How to Profit From Our Nation’s Greatest Growth Industry

With each passing quarter, Wall Street analysts tweak their forecasts and price targets, trying their best to predict what a company’s sales and profits will look like three or six months from now.

That myopia has led them to miss out one of the greatest long-term success stories in the U.S. economy.

It isn’t found in the engineering labs in Silicon Valley or the canyons of Wall Street. Instead, it’s in places like Iowa, Nebraska, Texas and Pennsylvania. That’s where our nation’s most dynamic export opportunities have emerged on vast tracts of arable land. Consider this stat: The U.S. exported $29 billion in corn, wheat, soybeans, apples, pistachios and many other farm products in 1985. A decade later, that figure had doubled, and by 2010, surpassed $115 billion.

The U.S. also imports many farm items as well. But in 2012, the farm belt ran a $38 billion trade surplus. How many industries can say that? And there’s no reason to expect this trend to reverse course. Simply put, heavy investments in technology have enabled our farmers to become the most productive in the world. Here’s a look at three companies that should prosper in the years ahead as farmers invest even more heavily in technology and other productivity enhancers.

| 1. Lindsay Corp. (NYSE: LNN ) |

Along with Valmont Industries (NYSE: VMI), Lindsay controls 75% of the global market for mechanized irrigation systems. These motor-driven devices ensure that water gets spread evenly at a controlled rate over a given plot of land — a key benefit when water resources aren’t plentiful. Along with Valmont Industries (NYSE: VMI), Lindsay controls 75% of the global market for mechanized irrigation systems. These motor-driven devices ensure that water gets spread evenly at a controlled rate over a given plot of land — a key benefit when water resources aren’t plentiful. As farmers have stepped up their spending on Lindsay’s pivot-arm irrigation systems, sales have surged roughly 108% from fiscal 2009 to nearly $700 million in fiscal 2013. Many global farmers are now looking to adopt the best practices employed by U.S. farmers. It’s still an untapped opportunity: According to the company, just 2% of farms outside the U.S. use mechanized irrigation, compared to nearly half of U.S. farms.

|

| 2. Agco (NYSE: AGCO ) |

Thanks to its $940 million acquisition of GSI Holdings in 2011, this company is now one the world’s biggest providers of grain storage systems, augmenting its role as the world’s third-largest producer of tractors and other farm machinery. Thanks to its $940 million acquisition of GSI Holdings in 2011, this company is now one the world’s biggest providers of grain storage systems, augmenting its role as the world’s third-largest producer of tractors and other farm machinery. The acquisition is already delivering solid returns as farmers in the U.S. and elsewhere increasingly rely on grain storage to ride out the ups and down of spot price markets. If spot prices plunge, these farmers can simply hold onto their inventory until pricing improves. “The GSI grain storage business should be the fastest growing part of AGCO for the next two to three years, and is the highest margin category in the portfolio. GSI should generate $750 million in sales with 15% operating margin in 2013, aiming for $1 billion in sales by 2016, according to analysts at Merrill Lynch, who rate shares a “buy” with a $70 price target. In keeping with the theme of investor myopia, shares of Agco fell nearly 7% this week to below $60 as the company noted that spending in Europe is likely to be weak in the current quarter. Yet the long-term bottom-line picture appears quite robust. In addition to any secular growth benefits the company gleans from the expanding global agricultural sector, management is also trimming spending to boost free cash flow (FCF). Merrill Lynch expects FCF to rise nearly 150% from this year to around $570 million by 2015. That equates to a FCF yield of around 10%, which is hard to find with companies poised for long-term growth. |

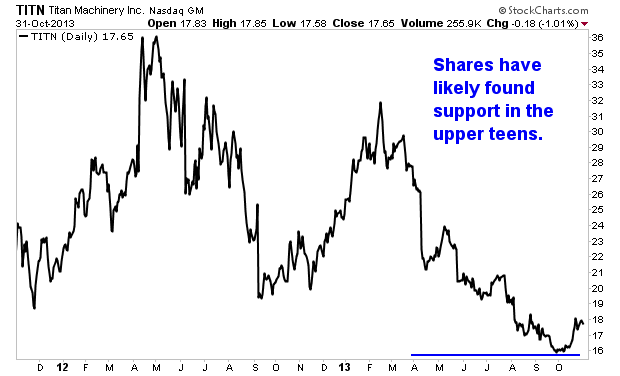

| 3. Titan Machinery (Nasdaq: TITN ) |

I highlight this stock primarily because of its positioning as a deep value play. The company merely acts as a retailer for the CNH Industrial (NYSE: CNHI) brand of farm equipment in the U.S. and Europe, and likely only has modest long-term growth prospects. I highlight this stock primarily because of its positioning as a deep value play. The company merely acts as a retailer for the CNH Industrial (NYSE: CNHI) brand of farm equipment in the U.S. and Europe, and likely only has modest long-term growth prospects. But this is another example of investor myopia, which enables long-term oriented investors to lock onto value. In a typical year, Titan earns roughly $2 a share, but weak sales in Europe, coupled with the impact of the delayed farm bill here in the U.S., will most likely lead to subpar 2013 results. Titan concedes that per-share profits are unlikely to exceed $1.30 in the current fiscal year, which ends in January, and investors should assume a gradual recovery next year before earnings per share returns to $2 in fiscal 2016.

|

Risks to Consider: Policymakers in Washington have created a great deal of noise in the farm belt, thanks to delays in the passage of the next major farm bill. Extended delays could lead farmers to hold back on discretionary purchases, hurting sales of Lindsay, Agco and Titan Machinery.

Action to Take –> Though farmers have the occasional bad year, the long-term trends, led by robust export growth, appear quite appealing. All three of stocks have pulled back from their highs, providing an attractive fresh entry point.

P.S. America’s farm belt provides much more than food — it also provides a growing share of America’s fuel supply. In fact, a bizarre plant from the Midwest could help end America’s dependence on foreign oil altogether — and one company is especially well positioned to profit. Click here for more information.