Insiders Love These 5 Little-Known Stocks

There are many reasons investors might get bullish about a company: high yields, low valuations, strong growth or simply a product they like. Ultimately, though, we invest because we want a company’s shares to make money for us, via price appreciation and, in many cases, a dividend. There is no stone left unturned in trying to find a stock that can potentially appreciate faster than the market.

| —Recommended Link— |

| URGENT NEWS: Experts Warn Your Pension Is “A Disaster Waiting to Happen” Save your retirement from miserly interest rates and an overstretched stock market with our special “Executive Dividends” Program… Learn more inside. |

But who knows more about a company than its insiders: senior management, various executives or members of the board of directors? They are intimately aware of a company’s ultimate direction, its prospects, and they should understand way better than you and me its investment story and outlook.

Insider trading is regulated (for instance, insiders cannot just buy or sell shares in their companies — they have to get preapprovals for any such transactions), which means that #-ad_banner-#insider activity can be followed via regulatory filings.

The Screen

With this in mind, I went on a search for small- to mid-sized U.S. companies ($1 billion to $10 billion market capitalization) that have experienced the largest insider buying sprees over the last month.

The premise is simple. If insiders are buying shares in this market, which has been trading at or near record-high levels, this means one of two things: Either these insiders are uniquely bullish or the shares of those companies are attractively valued.

I should note that I ran this screen on Monday, October 8, just before the market’s sharp drops, so the results wouldn’t be skewed by any temporary share-price “bargains.”

Here’s what I found…

As of 10/8/18

A couple of important observations.

First off, while the total amount of insider buying may not seem too large, remember that it’s only a one-month total.

Second, it’s the relative amount that matters: even among the top five, insider buying declines from as much as 0.3% of the total market cap (and nearly $3.3 million in total) for Revlon (NYSE: REV) to as little as 0.08% of the company’s total market cap for Magnolia Oil & Gas (NYSE: MGY) and Independent Bank Group (Nasdaq: IBTX).

Finally, all five companies in the table had large insider purchases during the period in question, relatively speaking. The #6 company in my screen had seen only about half of the insider buying of the #5 company, IBTX, and only 13% of REV, the #1 insider-buyer small-cap company of the four-week period.

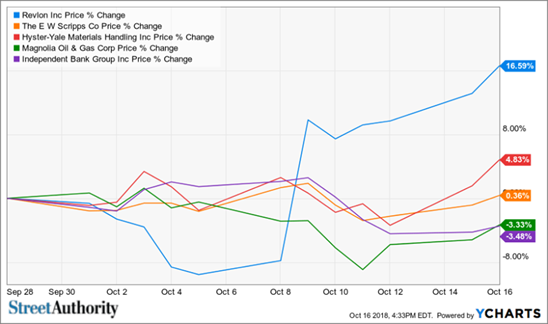

Cosmetics maker Revlon also stands out in another respect: this company is 85.7% controlled by insiders (and 85.18% of that is owned by one person, Ron Perelman). I’m not sure we can fully trust insider-buying signals from such a closely-owned company — but the market surely has: shares of REV have ignored the market volatility of early October, rallying more than 16% in the first 16 days of the month (vs the market’s 3.5% decline).

While the amounts of insider purchases for Magnolia Oil and Gas (NYSE: MGY), an independent oil and gas producer, and Independent Bank Group (Nasdaq: IBTX), a Texas-based commercial bank, are among the top five for the month, there is nothing in these two companies that I find interesting enough or potentially relevant to our Game-Changing Stocks mandate — which is to find companies on the cutting edge with the potential to deliver big-time gains. So I’m leaving these two companies off my watch list for now.

| —Recommended Link— |

| LEAKED: Secret List Reveals Top Growth Stocks To Buy Now Private clients have been getting this secretive research for years, using it to make gains of 310%, 452%, 569%, and more… Now, a small research outfit is leaking THE LIST to the public. Take a peek at it here… |

Insiders also liked EW Scripps (NYSE: SSP) and Hyster-Yale (NYSE: HY).

HY, a lift-truck manufacturer whose shares declined 23% year-to-date, does seem to present a bargain. Whether it’s a true bargain (as HY’s insiders seem to believe) or a value trap remains to be seen. However, some of HY’s business can surely qualify it as a forward-looking company: it has a high-potential fuel cell business, run under the brand name Nuvera. Thanks to this fuel cell potential, I’m also adding HY to my watch list at this time.

SSP, one of the nation’s largest independent TV station owners, has managed to remain relevant and innovative after 140 years in business: its portfolio of assets stretches from TV stations (33 at last count) to news (SSP owns the next-generation national news network Newsy) to podcasts (the company also owns Stitcher, the industry leader).

SSP is an interesting company; I’ll add it to my watch list as a potential addition to the Game-Changing Stocks premium portfolio and will let my readers know if it passes further muster.

Want More Picks Like This?

At the end of it all, we’re left with two interesting companies that are worth researching further.

But keep in mind that the investing ideas I present here are intended to provide a starting point for further research, not a final recommendation. As with any quantitative tool, this stock screen should not be used in isolation. Please make sure to evaluate fundamental characteristics of every potential investment opportunity to determine if it is a right fit for your portfolio.

My Game-Changing Stocks subscribers know all too well what it takes to find a true game-changer. Even after a screen like this, there is still a lot of research to be done before my staff and I feel confident in making a recommendation. That’s a big reason why we’re currently sitting on gains of 60.8%, 85.9%, 105%, and 166.2% in our portfolio. If you’d like to see our latest research, and get access to our entire list of current picks, go here right now.