Household Wealth Jumps… Fed Taper Talk… And The Perfect Way To Profit From The Shipping Crisis

When I looked up our home value estimate on Zillow the other day, I noticed that it had dropped a bit.

How could this be? The market is red-hot!

The rational part of my brain soon kicked in, and I reminded myself that while the local market here in Austin is arguably the hottest market in the country, like all residential real estate, this stuff is seasonal.

And while Zillow’s platform is great, its algorithmically driven estimates are just that, estimates. For perspective, I looked at where it was valued a year ago.

“Better than I deserve…” If you’ve ever listened to Dave Ramsey on the radio, you may recognize that line.

I hope a lot of us are feeling fortunate in a similar manner, because according to the Federal Reserve, U.S. households are swimming in new wealth.

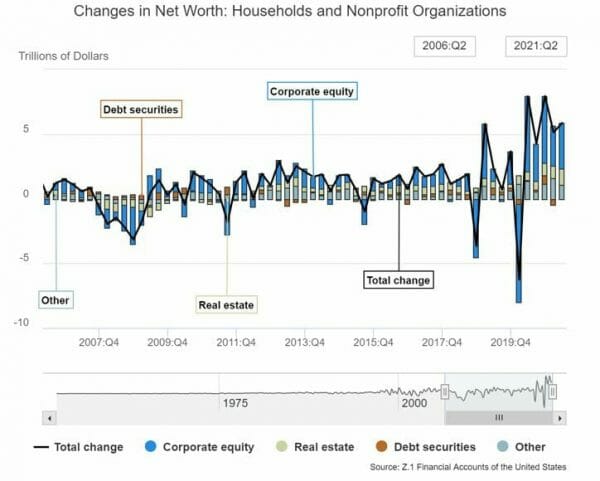

According to the central bank, U.S. household net worth rose by $5.85 trillion in the second quarter. That’s a staggering increase of 19.6% from a year ago and pushes household wealth to a record $141.7 trillion.

Source: Federal Reserve

Driving much of this gain is, of course, surging real estate prices. About $1.2 trillion of that wealth came from real estate, with home equity rising to 67.7%, the highest level since 2008.

Where did the rest come from? A little place you may be familiar with… it’s called the stock market.

U.S. households gained $3.5 trillion in wealth from the stock market, as all of the major indices have eclipsed their pre-covid highs… and then some.

But as stimulus measures begin to wind down, investors should take note. Household debt also rose in the second quarter (by 7.9%), and the cheap-money train can’t continue indefinitely.

And on that note, we also got some important news from the Fed…

Taper Talk… The Fed Makes It Official

On Wednesday, while we were discussing the situation in China with the Evergrande Group meltdown, the Federal Reserve made some big news that sent markets sharply higher.

Fed Chair Jerome Powell officially announced that the central bank will begin tapering asset purchases. While that’s not exactly new news, per se, what is news is that it could begin as soon as next month and end by mid-2022, assuming nothing changes.

(This is the part where we can chuckle to ourselves about nothing changing between now and then.)

Remember, the Fed has been purchasing up to $120 billion in U.S. government debt and mortgage-backed securities per month. This has undoubtedly had a dramatic effect on money supply, lowering long-term interest rates, and pushing investors further along the “risk” curve into other market assets.

What’s more, the Fed telegraphed that it may raise interest rates a bit faster than anticipated.

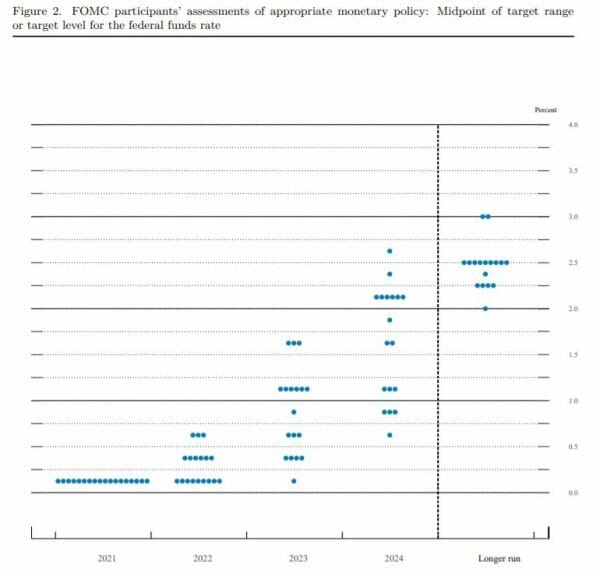

According to the latest “dot plot,” nine of the 18 Fed officials surveyed said that they would be comfortable raising rates next year.

Source: Federal Reserve Summary Of Economic Projections

This came as somewhat as a surprise to most Fed-watchers. Some may worry that this all feels a bit too soon.

On the one hand, the Fed seems to be acknowledging (perhaps begrudgingly) the persistence of inflation. Officials now project 4.2% inflation for 2021, more than double the Fed’s 2% target, but for the rate to normalize back to 2.2% next year.

That passes one of Powell’s outlined criteria for raising rates.

But on the other hand, some worry if this hawkish turn – specifically the prospect of raising rates next year – is perhaps a bit too soon.

As we briefly touched on in these pages, we had a dismal jobs report in August. The U.S. Census Bureau reported only 235,000 new jobs, well short of the 720,000 that were expected.

Fed officials also projected gross domestic product (GDP) to rise 5.9% in 2021. That sounds good on the face of it, but back in June, that projection was 7%.

What’s more, as I’ve mentioned several times, global supply chains are in an absolute mess right now and threaten to derail much of the progress we’ve made this year.

Then, of course, there’s the coronavirus. While the CDC recently approved boosters for over-65 Americans, the Delta variant continues to worry everyone from employers to employees (and would-be employees) to economists and investors.

It’s important to keep in mind that of the Fed members who project rate hikes next year, only three project two rate hikes, while the remaining six expecting one. That means rates will remain low next year, and likely beyond that.

Still, these are all key items to keep an eye on as they unfold, particularly with the September jobs report, scheduled to be released on Friday, October 8.

The Perfect Way To Profit From The Shipping Crisis

For our final item for today, I want to turn back to our discussion regarding our supply chains over the past few months. Particularly, the situation I mentioned last Friday at our ports…

When looking for a great investment, I’m a fan of identifying a problem and then looking for a company with a solution. It sounds simple, but trust me, successful investing really can be that simple.

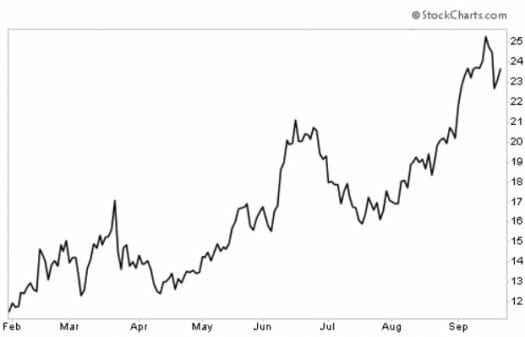

Yesterday, I told readers that my colleague Nathan Slaughter identified a shipping company back in January that was perfectly positioned to take advantage of sky-high charter rates. And as I pointed out, he was spot-on – that pick is up by 110%, while continuing to dish out a healthy 4% yield.

And while I can’t mention that “Buy First” pick out of fairness to his subscribers, I want to tell you a bit about another pick that’s perfectly positioned to profit…

Back in November, Nathan also told High-Yield Investing subscribers about another great play on this theme. It’s a company that makes shipping containers – the workhorse of the global shipping industry.

As Nathan pointed out recently to subscribers, the price of a new 20-foot shipping container straight from the factory will now set you back a cool $3,800 per unit. A large containership can easily fit more than 20,000 of these containers on their deck. That would set you back about $76 million.

Most shipping lines have no interest in bearing that kind of up-front expense. So they lease these containers instead.

With global trade disrupted by the coronavirus, related shutdowns, as well as persistent labor and material shortages, shipping companies are desperate to keep up with demand.

That puts Nathan’s pick right in the sweet spot. In fact, its fleet of containers is 99.6% leased, with revenues and profits surging.

Here’s what Nathan had to say about the company:

…I applaud management for increasing its asset base in this environment. The company has invested $3.4 billion in new containers so far this year, about 400,000 of which were hired out last quarter (under very favorable terms). Most of the rest have already been pre-leased even before they leave the factory floor.

Considering the average lease is 13 years, this explosive growth period will drive future revenues and cash flows well into the next decade.

What’s more, while this stock has rallied somewhat, it still has some catching up to do, trading at less than seven times earnings. It also sports a 4.5% yield.

Add it all up, and you have another no-brainer way to profit from a company that will play a key role in fixing the troubling situation with the global supply chain.

To get access to this pick, as well as Nathan’s other top buys, go here now.