Looking To Build Wealth? These Monthly Paychecks Are The Answer

Investments that pay a dividend every month aren’t a hard sell. After all, who doesn’t want a little extra monthly income to help tackle the monthly bills?

Investments that pay a dividend every month aren’t a hard sell. After all, who doesn’t want a little extra monthly income to help tackle the monthly bills?

Sadly, that’s where too many investors believe the benefits end. Indeed, many still think that buying a security paying $0.10 per share in dividends a dozen times a year gives them the same long-term payoff as buying one that pays $1.20 in dividends annually.

That idea couldn’t be more short-sighted. Beyond the convenient payouts that monthly dividend stocks and funds provide, these frequent dividend payers offer much more than most people realize when it comes to building wealth.

Here are few excellent reasons to love monthly dividend payers…

4 Reasons Why You Should Love Monthly Dividends

1. Higher Frequency Leads To Faster Growth

If you choose to wisely reinvest your dividends (assuming you don’t need to live on them right away), you will ultimately make more. You’ll build wealth faster with a monthly dividend payer than with an annual dividend payer.

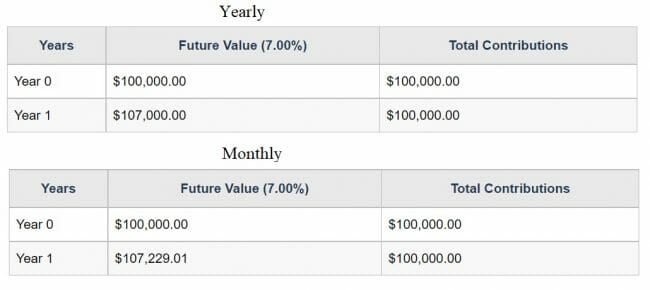

Let’s say you invest $100,000 in two securities that each paid a 7% annual dividend yield. One pays dividends monthly and the other pays once annually. For simplicity, let’s also say these investments don’t change in value over time (i.e. no capital gains or losses) and that you reinvest dividends as soon as they’re paid out.

After one year, the annual payer would be worth $107,000 (my original $100,000 investment plus $7,000 in dividends) at the end of the year. By comparison, the monthly payer would grow to $107,229 as long as you reinvested dividends every month and let them compound. That’s $229 more growth than the annual payer in just one year.

Source: Investor.gov

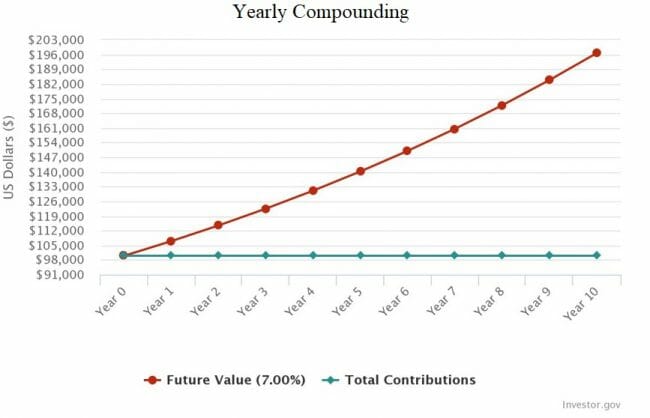

As you continue to reinvest dividends and let them compound over time, the rewards of the monthly payer only get better. After 10 years, the yearly compounder grows into $196,715.14. Not bad at all.

Source: Investor.gov

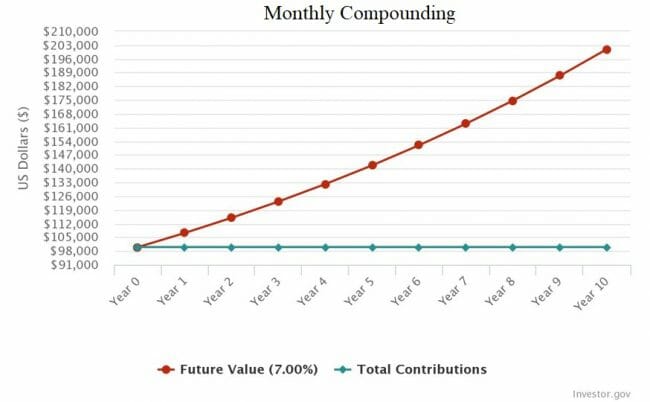

But the monthly payer in this example would be worth$200,966.14 — $4,251 more than the annual payer.

Source: Investor.gov

The key here is that the more often you reinvest your dividends, the more time they have to compound and grow.

2. Less Market Risk

When you buy an annual payer, you only have one day a year to buy additional shares through a dividend reinvestment program. But what if the stock hits an all-time high price on that day? You could get unlucky and reinvest in shares at a high price — and get stuck with a low dividend yield.

A monthly payer on the other hand lets you reinvest dividends to buy shares 12 times a year. This spreads out your market risk by letting you buy a few shares at a time. This gives you a greater possibility of buying shares when they’re cheaper, too, for higher potential returns if the security gains in value.

3. Peace Of Mind

When you buy dividend-paying stocks, it’s often best to hold them for the long haul. But sometimes the unexpected happens. Maybe market conditions get too risky for a specific asset class. Maybe a company runs into trouble. Or maybe the cash is needed for a personal emergency.

You could face difficult and expensive choices if a stock you own pays dividends annually and an unexpected situation comes up. I’d hate to hold on to a stock for 11 months, only to have to sell it right before its payoff date and miss out on the dividend income. I’d also hate to hold on to a problem stock just for its dividend — who’d want to see their stock fall $2 in price just to collect $1 in dividends?

In contrast, a monthly dividend payer gives you easier decisions and greater peace of mind. You don’t need to wait around as long for a dividend if you ever need to quickly get out of the investment. And you don’t have to worry about payoff dates or “missing out” on dividends as much.

4. Convenience

While many of my High-Yield Investing premium subscribers use dividend reinvestment as the growth engine toward building a retirement fund, many will eventually need to start living off the income from their portfolio. Some are already at that point.

Regardless, monthly dividend payers will give them a convenient way to pay bills every month. They might use monthly dividends to pay the final mortgage bills to pay off their home. They also might use them to pay a monthly electric bill, a monthly cable bill, and a monthly phone bill.

The Takeaway

There are hundreds of monthly dividend-paying securities on the market, with more launching every day. Unfortunately, the vast majority of monthly dividend payers are fixed-income securities (i.e. bond funds), which are interest-rate sensitive and can lose value if interest rates go up.

Stocks and ETFs that pay a monthly dividend are less common, but may be the better choice as they are less exposed to interest-rate risk than bond funds.

Either way, I’m fond of monthly dividend payers because they help my readers grow their retirement fund faster while also helping them sleep better at night. And when they’re ready to stop reinvesting dividends and start living off the income, they’ll be handy toward paying the bills every month.

In High-Yield Investing, we hold over a dozen monthly dividend payers in our portfolios. As a nice bonus, many of these carry annual dividend yields of 5% or more.

It’s this kind of approach that has allowed our readers to build a sizeable nest egg to live off of in retirement. And it’s not too late for you to get started, either. If you’d like to learn how to join us — and get access to the names of my absolute favorite dividend stock picks while you’re at it — I invite you to read this short report.