Not-So-Chill Numbers From Netflix… A Special Invitation… And Why Tech Could Fall Further…

The selloff continues.

What started as a correction in tech stocks thanks to the prospect of rising interest rates is now threatening to turn into a full-blown correction.

The Nasdaq officially entered correction territory earlier this week. And as I write this, the S&P 500 is down about 8% from its all-time high from just a few weeks ago. (Remember, a correction is officially considered a 10% drop from highs.)

In today’s market action, Netflix (Nasdaq: NFLX) was a big culprit for the volatility after issuing weak guidance for the first quarter of 2022.

This was enough to send the stock plunging by more than 20%. Other streaming names (and the tech sector as a whole) sold off in sympathy.

More on that in a moment.

Next week, we’ll be tuned in to the Federal Reserve’s policy meeting.

Any info coming out of the powwow could give clues as to whether we will see the first of as many as four rate hikes beginning in March, as expected. Or perhaps the recent market weakness will prompt policymakers to tone down their recent hawkish signals.

Not So Netflix And Chill…

As mentioned earlier, things haven’t been so chill over at Netflix (Nasdaq: NFLX).

The streaming giant reported earnings per share (EPS) of $1.33 on $7.71 billion in revenue for the fourth quarter.

That was good enough to match estimates on the top line and beat expectations on the bottom line. But it wasn’t good enough. It was the subscriber growth numbers that disappointed investors.

According to Netflix, it added 8.28 million global subscribers in the quarter, beating the analyst estimate of 8.19 million – but missing the company’s own projection of 8.5 million.

To make matters worse, Netflix said that it expects to only add 2.5 million subscribers during the first quarter of 2022.

You read that right. For context, the company added nearly 4 million new subscribers in the first quarter of 2021. And analysts were hoping for close to 7 million new subscribers this quarter.

That letdown caused investors to dump shares of NFLX to the tune of 21%. Yikes.

Source: Statista

The broader context is beginning to get clear. After scoring big wins thanks to the early stages of Covid, work-from-home, and lockdowns, the streaming giant began to stall out in 2021.

You can see the tepid growth numbers in the chart above.

The first question here is whether Netflix is falling behind in the streaming wars. The company maintained that the recent results are due to Covid “overhang” and that it signed on a bunch of subscribers in 2020 that it would have gotten in 2021 anyway.

But with competition heating up between Netflix, Amazon (Nasdaq: AMZN), HBO Max, Disney (NYSE: DIS), and countless others, that remains to be seen.

(Shoutout to our new household favorite Paramount Plus: home of Hawaii Five-0 reruns and Yellowstone spinoff 1883.)

The bigger question though, is whether the boom times experienced by many tech names are beginning to come to an end.

At the end of today’s issue, my colleague Jimmy Butts explains why that may be the case – and what we should do about it…

The Doctor Is In…

But first, I want to introduce you to a guy you’re going to be hearing more from in the weeks ahead.

Meet Dr. Joe Durarte. Longtime Investing Daily readers may have seen his work, but many of you here may not be familiar.

Meet Dr. Joe Durarte. Longtime Investing Daily readers may have seen his work, but many of you here may not be familiar.

Joe has been analyzing, trading, and writing about the financial markets since 1990. He’s a former money manager and a professional investor who now trades his own account and shares his knowledge with individual investors.

Joe has written several bestselling books, including “Trading Options for Dummies,” “Trading Futures for Dummies,” “The Everything Investing in Your 20s & 30s Book,” among others. He was also an original CNBC Market Maven, has been quoted in Barron’s, The Wall Street Journal, and has also written for Marketwatch.com and other major publications.

Like I said, you’re going to be hearing more from Joe soon. That’s because in addition to being named Chief Investment Strategist of Profit Catalyst Alert – the newest premium trading service over at Investing Daily – he’s going to be hosting a special, one-of-a-kind event…

He’s calling it the Profit Catalyst Symposium, and you can sign up to secure a spot for free.

Mark your calendar for Tuesday, January 25th. Then, grab a pen and paper, and get ready… because Dr. Duarte isn’t going to hold anything back when he reveals the top catalyst trade for 2022 and beyond.

Because despite all the algorithms and supercomputers on Wall Street, Dr. Duarte believes the surest path to wealth is the same approach that worked best decades ago: pinpoint “profit catalysts” before they happen.

At this free event, Joe will reveal his number one catalyst trade for 2022, and why it could hand you a a monster profit this year. To claim your free VIP seat, click here now.

Why Tech Stocks Could Fall Further From Here — And What To Do About It…

I’m not going to sugar-coat this… This is a tough market environment to trade.

I’m not going to sugar-coat this… This is a tough market environment to trade.

I’ve seen this before, and I’ll give it to you straight. Not many traders will be able to stomach it. We will see a lot of traders fold their cards, becoming “buy and fold” investors.

I don’t say this to scare you, but rather to say… Don’t let this happen to you.

The biggest reason traders fail, or blow up their accounts, is because they don’t have any sell signals or stop losses in place. And if they do, they usually don’t have the discipline to follow them. They let small losers dwarf into big ones.

When it comes to selling a stock, it’s easy to kick the can down the road. The voice in the back of our heads says, “sell tomorrow, when the stock turns green.” If the stock is still trading down the following day, we throw up our hands and quickly log out of our accounts.

If the stock happens to be trading in the green the next day, most people still never sell. That green day gives them hope that the stock is turning around.

You don’t want to be the one left holding the bag. Remain disciplined and stick to your sell signals. And if you can’t stomach the volatility, then that’s a sure sign that you have too much exposure to equities.

We’ve Seen This Movie Before…

If you’ve decided to ignore some of your sell signals, holding out hope that many of your holdings are near the bottom… Well, I have some bad news: they can fall a lot further from here.

I bring this up especially when we look at the tech-heavy Nasdaq, which has officially entered correction territory (a decline of 10% from highs).

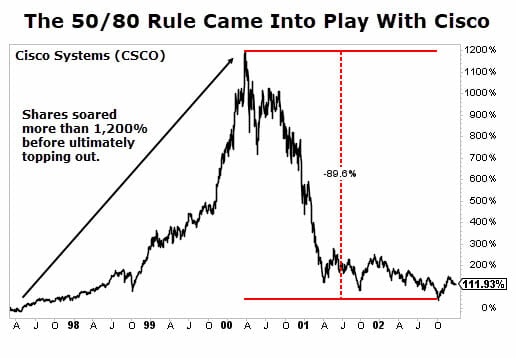

Some of our favorite tech plays have rewarded handsomely us over the years. And that’s great. But here’s a dirty little secret about secular market leaders (like tech stocks) from famed trader Mark Minervini… once they put in a major top, there’s a 50% chance that they will decline by 80%, and an 80% chance they will decline by 50%.

I want you to think about this for a second. After a stock or industry makes a major move upward over a long time, it will almost assuredly drop by 50% when it ultimately tops out. And it’s a flip of the coin whether that downward move will be as much as 80%.

Don’t believe me? Think about what led markets higher in the late ’90s. Internet stocks. When they finally topped out, they came crashing back to earth.

Just look at Cisco Systems (Nasdaq: CSCO). Shares rocketed higher. A 10-bagger. But when it finally topped out in March 2000, shares lost nearly 90%…

Am I cherry-picking one stock during a major crash? Sure. Maybe. But this isn’t a one-time deal. Fast-forward to the lead-up to 2008. What were the secular growth stocks during this time? Banks and financials. They were making a grip on the housing boom. But once again, when the music stopped it wasn’t pretty.

Citigroup nearly went belly-up. Shares lost more than 97% from top to bottom.

Okay. Fine. These were two massive market corrections. But let’s keep going.

Coming out of the financial crisis the new growth leader was the innovation coming out of the oil industry. Recall, that fracking allowed America to become a global leader in oil.

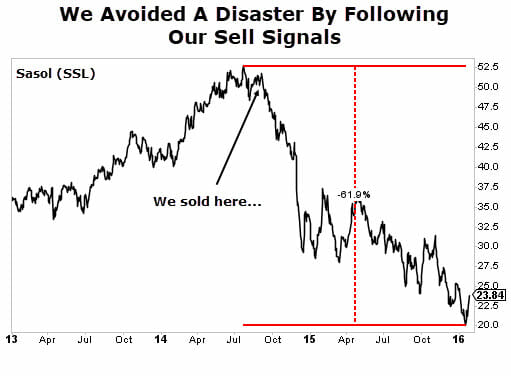

The oil boom was well underway and these stocks surged higher. We made good money from this sector in both of my premium newsletters, but especially over at my trading service, Maximum Profit. But when this secular growth sector finally topped out, we followed our sell signals and escaped unscathed. Those who held onto “hope” lost their shirts.

We made a quick trade in oil and gas company Sasol Limited (NYSE: SSL). We didn’t make much on the trade (7.2%), but more importantly, we didn’t lose it all.

Closing Thoughts

This is what having sell signals and stop-losses can do for you. Nobody thinks they need them — until they do.

After the energy sector fell apart, the tech industry picked up the pieces and has been the secular growth sector leading the market.

But I think the top is in for tech stocks, and we’re already seeing many former leaders posting big selloffs.

The point is that you don’t want to ride these stocks down. Follow your sell signals. If you don’t already have them, make them. Book profits, cut losses short, and never add to losers (no sense in throwing good money after bad).

The market’s next leader will reveal itself in time. I have a few ideas on where that will be — but for now, we need to remain patient and remain disciplined.

In the meantime, if you’re looking for growth opportunities in this market, then you need to check out my report of investment predictions for 2022…

While the top may be in for the tech sector, that doesn’t mean there aren’t other opportunities for mega-gains. You may remember last year’s report — our calls on copper, pipelines, crypto, and timber returned up to 391%… (and most of them are STILL a buy!)

Now, my team and I have just concluded three months of research — and released an a brand new set of predictions for the coming year that could turn a modest investment into small fortune.

To put it simply, these could be my most profitable predictions yet… Click here to learn more.