12 Stocks That Pass The ‘Bollinger’ Test

Almost anybody with interest in investing was glad to see 2018 come to an end. Of course, even as stocks continue to sell off, a selected few manage to buck the trend.

| —Recommended Link— |

| Ex-Military Intelligence Officer Finally Reveals The Secret To Her 90.9% Success Rate Today only, get the system that is helping smart investors like you make massive gains for more than HALF OFF. Hurry, wall street insiders hope to shut this down soon… Click here before it’s too late. |

Such is the nature of the markets — some stocks are attractive because of their perceived safety, some have such good news that even pessimists get convinced, a company or two might have been acquired during the period in question, and a few will attract buyers simply because of dirt-cheap valuation.

#-ad_banner-#In today’s Fast-Track Millionaire stock screen, I’m going to show you those exceptional stocks that have bucked the S&P 500 trend — stocks that are on the move up, not down. Better yet, this screen aims to find stocks with positive trading signals, as defined by one of the most well-known technical indicators: Bollinger Bands.

The theory behind Bollinger bands is quite simple. Based on the moving average of a stock’s share price (most typically, a 20-day moving average), they define the area between this moving average plus (the “upper” band) or minus (the “lower” band) two standard deviations of that average.

If a stock’s price action accelerates, it might break out of the range between the two bands. If a stock breaks through the lower band, this indicates an accelerating selloff and often serves as a bearish indicator. On the other hand, when a stock price breaks through the upper band, indicating an accelerating stock-price increase, this is often seen as a bullish technical indicator.

The below chart illustrates this concept. Basically, it’s a one-year price chart for Procter & Gamble (NYSE: PG), with a few important additions. The 20-day moving average line, as is typically the case, runs approximately in the middle of PG’s price action. The two orange lines “framing” that price action are the upper and the lower Bollinger bands. As you can see from this chart, when PG’s price volatility increases, the band between the two orange lines widens, and vice versa. This is exactly what you’d expect from a measure based on stock price volatility (in this case, 2 standard deviations from a 20-day moving average). And while Bollinger Bands, just as with any other indicator, are not infallible, they have generated a few correct “sell” and “buy” signals for PG over the past year.

Not every stock will follow through, of course, either on the downside or the upside, once the Bollinger bands are broken. But as far as technical indicators go, a break through an upper or lower Bollinger band is one of the better ones.

That’s why I recently went on the hunt for a bullish trend. I went through the Russell 3000 index (the index of 3,000 largest U.S. stocks), in search of companies that, as of the last five trading days (the week ended December 14) traded above their upper Bollinger band at least once. Note that, just as with any technical indicator, this one is time-sensitive (I had to share this data with my Fast-Track Millionaire premium readers first, so it’s a little out of date). It’s also not infallible. And, just as with any other technical indicator, this one does not tell the whole story.

The Results

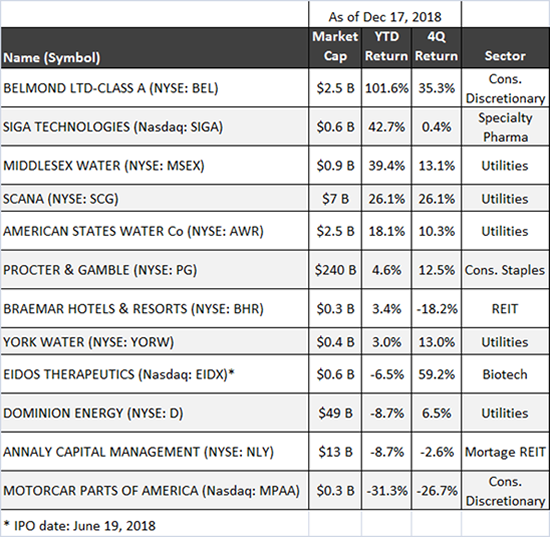

Still, it could be quite educational to see which stocks have been doing better than the rest. Turns out, there are only 12 such stocks that fit the bill. Here’s the list:

Please keep in mind that the investing ideas I present here are intended to provide a good starting point for further research. As with any quantitative tool, my Fast-Track Millionaire stock screen should not be used in isolation. You need to evaluate other fundamental characteristics of every potential investment opportunity to determine if it is right for your portfolio. With that said, let’s take a deeper look…

Five of these companies belong to the utility sector, with three of the five classified as water utilities. Utilities, and especially water utilities, are considered recession-resistant investments.

The two non-water utilities, Scana (NYSE: SCG) and Dominion (NYSE: D), are in the process of finalizing a takeover; because Dominion is an acquirer and SCG is being acquired, it’s no wonder Scana has outperformed. The merger was announced nearly a year ago, on Jan 3, 2018.

| —Recommended Link— |

| The Discovery That Could End Disease As We Know It Ex-Economics Professor uncovers the company that could be on the brink of erasing disease with “custom coded cures” that could add 40 pain-free years to your life… It may sound like science fiction, but this company is turning it into science FACT. The best part is, you could make millions with it. Full story here. |

Procter and Gamble (NYSE: PG) is the consumer staple on the list. This stock might be getting ready to decisively break out of its recent tight trading range.

Luxury hotel owner Belmont (NYSE: BEL), a consumer discretionary stock, stands out from the crowd. But there is a good reason for this: on December 14, it was announced that the company is been acquired by LVMH Moet Hennessy Louis Vuitton, a luxury goods company. This seems to be a result of the company pretty much putting itself out for sale (which it did in early August, 2018).

Among the two real estate investment trusts (REITs) on the list, one — Braemar Hotels and Resorts (NYSE: BHR) — specializes in luxury hotels. Annaly (NYSE: NLY) is a high-yielding stock. The former might have gotten a sympathy boost from traders who like the BEL deal, and NLY seems to have been supported by its big payout.

My Favorites

Finally, of most interest to me and my premium subscribers at Fast-Track Millionaire, are the two healthcare companies on the list — a recent IPO, Eidos (Nasdaq: EIDX), and a medical security company Siga Technologies (Nasdaq: SIGA).

As different as these two companies are — EIDX is focused on a so-called unmet medical need in Amyloidosis, a systemic disorder, and SIGA owns a drug recently approved for treating deadly smallpox — their recent price action reflects investors’ optimism about the companies.

EIDX and SIGA are the ones I like the most out of this 12-stock group. They’ll both be included on my watchlist as potential future additions to the Fast-Track Millionaire portfolio. In the meantime, if you’d like to see what I’ve been working on lately, go here.