Want To Build Wealth? Let Your Portfolio Pay You Over Time…

Before we get into today’s issue, I want to take a moment to wish each and every one of you a Happy Thanksgiving.

This year, the holiday takes on a whole new meaning for us, as it will be the first one with our newborn baby. We’re also thankful to have sold our old house near the peak of the market, lock in a low interest rate for our new place before they skyrocketed, and be able to move in and make renovations before our baby was born.

I’m also thankful for being able to write about the stock market for a living and edit for some of the best analysts in the country.

For today’s issue, here’s a classic essay from my colleague Nathan Slaughter, chief strategist of High-Yield Investing, about the importance of dividend reinvestment and compounding. We hope you enjoy.

We’ll be back in full swing next week. In the meantime, whatever your plans are, do yourself a favor and take some time to unplug from everything if you haven’t already. Spend some quality time with family. The market will be here when you get back.

Happy Thanksgiving!

Brad Briggs

StreetAuthority Insider

Want To Build Wealth? Let Your Portfolio Pay You Over Time…

In all of my years in the market, it’s the most lucrative investing strategy I’ve ever found. It won’t make you rich overnight, but I’m convinced that anyone can earn a significant amount of money by investing this way.

In all of my years in the market, it’s the most lucrative investing strategy I’ve ever found. It won’t make you rich overnight, but I’m convinced that anyone can earn a significant amount of money by investing this way.

Today, investors have a ton of options when it comes to investing their hard-earned money. From high-growth tech names to sophisticated options strategies to algorithmically-designed funds, the choices are endless.

There’s nothing wrong with any of these, necessarily. It’s just that you just can’t beat the simplicity of owning a basket of high-quality dividend payers.

If you’re a regular reader, then you know I’ve shared the details behind the strategy we use over at High-Yield Investing before.

But allow me to explain just how powerful it can be…

Consider your typical income portfolio. It holds a position in a few dividend payers and maybe a fund or two. You get paid occasional dividends, that’s for sure. But because you only hold a few positions that pay quarterly dividends, the income you receive is inconsistent.

That’s where our High-Yield Investing strategy is a little different. The goal, for most of our subscribers, is to build a high and steady stream of income. And if you were so inclined, you could even build out a portfolio that pays a dividend for every month of the year.

Some of my subscribers do just that. And that total will grow with each passing year thanks to the power of reinvestment…

At the same time, I’m generating yields of 6%, 8%, and even 10%… at a time when interest rates — which fuel the yields on most “normal” income investments — are close to the lowest they’ve ever been in history.

There’s a major caveat, though. And it’s one that will cause most investors to never take the first step to start their own income-driven portfolio. Most investors don’t have the most important characteristic that allows you to earn the greatest amount of wealth with this strategy — patience.

Use Time And Patience To Grow Your Wealth

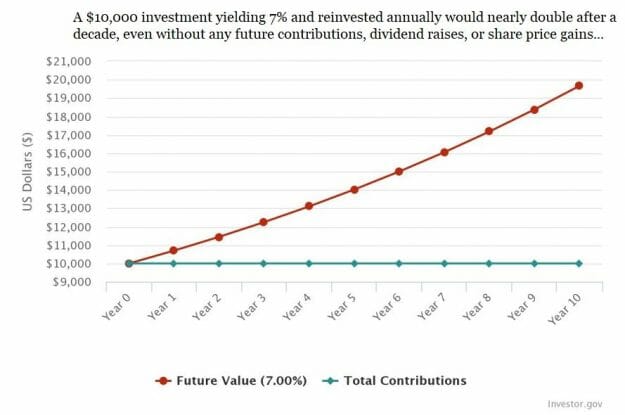

Take a $10,000 investment. In a portfolio that earns an average yield of 7%, that amount would earn $700 in dividend income during the year. I wouldn’t sneeze at $700, but it’s just a fraction of what you could earn if you simply let your portfolio pay you year after year.

The table below shows exactly what I mean. It shows how much you’d earn… if you have patience. As you can see, even modest amounts can generate substantial dividends over time.

Your $10,000 investment would earn a staggering $7,000 in dividends in a decade. And that amount is before any capital gains and ignores any dividend increases.

But it gets even better. Many of my subscribers use dividend reinvestment — a criminally underrated, yet powerful way to increase your long-term returns.

Just take a look at what dividend reinvestment can do to that $10,000 in just a decade.

Action To Take

I want to make something clear… this isn’t a “get-rich-quick” scheme. You aren’t going to invest a few thousand dollars and be buying expensive sports cars or going on exotic vacations. At least, not yet…

But I think that’s part of what makes this style of investing so powerful. It’s not overly complicated – anyone can do it.

Now, are you going to be able to find a 7% yield in this market? Well, it depends. Sure, the average S&P 500 stock yields less than 2% — but, trust me, the high yields are out there if you know where to look…

Besides, most of our readers have more than $10,000 to work with — and this example is purely hypothetical. It doesn’t take into account price gains, dividend raises, or any additional investment.

The point is, if you want to become wealthy in the stock market, it’s probably not going to happen overnight. The key is finding stocks that will pay you consistent dividends… and having the patience to let them grow your wealth over the long-term.

Truth be told, there’s a lot more to share about what we do over at High-Yield Investing. My team and I have built a solid portfolio full of market-beating yields that can be used for investors of all portfolio sizes and stages of life. But with a little patience (and dividend reinvestment), you could be on your way to earning tens of thousands in dividends a year.

Go here to learn more about our top picks and how to get started.