How To Deal With A Spike In Volatility

One of the things investors fear the most is volatility.

And now that volatility has reared its ugly head again in the markets this week, it’s worth looking back and examining just what exactly makes a market “volatile,” and what we can do about it…

| —Recommended Link— |

| 3 Minutes to Collect 12 Times More Money Than Social Security Just make this simple little 3-minute call and you can get set up to start collecting your checks. All told, your checks can add up to $225,326 over the next 25 years. Imagine that! And these checks are supported by $1.75 billion in new money every year. But you must act right now… because the next wave of checks will be sent out in just a few days. Click here for the details. |

What Is “Volatility”?

The most commonly used metric to measure market volatility is the Cboe Volatility Index (VIX), commonly referred to as the “fear gauge” or “fear index.”

The VIX is a benchmark of expected volatility over the next 30 days in the S&P 500 index. It’s calculated by the Cboe Options Exchange, using the mid-point of real-time index option bid/ask quotes.

It’s not perfect — but what is? Investing is an imperfect science, to the extent that some call it an art.

Volatility has long been considered a contrarian indicator, i.e., “When the VIX is high, it’s time to buy. When the VIX is low, look out below.”

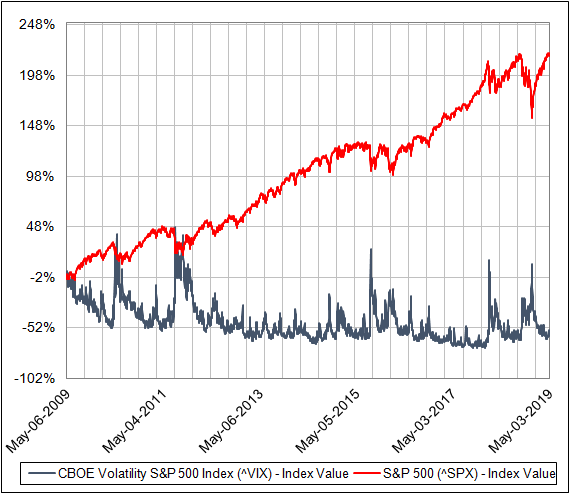

But the persistently low volatility of a more stable market has seemingly belied the reality of this mantra. Long stretches of very low levels of the VIX for years now have not translated to “sell.” That’s partly because a very low VIX creates an atmosphere of panic-avoidance and thus, as the chart below shows, can last a very long time.

Selloffs, however, have been more consistent. In the past decade, as can be clearly seen on the chart, market declines have coincided with the VIX climbing — and the peaking VIX has served as a relatively reliable buying indicator.

As with many things in the market, of course, this is perfectly clear in hindsight. For example, in the aftermath of the fourth-quarter market selloff last year, the VIX had set a climactic high of 36.07 on December 24; it was all downhill for the VIX from there (and uphill for the major market indices). But nobody could tell, on Christmas Eve, whether the VIX would stop there.

Of course, there isn’t a way to tell ahead of time what will happen with the market or with market volatility. This uncertainty is what makes investors nervous, especially those who’ve lived through market bubbles and the two horrific bear markets of the past two decades.

How To Deal With Volatility

While it’s not possible to consistently time the market’s ups and downs, it is possible to put the odds in our favor.

One way to make this happen is to actively manage portfolio positions as the markets (and stock valuations) climb. This is the method I employ at my Game-Changing Stocks premium newsletter — taking opportunistic gains while choosing which positions have, in my view, the strongest potential to appreciate the most from this point on.

This strategy is not without its drawbacks. One is the potential for a so-called “opportunity loss” — selling a stock into strength in a still-strong market might mean leaving some money on the table. On the other hand, as the saying goes, nobody has ever gone broke by taking a profit.

At some point, I might even take the more drastic step of establishing trailing stop-loss protection for some positions in the portfolio. There are some negatives and positives to this strategy (which I will discuss in detail in upcoming issues); for now, though, I feel that the strategy of taking a few gains every now and then while keeping a core of the portfolio intact is working to our benefit.

How Buffett’s Latest Moves Can Guide Us Through Volatility

To illustrate my point, let’s also take a quick look at that of Warren Buffett, arguably the most successful investor alive.

Famously, Buffett does not like investing in tech — and this is why it’s a big deal that his Berkshire Hathaway (NYSE: BRK-B) has been buying the shares of Amazon (Nasdaq: AMZN). The news broke last week and the purchases will be duly reported in a regulatory filing later this month, Buffett said in a CNBC interview. And while the decision to buy Amazon for the Berkshire portfolio wasn’t made by Warren Buffett himself, he has clearly approved the move.

Here is what I learned from this transaction…

1. There is no reason to rigidly stick to a set of rules, even if they served you well for decades. The world changes, the economy changes — and investing rules can change, too.

2. There is also no reason to betray everything you stand for — or forget everything you know about investing. In this case, Amazon is not the same company it was just a couple of years ago. Utterly dominant and profitable, it fits at least some of the investment criteria Buffett has been following for years.

3. Don’t be afraid to admit you’ve made a mistake. It can be costlier to ignore a mistake than to admit it and move on.

4. And, finally, there is nothing wrong with buying a stock that has rallied multifold if your research shows that this stock is headed even higher.

Action To Take

Let’s take these lessons into consideration and continue to make our portfolios stronger and healthier despite — and maybe even thanks to — the volatility. Market volatility, as scary as it can be, can also be used to our advantage as it creates buying opportunities otherwise absent in the current bull market.

In the meantime, I’d like to invite you to check out my latest research report about a revolution that’s quietly taking place in the area of “personalized medicine.” From genetic editing to potentially extending the human lifespan by decades (and the companies behind this technology), you’re going to want to hear what my team and I have found in this exclusive briefing. Go here to learn more…