Big Economic News… The Hottest Sector For M&A… Plus: 3 Bonus Trades You Can Make Today

There’s been a common thread among discussions that has popped up among friends and family the past few months. It’s happened so much that it’s hard not to notice, and it tells you a lot about where we’re at in this (almost) post-Covid world.

Whether it’s someone buying a house in the (insane) Austin market for the first time, a couple having a baby during Covid-lockdowns, or a neighbor trying to secure materials for a building project (I could go on…), someone inevitably voices the feeling, “I can’t imagine doing that right now…”

There’s no doubt that between Covid and the economic disruption caused by it, we’re in a different world right now. Yet life goes on. I was reminded of this when reading my colleague Nathan Slaughter talk about the real-world impacts of inflation and Fed policy earlier this week. (If you missed it, I highly encourage you to go back and check it out.)

It’s easy to forget, especially during a week like this one, where we’ve had Fed meetings, economic reports, news on Capitol Hill, and earnings season. Let’s take a brief look at some of the things that happened…

The Fed Meets… GDP Numbers… And An Infrastructure Deal (Finally) Takes Shape

The Federal Open Market Committee meeting was the big story on Wednesday. The central bank unanimously voted to keep benchmark rates where they are, at 0% to 0.25%. So nothing surprising there. But investors did take note that Fed Chair Jerome Powell has grown increasingly candid about acknowledging inflation.

The most recent Consumer Price Index (CPI) results showed that prices rose 5.4% last month when compared to last year. That’s the biggest increase we’ve seen since 2008, and Powell has acknowledged that the increases are a little higher than anticipated. Still, the Fed has maintained the stance that it is “transitory” and should ease up once supply chains are able to catch up from the effects of Covid-related shutdowns.

Also, Chairman Powell said in the post-meeting press conference that the Fed would like to see more progress on unemployment numbers before making any move to raise interest rates. Meanwhile, discussions about tapering bond purchases are ongoing.

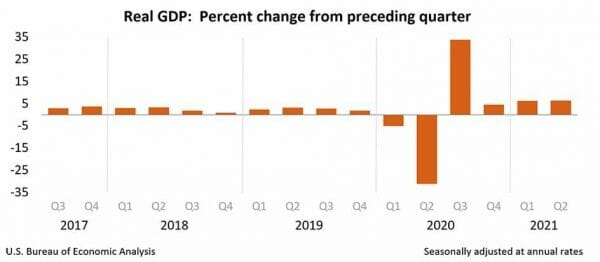

Meanwhile, the Commerce Department reported on Thursday that gross domestic product (GDP) grew by 6.5% for the April-June period. As a reminder, GDP is a measure of all goods and services produced by the economy. The figure was a little better than the 6.3% gain last quarter, yet fell well short of the Dow Jones estimate of 8.4%.

In other news, a group of Republican and Democratic Senators reached agreement earlier this week on the details surrounding an infrastructure spending package. The deal is a compromise based on the details of a larger package proposed by the Biden administration.

Here’s a broad overview of what the proposed package includes:

- Roads and bridges ($110 billion)

- Power infrastructure ($73 billion)

- Passenger and freight rail ($66 billion)

- High-speed internet ($65 billion)

- Water infrastructure ($50 billion)

- Public transit ($39 billion)

- Airports and waterways ($42 billion)

The total price tag for the legislation comes out to about $1 trillion. President Biden has already voiced his support, and debate is expected to begin in the Senate next week.

The Hottest Sector For Deals In The Market

My colleague Nathan Slaughter shared an amazing statistic with his Takeover Trader readers this week.

In case you haven’t noticed, M&A deals are heating up big time. In fact, global deal-making volume has reached $2.4 trillion so far this year, according to Refinitiv. As Nathan pointed out, the media sector has been “ground zero” for these mega-deals, making up one-third of the deal amount in dollar value.

Among the “Mega Mergers” in the media sector of the past year: the $43 billion deal between WarnerMedia and Discovery… Amazon’s $8.5 billion takeover of MGM studios… and Disney’s $71 billion monster deal for 20th Century Fox.

This has turned into an all-out war for dance partners, and there are a few big players who have yet to find someone to tango with.

Among those hoping to no longer be a wallflower is the cable TV giant Comcast (Nasdaq: CMCSA).

As Nathan pointed out, it was one of the initial suitors for 20th Century Fox, but it was outbid by Disney. While the fees provided by subscribers in the legacy cable TV business is still a cash cow, Comcast has been deeply impacted by cord-cutting along with the other big cable providers.

The company was rumored to be making a play for Roku (Nasdaq: ROKU), the maker of streaming devices (and increasingly a purveyor of its own streaming content). A deal would have made perfect sense. But ROKU has been firing on all cylinders during the Covid era, and shares have more than tripled. (Good news for Nathan’s Takeover Trader subscribers, bad news for Comcast.)

Now, with a $57 billion market cap (plus the premium it would require to take over the company), a deal might be too rich for CMCSA to consummate.

Either way, as Nathan pointed out, Comcast needs to reinvent itself, and time is running out. And he thinks he knows who the company will set its sights on next.

This pick is fresh of the press, so to get the details you’ll need to be a Takeover Trader subscriber. To learn more about the Mega Mergers that Nathan is targeting, go here for a full report.

3 Bonus Trades You Can Make Right Away

We’re going to close out today’s issue with a special treat…

We’ve recently been discussing my colleague Amber Hestla’s unique approach to earning extra income in the market. By following her simple strategy, based on her track record, you could earn about $748 a week on average. Not only that, but her trades have been successful about 90.2% of the time.

Now, many of you know this strategy involves selling put options. And despite the perceptions that some novice investors have, the truth is that you can play it safe AND earn thousands in extra income each month, thanks to Amber’s unique strategy.

So the goal with what we’re doing today is simple. We’re going to skip the basics of the strategy, and actually show you just how powerful this strategy can be… And we’re going to do it by offering you some free trades.

If you know how this works, then you can use these trades to start earning more right away, regardless of whether you choose to give Amber’s premium service a try.

If you don’t know hot it works, then you’ll have some concrete examples to see what’s possible. And once you’re up to speed, you can be making trades like this, too.

Keep in mind, these aren’t official Income Trader recommendations. These are “bonus” trades that Amber sends to her subscribers each week. Although these trades were identified by Amber’s award-winning Income Trader Volatility (ITV) indicator, Amber recommends that you do your own due diligence to be sure the trades fit your risk profile.

While each trade will be different, Amber emphasizes keeping a few things in mind. First, remember to use limit orders for your trade to ensure you get the best possible price. Second, these trades went out in this week’s issue of Income Trader. And because options pricing can move quickly, that means it’s on you to determine whether prices are still advantageous when you go to make the trade yourself.

Also, if the trade moves sharply against you, be prepared to cut your losses with a “buy to close” order if you’re not prepared to own the stock outright. (Remember, nobody has a perfect batting average.) And lastly, since these trades do not contain the normal in-depth analysis in regular issues of Income Trader, we’ve provided the probability that the option will expire worthless (which is a good thing).

Closing Thoughts

Remember, it’s our job to tell you about impactful ways to grow your wealth. Regardless of whatever else is going on in the market, we’re convinced that this is one of the best ways to earn extra income out there. Even better, once you’re all set up and ready to go, it only takes about 10 minutes a week…

You certainly won’t hear about strategies like this in the mainstream financial media. Yet Amber’s track record is one of the best in the business. So if you’d like to get more trades like this, then consider joining Amber and her Income Trader subscribers for more trades.