The Fed Hikes Rates… 3 Dozen Yields Above 5%… An Under-The-Radar Spot For M&A…

Well folks, I hate to say I told you so.

You may remember two weeks ago, when we learned that inflation reached a new high by rising 9.1% on a year-over-year basis in June. Because of that, I said that the Fed was likely to hike the benchmark rate by 75 basis points at its next policy meeting.

That’s exactly what happened this afternoon. And here’s the crazy part… After more than a year of bickering between so-called “hawks” and “doves”… this time, the vote was unanimous.

Another interesting thing I’ve read are some of the subtle differences in the FOMC’s official statement in June compared to yesterday. (I’ll link to June’s statement and July’s statement for your reference.)

To my mind, one important difference is a shift to acknowledging that “recent indicators of spending and production have softened”. (Last month, the Fed seemed to dismiss the Q1 GDP report showing a contraction.) The other is the addition of acknowledging higher food prices in addition to energy prices.

Changes in verbiage like this are slight, but they matter. It signals to investors that the Fed is trying to adapt to market realities after two previous 50-basis-point hikes didn’t seem to get the job done. (Although critics will say they’re still slow to the take.)

We’ll know more about the state of the economy tomorrow when the Q2 GDP report numbers are released. After posting a drop of 1.6% in Q1, median estimates are calling for a rise of 0.5% for the three months ending in June.

But if the report surprises and shows a negative number, then we’ll be in a recession as it’s generally understood. (Technically, the National Bureau of Economic Research gets the official word.)

We’ll stay on top of things, as usual. In the meantime, I turned to my colleague Nathan Slaughter to talk about high yields, bonds, and buyouts…

Nathan, as you know, the average stock in S&P 500 yields about 1.7%. How can investors find the income they need in an environment like this?

I get it. It’s not easy. But trust me when I say this…

I get it. It’s not easy. But trust me when I say this…

If you truly want to build long-term wealth, then the core of your portfolio MUST have a yield attached to it.

Dividends make up for more than half of the market’s total return over the long haul. Other investing fads may come and go, but it’s the single easiest way to create wealth in the market.

As I like to tell my premium readers, there are plenty of high yields out there. You just have to know where to look…

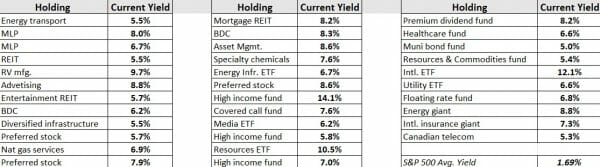

Take a look at the table below. I compiled the holdings in our premium portfolio over at High-Yield Investing that yield above 5% right now. The grand total? 36. That’s three dozen holdings that pay anywhere from 5% to double-digits.

Of course, those are the yields you’d earn if you bought today. But some of our holdings have been around so long — and have raised their payouts so much — that we’re earning a yield-on-cost in the double digits. In fact, one holding is paying us 24%!

And the great thing is that more than a few of these holdings have delivered triple-digit gains, too.

The point is, there are plenty of high-quality picks out there that yield more than 5%. And we find them by looking beyond just stocks – we touch on everything from REITs to MLPs to bond funds and more.

Speaking of bonds, you’ve noticeably shied away from bonds over the past couple of years. Why is that?

As some of our readers may know, U.S. stocks have endured the worst first half in more than half a century. But some sectors of the bond market (like long-dated Treasuries) have endured even more punishment.

With rising rates on the horizon, I have assiduously avoided bonds over the past couple of years, almost to the point of exclusion. Aside from floating rate securities, Eaton Vance Muni (NYSE: EVN) is the only traditional bond holding in the High-Yield Investing portfolio. And that’s largely for the tax advantages.

But the calculus has changed. The fierce selloff in both corporate and government IOUs has elevated yields across the board, with some corners of the fixed income world paying more now than they did during the pandemic crash. Spreads over comparable Treasuries have widened considerably.

The yield on Bank of America’s junk bond index, for example, has topped 8.4% — up from 4.5% at the beginning of the year. Historically speaking, this has been a good time to invest in these higher-paying securities. Previously, when yields hit this level, returns over the next 12 months have ranged anywhere from a 7% gain to as much as 17%.

High-grade municipal bond yields have been on the rise as well, shooting up approximately 175 basis points since the start of the year, without any real deterioration in credit quality. Defaults in this sector are quite rare, averaging just 0.12% over the past decade.

I don’t know if it’s quite time to jump into junk bonds just yet (but stay tuned). In the meantime, EVN has rallied nicely over the past month, bouncing about 10%. Yet, payouts on this five-star fund remain at 5%, for a tax-equivalent yield (TEY) of better than 8% for upper-income taxpayers.

This fund has been a best-in-class performer for many years. So while more rate tightening lies ahead, I think it’s a “buy” for tax-conscious investors at these levels.

Switching gears for a moment, what’s one sector you think is ripe for M&A deals that most readers might not think about?

Oh that’s easy. It’s the asset management business.

In my younger days as a financial advisor, I remember a fellow broker excitedly pushing his clients into a brand new fund that placed every member of the Nasdaq 100 Index into a single basket… which traded just like a stock.

The ticker was pretty easy to remember: QQQ.

I didn’t realize it at the time, but this was the beginning of a revolution. Today, the Invesco QQQ Trust has $170 billion in assets and generates well over $300 million in annual fees for its owner. Investors have been rewarded with market-beating 18.1% annualized returns over the past decade.

Unless you’ve been living under a rock, you are probably acquainted with these exchange-traded funds (ETFs). You may even own a few. They offer similar diversification to traditional mutual funds, but with fully transparent portfolios and much lower fees in most cases. And since they are typically tethered to a specific index, turnover rates are low, which benefits tax efficiency.

For most investors, it’s simply a better mousetrap. There are now 2,805 different ETFs on U.S. exchanges covering every conceivable investment under the sun, from plain vanilla to exotic.

Approximately $919 billion flooded into U.S. ETFs in 2021, shattering the previous record inflow of $490 billion the year before. With 28 consecutive months of positive inflows, industry assets now stand at a staggering $7.3 trillion – and nearly $10 trillion globally.

The playing field has tilted, and it’s made life much more difficult for traditional mutual fund families. For every $1 deposited into a mutual fund, nearly $5 was pumped into an ETF.

This trend appears to be unstoppable. Some mutual fund companies have adapted by either developing their own ETF units (Vanguard, Fidelity, Charles Schwab). Others (BlackRock, Invesco, to name a few) took the shortcut by acquiring smaller rivals.

Others, meanwhile, are bleeding assets.

I could go on. But the point is that there are still dozens of independents out there, even after years of consolidation. In fact, I recently told my Takeover Trader readers about a pick that would be perfect for the likes of AllianceBernstein or T. Rowe Price, established old-school asset managers that are late to the game and only now seeking a foothold in this crowded market.

Editor’s Note: According to Nathan, companies are flush with cash and eager to buy their way into growth in this uncertain environment. And that means we could see a wave of deals in the coming months…

Even the whisper of a “mega-merger” can lead to enormous returns, so it can be extremely profitable to pay attention to this space. And over at Takeover Trader, Nathan has just pinpointed a potential deal that could dwarf them all.

Want to get in on his next big trade? Click here for details.