here.