Our Income Expert Weighs In On The Crazy Housing Market (And More)…

Earlier this week, we spent the bulk of our issue talking about the Fed’s latest decision to raise interest rates by 75 basis points, the prospect of future rate hikes, and the implications for the broader market.

I also touched on some of the ramifications of the Fed’s policy decisions on the housing market. (In short, it’s getting wild out there.)

My colleague Nathan Slaughter, Chief Investment Strategist of High-Yield Investing, recently shared some timely insights on this topic with his premium readers, so I decided to chat with him this week and learn more. My questions are in bold.

Enjoy,

Brad Briggs

StreetAuthority Insider

We’ve gained some new readers recently who might not be familiar with your background. Can you tell us a little about how you got into this business?

I got hooked on the market at an early age. In junior high, my school sponsored a stock investing contest. Each student picked one ticker symbol, and we followed it daily in the newspaper (incidentally, this was when stock prices moved in fractions of a point, not decimals). After a month, the top performer won a real stock certificate for a single share. I chose IBM and was the winner. It was sheer luck, of course, but it always stuck with me.

I got hooked on the market at an early age. In junior high, my school sponsored a stock investing contest. Each student picked one ticker symbol, and we followed it daily in the newspaper (incidentally, this was when stock prices moved in fractions of a point, not decimals). After a month, the top performer won a real stock certificate for a single share. I chose IBM and was the winner. It was sheer luck, of course, but it always stuck with me.

Fast-forward to 1997, I got a job with AXA/Equitable Advisors. The job was commission-based, so I made peanuts in the beginning. My colleagues were more driven by the insurance side of the business, but that held zero interest for me. I wanted to manage money, so I became the first in my district to pass the Series 7 exam, licensed to sell individual stocks and other securities. I had a front-row seat to the birth of exchange-traded funds, the dot-com crash, and many other major market/economic events.

I left AXA in 2001 for a regional brokerage firm, Morgan Keegan, which offered much better tools and resources. It felt like getting called up to the Major Leagues. But they wanted brokers to spend 99% of their time in the field meeting prospective new clients and 1% actually managing the assets, which left me disillusioned. I was more interested in company research, economic reports, and investment performance than cold calls and country club brunches. So I left in 2004, started writing about the market, and never looked back.

What are some of the things you learned about investing and money growing up that have stuck with you over the years?

Well, first, I would say that my father instilled the importance of saving and taught me the power of compound interest.

Another thing is entrepreneurship. My parents were second-generation small business owners, and I saw firsthand the kind of work it takes to build a successful business.

Growing up, I had a series of part-time jobs (including selling Christmas trees in high school). After college, I became a licensed financial advisor helping clients set financial goals, build portfolios, and grow their assets. But years later, I had the crazy idea to start my own business — a craft beer and homebrew supply retail store.

I can say without a doubt there’s no better way to understand the inner workings of the business world than running one yourself. Very rewarding, but also far more work than most people realize.

You recently wrote about the rapid decline in mortgage activity here. Are we headed for a housing bust? Care to share the Reader’s Digest version of what you told your premium readers?

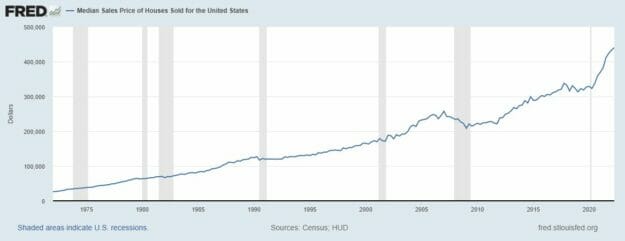

Sure thing. Look, it’s pretty simple. As you can see from this chart, prices were on a steady uphill climb for decades, but the pandemic really sent things into overdrive.

The typical American home costs about $449,000 these days. Just two years ago, the median home price stood at $322,000. That might be doable for some folks — that is, if mortgage rates were what they were last year. But they’re not. In fact, they have been rising even faster than home prices. According to Freddie Mac, the average rate for a 30-year loan rose to 6.29%. That’s double what they were last year — and the most since the 2008 financial crisis!

Source: Federal Reserve Bank of St. Louis

To understand the implications, let’s crunch some numbers…

Let’s say you purchase a $500,000 home with a standard 20% down payment. The monthly principal and interest due at 4% (financing $400,000) would be $1,910. A one percentage point increase to 5% would raise the monthly payment to $2,147. At 6%, you’re talking about $2,398 each month.

I’m being extremely conservative with my example here. Many people who easily got 3% during the pandemic would be lucky to get 6% today.

That sounds pretty rough on its own. But when you combine this with elevated prices, it starts to get crazy. Before Covid, an average home under an average mortgage would have cost about $1,100 per month. Today, the same property would run $2,150. That’s over $1,000 more per month or $378,000 over the life of the loan. And that’s before you include property taxes or homeowners’ insurance.

The point is people are being priced out. I don’t know if that means we’ll have a full-on housing bust, but prices will have to start coming down soon.

So what’s the play here for investors?

That’s easy. Rental properties. A recent Rent.com survey found that almost 80% of respondents plan to stick with their current accommodations and have no plans to buy a house. Another poll found that regardless of savings, nearly one-in-five Millennials intend to be “forever renters.”

There’s clearly a generational mindset shift going on, outside of the cost problem I outlined above. Whatever the reason, there are several ways we can play this as income investors.

Single-family housing has some appeal, but I’m holding off until we get some clarity about the market. In my mind, multi-family is where it’s at.

My latest pick over at High-Yield Investing is a multi-family REIT that owns thousands of apartment units in core coastal metro areas like Los Angeles, Miami, Boston, and Washington, DC.

This is purely a rent-collecting landlord that only deals with stabilized properties. We’re talking about high-quality communities with premium furnishings, plush amenities, and prime locations close to large employers and desirable school districts. This property class tends to attract higher-income tenants and generally commands better rental rates.

It’s a best-in-class operator that should throw off a solid stream of income for years to come.

Editor’s Note: If you’re looking for more mouth-watering yields to add to your portfolio, then that’s where Nathan’s latest report comes in…

Nathan and his team have spent countless hours researching the dozens of holdings that make up the High-Yield Investing portfolio. But if you could only pick five to own, these would probably be it…

That’s because they’ve weathered every dip and crash over the last 20 years and still handed out massive gains. So if you who want to “keep it simple” and worry less about the market, then you need to know about these five safe, high-yield securities right now.