Yes, I’m Worried About The Market. Here’s Why…

Generally, I believe, people are optimistic by nature. Many of us always look for that proverbial silver lining. That is especially true when it comes to investing.

Optimism explains the popularity of buy-and-hold investing. Individuals following this model say things like, “Prices always come back.” And, so far, prices in the U.S. stock market have always come back.

| —Recommended Link— |

| Dear StreetAuthority Reader, I want you to be the FIRST to hear about this. A stock market “hack” we’ve been tweaking is actually working. I’m talking about gains like +20% in 14 days, +83% in 28 days, +64% in 48 days, +118% in 86 days…+266% in less than a year. Click here to learn more. |

But it took 13 years for the S&P 500 index to fully recover from the 2000 bear market. Prices did reach new highs in 2007 but then fell to new lows. It took 11 years to recover after prices peaked in 1968 and 25 years to recover from the 1929 peak.

#-ad_banner-#In global markets, the track record is worse. Japanese stocks still remain more than 40% below their 1989 highs. That’s an extreme example but it’s been almost 30 years since Japanese stocks peaked.

All of this is to show that, yes, stock prices will almost certainly come back, but an extended bear market can have a significant impact on retirement plans. And, in all honesty, faith that prices will come back won’t lessen the pain of working an extra 10 years. (And while we’re on the subject, selling put options to generate additional income is a great way to create an extra source of money, even when the market is in the doldrums. You’re already on a great path toward being “retirement ready.”)

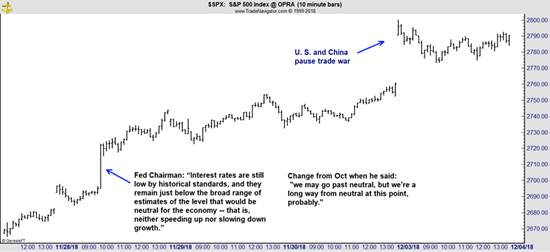

But optimism also drives short-term thinking of many investors. Optimism explains two big moves in the stock market over the past few days, which I’ve highlighted in the chart of the S&P 500 shown below.

This chart uses intraday data to highlight the fact that the large price moves were nearly instantaneous. But let’s look at what really happened.

Back in October, Federal Reserve Chairman Jerome Powell said interest rates were “a long way from neutral.” Then, on November 28, he hinted that he might favor a pause in interest rate hikes. The Fed had not made many changes in its policy between the two statements, which means the only explanation for interest rates going from “a long way from neutral” in October to just below neutral in November is that the pace of economic growth has slowed.

Stock prices jumped at the thought of fewer rate hikes, but the reason for the jump could just be unjustified optimism.

This week’s gain in stocks could also be based on unjustified optimism.

The news that sparked the rally was an agreement between Chinese President Xi Jinping and President Trump to delay new tariffs for 90 days while the two countries continue to talk. American and Chinese officials will continue to work on agreement related to technology transfer, intellectual property, and agriculture.

Hoping that finding a solution to issues have divided the two governments for years in 90 days might be a case of unjustified optimism.

The next chart shows daily data. You can clearly see the shift from pessimism to optimism (and, as of this morning, back to pessimism).

The chart also shows the 200-day moving average (MA) in blue. Just a few days ago, the S&P 500 was trading back above its 200-day MA — a potentially bullish indicator — but prices broke back below this level again this morning (not shown on the chart). A clear, multi-day break above that level would be bullish from a technical perspective, and I’m watching for that. That would provide a reason for optimism. But we’re definitely not there now.

The Takeaway

It is possible that a slowdown in economic growth isn’t anything to worry about. It’s also possible a resumption in the trade war won’t happen in 90 days. But personally, I’m worried, and I will continue to worry as long as prices continue to reflect an irrational optimism. We’ve seen irrational optimism precede major declines in 2008, 2000, 1990, 1987… in fact, before every major bear market.

So, just because we’re seeing moments of optimism doesn’t mean we’re out of the woods. In fact, the fundamentals continue to point to a bear market. But for now, there are still high-probability income opportunities, like the ones we find in my premium service, Income Trader.

| —Recommended Link— |

| Just Released To The Public: 10 Stocks You MUST Own If You Want To Beat The Market Discover the 10 stocks with the most potential to crush the market in 2019. This is your chance to gain access to the definitive guide to beating the market for FREE ($99.00 value). Click here for the full details. |

I think a recent subscriber put it best:

“When I first started using [Amber’s] picks, my goal was to earn $500. Then I quickly realized I can earn at least $1,000 per month. I use the profits to buy more… Not only are your picks excellent with low risk, it teaches you to look for other options on your own, which I have done.”

–Nathan S., West Long Branch

I know you’re probably thinking that to be able to make that much money a month, there must be enormous risk involved. That actually couldn’t be further from the truth.

That’s because we use a proven approach that reliably helps more than a thousand people pocket an average of $565 in less than seven minutes of “work” each week.

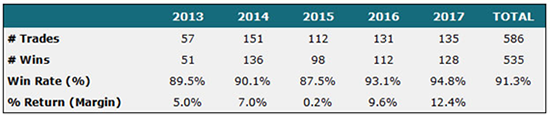

Since I started sharing my strategy back in 2013, we’ve generated a total of $140,490 in income this way.

Not only that, but my subscribers and I have made winning trades 91% of the time. Of course, nobody can be right 100% of the time, but I think our track record speaks for itself…

If doubling or even tripling your income stream sounds appealing to you, you can learn more about how this works right now right here. You’ll also have the chance to join me and my Income Trader readers, and you’ll get access to the award-winning indicator I’ve personally developed to help identify these trades. To learn more, go here.