This Un-Sexy Dividend Champ Is Still A Buy

Earlier this year, I profiled one of the best stocks in the perennially un-sexy aftermarket auto parts sector. This stock is still an incredible buy for patient, conservative investors focused on the long haul.

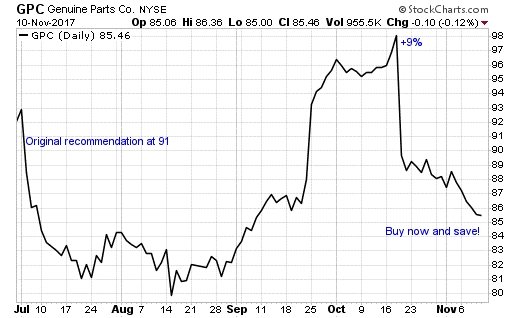

After delivering 9% (including dividends) since my recommendation, shares of Genuine Parts Co. (NYSE: GPC) now trade at an attractive 15% discount to their 52-week high. Despite the rise and sudden drop, my original investment thesis is still intact.

As I pointed out in the previous article, the U.S. aftermarket auto parts space is still highly fragmented. While the big national players such as GPC, O’Reilly (Nasdaq: ORLY), and AutoZone (NYSE: AZO) seem to have a gigantic presence, mom and pop operations are still relevant players on a market share basis. However, consolidating within that independent space is GPC’s growth strategy.

Recently, the company closed on two acquisitions: Apache Hose and Belting Company and Monroe Motor Products. With these two smart buys, GPC was able to add another $125 million to its current annual revenue number of $15.28 billion. They also help solidify GPC’s automotive and industrial supply footprint.

#-ad_banner-#The company also has its sights set overseas growth, as demonstrated by the completion of its Alliance Automotive Group acquisition. Alliance is a leading distributor of aftermarket light and commercial vehicle parts in the UK, France, Germany, and Poland. Historically, a lack of international presence has been GPC’s only major weakness. But with the closure of this particular merger, all that has changed.

So, what does the company’s growth picture look like going forward? After turning in $15.3 billion in sales for 2016, the company is poised to see an even higher number in 2017. As of the end of the third quarter of this year, total revenue numbers are sitting right at $12.1 billion. Sales have averaged $4.03 billion per quarter so far. Barring any disaster, the forecast for 2017 should come in, considering the trend, just north of $16 billion. This would mean a beat of last year’s number by better than 5%.

On the earnings side, GPC turned in earnings per share (EPS) of $4.59 for 2016. 2017 EPS for the full year is expected to come in at $4.69, just 2.1% better. However, the company projects 2018 EPS of $5.43, which would represent a solid 15% growth rate.

The company’s internal metrics are also consistently rock solid. The stock trades at just 0.8 times sales and boasts a return on equity of 21%. GPC’s debt-to-capitalization ratio is also quite low at just around 9%.

Based on Genuine Parts’ current strategy of intelligent, value-oriented growth through acquisition and management’s consistent stewardship and execution, the outlook for the business remains strong.

Risks To Consider: The biggest risk facing the stock is the company assuming more debt to fund its shopping spree. Its long-term debt-to-market capitalization has effectively doubled since my previous article on the company. However, management has shown discipline in the past and will likely continue to do so. Also, the company’s debt-to-capitalization remains low in comparison to its peers.

Action To Take: GPC shares currently trade at a 15.5% discount to their 52-week high, representing an outstanding value for patient, long-term investors. Genuine Parts has also grown its dividend every year over the last 60 years.

The stock currently trades around $86 with a forward P/E of 18.6 and a 3.1% dividend yield. Based on the company’s fundamentals and consistent operating history, I am reiterating my original 12- to 18-month price target of $106. The resulting total return (including dividends) would be 27%.

Editor’s Note: While most companies have to start each day at $0 in sales… my favorite monthly payer generates daily profits rain or shine — and regardless of what’s going on in the economy. Plus… its revenue has risen more than 60% over the past four years. That’s why I’m urging you to grab this company right now. Don’t wait… Get the buy details here ASAP.