These 2 Dividend Aristocrats Could Deliver Big-Time Gains…

Who doesn’t love receiving a dividend check in the mail? In fact, many investors clamor over stocks that pay consistent and growing dividends. There’s even a select group of stocks within the S&P 500 that have grown their dividends consistently, every year, for at least 25 consecutive years. These elite stocks are known as “Dividend Aristocrats,” and you can invest in them through the ProShares S&P 500 Dividend Aristocrats ETF (AMEX: NOBL).

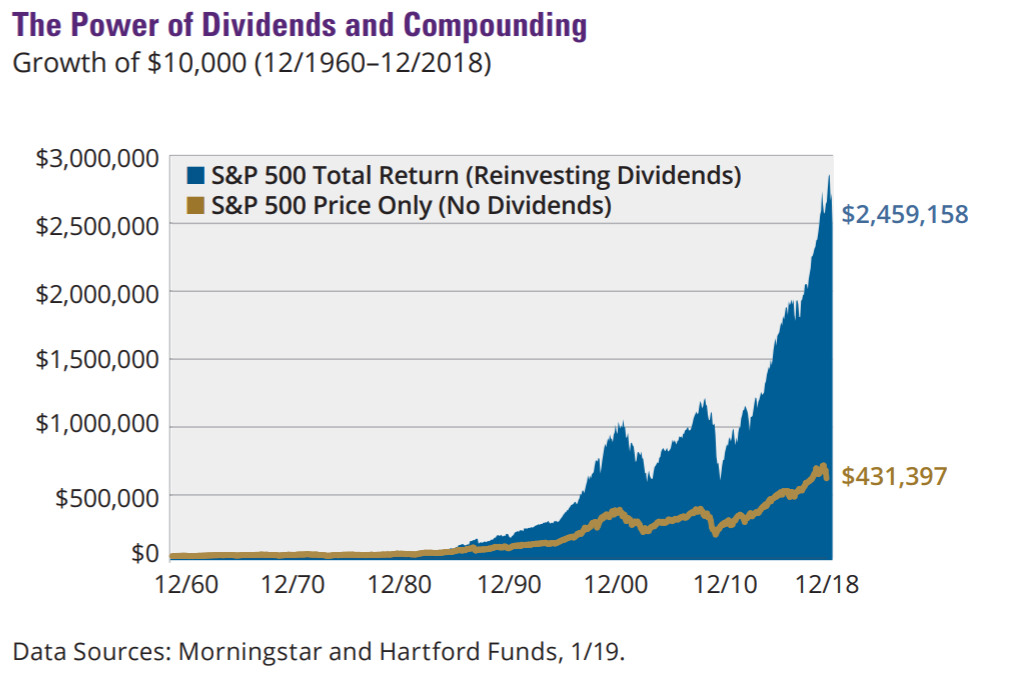

Of course, over at my Maximum Profit premium newsletter service, we aren’t necessarily concerned with dividends as much as short-term capital growth, but there’s little doubt that dividends, especially when reinvested, contribute a massive amount to total return over a long timeframe. To give you an idea, going back to 1960, 82% of the total return of the S&P 500 Index can be attributed to reinvested dividends.

What if we could have the best of both worlds? What if we could identify the top-paying dividend stocks that are also likely to see strengthening share prices? Sounds like a worthy mission for my next stock screen.

Let’s Hunt For Dividend Stocks With Momentum

There are currently 57 companies that meet the criteria of a Dividend Aristocrat (companies that have grown dividends for at least 25 consecutive years). Out of those 57, only two passed through my strict Maximum Profit criteria — outperforming more than 70% of all other stocks (relative strength greater than 70) and significantly growing cash flow (cash flow relative strength greater than 70).

(If you aren’t familiar with either relative strength or cash flow relative strength, that’s OK. Just know that they are the two pillars of my system, and have been shown time and time again to be among the most effective ways to beat the market.)

Now let’s talk about the two stocks that passed my Maximum Profit system with flying colors…

The first is financial services holding company T. Rowe Price Group, Inc. (Nasdaq: TROW). T. Row Price provides asset-management services for individuals and institutional investors. It has a strong mutual fund line-up with funds that cover everything from money market to blue-chip stocks to bond funds to international funds. At the end of March 2019, the firm had more than $1 trillion in managed assets.

The first is financial services holding company T. Rowe Price Group, Inc. (Nasdaq: TROW). T. Row Price provides asset-management services for individuals and institutional investors. It has a strong mutual fund line-up with funds that cover everything from money market to blue-chip stocks to bond funds to international funds. At the end of March 2019, the firm had more than $1 trillion in managed assets.

The company pulled in $5.4 billion last year, a 9.7% increase over the prior year, while the bottom-line figure jumped 22.5% to nearly $1.8 billion.

The stock sports a Maximum Profit score of 83. This tells me that this Dividend Aristocrat will not only keep growing its dividend but should see a good boost in capital appreciation as well.

While the corporate name of this next company might not be familiar, you likely will recognize one or two of its popular brands. VF Corp. (NYSE: VFC) designs, produces and distributes branded apparel and accessories. Its largest apparel categories include action sports, outdoor and workwear. Its portfolio of about 20 brands includes Vans, The North Face, Timberland and Dickies.

While the corporate name of this next company might not be familiar, you likely will recognize one or two of its popular brands. VF Corp. (NYSE: VFC) designs, produces and distributes branded apparel and accessories. Its largest apparel categories include action sports, outdoor and workwear. Its portfolio of about 20 brands includes Vans, The North Face, Timberland and Dickies.

In 2018 the company generated roughly $13.7 billion in sales, a 12.6% year-over-year increase. Operating cash flow surged to $1.6 billion compared with a $243 million loss the year before. The stock’s Maximum Profit score is 83, making it a “buy” in our system.

Action To Take

As always with the stock screens we provide, they are intended to provide a starting point for further research. They are not official recommendations. With that being said, the Maximum Profit scores of these stocks suggest that they are poised to deliver gains to investors in the coming weeks.

How do I know? Well, while nothing is certain when it comes to investing, the Maximum Profit system is the closest thing to “hacking” the stock market. In fact, we’ve used it to make gains of 135%, 181%, 242% and more — all in a matter of weeks or months. To see how you can, too — watch this short video.