Amid Historic Inflation, The Fed Hikes Rates… Plus: Tips To Keep Your Head In The Game

Well, the big day we’ve all been waiting for is finally here.

The Federal Reserve Open Market Committee announced the first interest rate hike since 2018.

The central bank has been telegraphing a rate hike for several months now. And up until recently, the question was simply “by how much?”

We got our answer today. The committee members announced a quarter-point hike, setting the target Fed Funds Rate at between 0.25% and 0.5%.

Around December and early January, some analysts were wondering if we would see a “double hike”. But markets had been selling off, and Russia’s invasion of Ukraine only added to growing global uncertainty.

By raising rates, the Fed is hoping to quell inflationary pressures sparked by post-pandemic demand and supply-chain bottlenecks. The latest Consumer Price Index reading shows prices for all items (including food and energy) spiking by 7.9% in February compared to the same month last year.

That’s the highest reading since January 1982. Stripping out food and energy (which tend to be more volatile), prices rose by 6.4%, the highest reading since August 1982.

Source: Bureau of Labor Statistics

But the Fed warned in its statement that we shouldn’t expect those inflationary pressures to abate any time soon:

“Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures”.

The Fed is in a tough position here, and policymakers will need to thread the needle with both the timing and amount of rate hikes. Raise too little (or too slowly), and inflation will only get worse. Raise too much (or too quickly), and it risks plunging the U.S. economy into a recession.

The Fed’s inflation projection for 2022, for what it’s worth, is 4.3%. That’s well above the 2.6% it projected back in December, which was also about the time the central bank finally abandoned its stubborn use of the word “transitory” when describing the nature of the problem.

Remember, as part of the Fed’s dual mandate, the goal is to keep inflation at about 2%. So there’s clearly some work to be done.

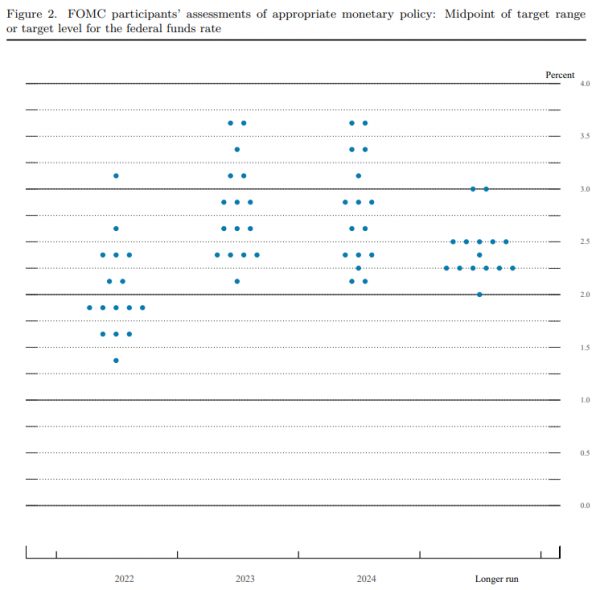

That’s why it’s important to consult the “dot plot” when Fed meetings occur. As we’ve highlighted before, this is a survey of Fed members’ assessments what they deem to be “appropriate” monetary policy over a span of time. Said another way, it shows what Fed members think the fed funds rate should be over the coming months and years.

Source: Federal Reserve Summary of Economic Projections

These FOMC projections indicate the likelihood of as many as six rate increases this year (which would put the Fed Funds Rate at 1.75%. The median expectation is for rates to return to 2.5% to 3% by the end of 2024.

Switching gears, if global events have you worried, I share some thoughts on how you can keep your cool in the essay below…

6 Tips To Keep Your Head When The Market Acts Up…

September 15, 2008 was an important date that marked an important change in the way investors looked at the markets.

If your memory is a little fuzzy, that’s the day that the investment bank Lehman Brothers filed for bankruptcy.

Most of us who were in the market the day that happened know what happened next. Waves of foreclosures… More bankruptcies… Global trade halted… Credit markets went bone-dry.

In fact, we came extremely close to a “systemic meltdown,” according to the International Monetary Fund. From the peak on October 9, 2007, to the bottom on March 9, 2009, the S&P 500 dropped 56.8%.

I’m not here to bring these events up to force you to relive those days. Instead, what I am here to do is remind you of a simple fact: We survived.

Fast-forward to March 2020. Less than 12 years after the financial crisis, we were subjected to another economic trauma as the coronavirus spread around the globe and brought life to a standstill. As states issued “shelter in place” orders, stores closed, people stocked up on food (and toilet paper). Zoom meetings became a thing. Guns and ammo flew off the shelves. And once again, markets tanked.

What’s important to keep in mind is that this is already in the rear-view mirror. Still, I wouldn’t blame you one bit if you didn’t get a bad feeling in the pit of your stomach when the latest bout of volatility hit and drug the markets lower. After two (albeit very different) major economic crises in our lifetimes, investors are understandably justified to feel a little traumatized. In fact, one of the most frequently asked questions we get is what to do when the next big market crash comes.

It’s time to put some of those concerns to bed. Below is a list of tips I’ve edited and compiled from our premium experts over the years that I always keep handy. They address how to stay objective with your portfolio regardless of the market or whatever else is going on in the world…

6 Tips To Keep Help Your Survive (And Thrive)…

1. Remember that the experts can be wrong. In fact, the experts can be wrong for a long, long time. And business television channels find guests with extreme views just to drum up ratings. So please don’t lose a minute of sleep over the ramblings of pundits or television talking heads.

2. Maintain a comfortable cash cushion. As investors, we have been made to feel guilty about holding cash. It’s as if we’re shirking our responsibilities. We feel like we should always have our entire portfolio working for us. But cash does work for us. Cash holds up pretty darn well in a downturn. Cash helps us sleep better at night, no matter what the market throws at us. And cash allows us to buy opportunities during a downturn, without having to liquidate another position.

How much cash you hold is a personal decision based on your financial needs, market conditions, and your risk tolerance. But if you wake up during the night worried about your investments, you probably need a little more cash in your portfolio.

3. Count your gains or dividends. Positive reinforcement is a valuable tool, especially if the pundits (or even worse, markets) turn negative. Personally, I like to review the gains I’m sitting on from my longest-tenured holdings – just to see how far I’ve come. The point isn’t to deny reality, but rather to gain perspective. When you’re sitting on a long-term winner of, say, 250%, then a 10% correction is a lot easier to digest.

4. Reevaluate your holdings. The goal for most investors is to buy, hold, and reinvest for the long haul. But when global economic or political conditions change, it is always a good idea to assess its potential impact on your holdings. To do this, you must stay objective, which can be difficult when information is limited and panic starts to rear its ugly head. Sell only what you believe has a significant negative outlook — and leave the rest alone.

5. Be careful with your stops. Stop-losses can be tricky. I don’t want to tell you not to use them, but think twice before you put one in place. The last thing you want is to get stopped out of a position at a low price, only to watch it rebound at the end of the day or week.

If it’s a stock that has a history of wild price swings, think about how you might react. Will you be glad you got out? Or will you be mad because you may actually want to buy more? Do this before putting the stop in place. If you want out of a position or need to raise cash — go ahead and sell outright. It takes discipline, but you need to develop this skill if you want to be successful in the long run.

6. Keep a shopping list. During the recent bull markets, there has been an acronym that investors and traders like to throw around when the enthusiasm is still high: BTFD. (Buy The Dip – I’ll let you guess what the F means.) This is not an endorsement to buy the dip every time. After all, what looks “cheap” today could be cheaper tomorrow.

Personally, I keep a watchlist of securities I wished I had bought the last time the market tanked. Occasionally, I may go ahead and buy if it’s still a good deal today. But if the Dow ever pukes up 2,000 points, you can bet I’ll be ready to go shopping, with a high degree of conviction whenever I pull the trigger. As an added bonus, income investors have a special incentive for bargain shopping high-quality income securities on dips — because when prices fall, yields rise. And it’s one reason why it always helps to keep a little extra cash on hand.

Closing Thoughts

I don’t know when the recent choppiness in the market will let up. I don’t know when inflation will cool off, or what will happen in Ukraine. I don’t have a crystal ball. But what I do know is that if you keep these tips in mind, you’ll be much better prepared for whatever the market throws at us next.

What I do know is that another major event is always around the corner. In an ideal scenario, when that happens, you’ll have these tips printed off next to you (or stored away safely in your head). And as you watch the talking heads on television start to wave their arms in exasperation as the next major economic event begins to unfold, and everybody else around you panics, you’ll smile quietly to yourself, because you’re ready.

P.S. Increasing your exposure to hard assets and raw materials is a shrewd way to simultaneously tap growth and insulate against both inflation and geopolitical turmoil.

That’s where one of the world’s most vital commodities comes into play: copper.

Copper is in great demand but short supply, which spells huge future gains for producers of the “red metal.” For details about copper and our top pick to profit from its rise, click here now.