The Future Of Social Security Isn’t Looking Good…

Imagine a boat that has sprung a leak. The damage to the hull can’t be repaired, so the vessel is constantly taking on water. It’s not a good situation. Fortunately, there are 20 able-bodied passengers aboard to help bail, keeping the ship afloat.

But after a while, one of those exhausted passengers tires and stops bailing. Then another, and another. Soon, there are just 10 people bailing, half as many as before, so the water level begins to creep ever higher. And one by one the remaining bailers give up their efforts, until there are just two left.

We’ll call them Mark and Erin.

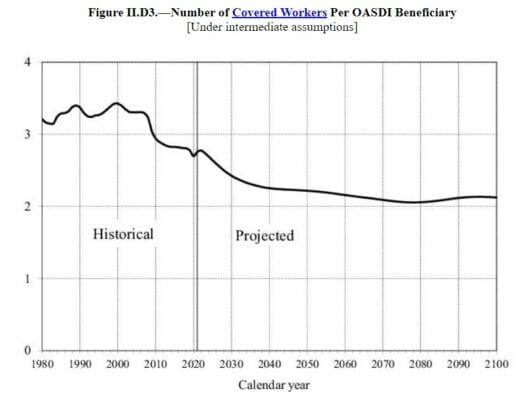

If you have a job right now, then you’re either Mark or Erin. Every paycheck, you have money withheld that helps keep the Social Security system afloat. In the early days, there were 20 workers just like you depositing into the system for every one retiree receiving benefits. Over the years, that ratio fell to 15:1, then 10:1, then 5:1. And now, there are just over two workers per beneficiary.

Source: Social Security Administration

The State Of Social Security

Of course, this little analogy flips the real problem upside down. When it comes to Social Security, there isn’t a threat of anything filling up, but rather of it being drained dry. But it inevitably leads to the same conclusion. All taxpayers and retirees are crammed in this boat, which is looking less seaworthy by the minute.

Don’t take my word for it. Here are some highlights, excerpted straight from the Board of Trustees latest annual report:

- During the year, an estimated 179 million people had earnings covered by Social Security and paid payroll taxes on those earnings. The total cost of the program in 2021 was $1,145 billion. Total income was $1,088 billion.

- Under the Trustees’ intermediate assumptions, Social Security’s total cost is projected to be higher than its total income in 2022 and all later years. Total cost began to be higher than total income in 2021. Social Security’s cost has exceeded its non-interest income since 2010.

- The ratio of reserves to annual cost is projected to decline from 230 percent at the beginning of 2022 to 74 percent at the beginning of 2031.

- The OASI Trust Fund reserves are projected to become depleted in 2034, at which time OASI income would be sufficient to pay 77 percent of OASI scheduled benefits.

In other words, the Social Security system has been running a shortfall ever since 2010. And the deficit is projected to get wider with each passing year.

You don’t need a Ph.D. in mathematics to understand that this dire situation is untenable.

Of course, the government can use creative accounting to help plug some of the gaps. But the interest earned on the $2.8 trillion cash surplus built prior to 2010 is no longer sufficient to cover the shortfall and the trust fund will have to start selling off assets to maintain benefits.

That’s when things really start getting ugly. And simple demographics mean they will only get worse from there. Every day, 10,000 Baby Boomers reach retirement age of 65 and are eligible to start drawing benefits. That’s 300,000 fewer people paying money in each month — and 300,000 more taking it out.

According to experts, the Social Security trust fund will be exhausted (i.e. no bond assets left to sell) by 2034. At that point, there will only be enough ongoing tax collections to pay out 77% of promised benefits. The government will have no choice but to hike payroll taxes or slash benefit payments by 23% across the board.

Source: Statista

No Good Options — It’s Time To Take Charge

Neither alternative is appealing.

Retirees are already howling mad because payments (which are adjusted for inflation) don’t always get a cost-of-living increase every year. But there is a huge difference between a 0% increase and a 23% decrease. Next year, however, retirees could bet a raise by as much as 9%, thanks to record-high inflation. The COLA increases are usually announced in October.

Imagine if an independent money manager approached you with a 401(K) proposal. But instead of a menu of investment options, you have zero control over the assets. They are invested in Treasury Bonds earning next to nothing, so your assets don’t grow over time. You also have restricted access to your money, and can’t transfer it elsewhere. Ever.

There is also a decent chance your future proceeds will be cut at some point. Remember, these “benefits” are not Uncle Sam’s generosity, but simply a return of your own money. Except in this case, you can’t pass any of it down to children or grandchildren. And if that wasn’t bad enough, any withdrawals might be taxable — even though you were already taxed on the deposit.

Nobody would willingly volunteer to sign up for a program like this.

Yet, every paycheck you have money forcibly withheld (some would say confiscated) whether you like it or not. And neither political party wants the fallout from enacting the reforms to make it solvent once again.

Advocating for a reduction in benefits is tantamount to political suicide. And it’s hard to ask hardworking families to surrender any more in payroll taxes than the current 12.4% (split between employer and employee).

We could raise the retirement age to 70 as some have suggested. But I don’t relish the idea of punching the clock that long. There just aren’t any easy solutions. And that’s why there hasn’t been any real legislative push to shore up Social Security since 1983.

Closing Thoughts

Personally, I’m not relying on Uncle Sam to meet my retirement needs. If there is still money in the system in 2034, that’s great. But at the rate the system is hemorrhaging money ($230 million per day), I’m taking charge of my own financial future well before then.

The key is to have a second income source that is free of the shackles and restraints of Social Security. Regardless of what happens in Washington, this revenue stream can put extra cash in your pocket each year. You also have the option of taking a lump-sum payment every now and then (maybe to pay for a vacation). And any assets that remain unspent can be passed down to the beneficiary of your choice.

That’s the power you have in your hands when you make the choice to take charge of your retirement. It won’t always be smooth sailing, but it’s one of the most important things you can do for yourself and for your family.

That’s why I’ve made it my life’s work to tell readers about the power of owning quality businesses that pay stable (and rising) dividends.

And that’s where my latest research report for High-Yield Investing comes in…

You’ll find five stocks with market-crushing yields… All of them have proven track records… In fact, they’re some of the strongest, most reliable, and generous income payers in the history of the market… Each one has delivered outstanding long-term returns, and I have little doubt they’ll continue to do so for years to come. Go here to check them out now.