The Case For Staying In The Market — Especially Growth

Should I stay or should I go?

If you’ve been singing this 1981 tune by the English punk rock band The Clash to yourself since late September, you are not alone.

In the fourth-quarter selloff last year, U.S. equities lost $4 trillion in combined market value. For those who had chosen to stay and not to go, a sharp market bounce has helped recover much of the losses: after the 17% rally off the December low, the S&P 500 has now returned to early January 2018 levels.

For the tech-heavy Nasdaq 100, the decline was deeper, but the bounce was sharper. At its lowest levels of 2018, the Nasdaq was down 23% from its highs. Since its December lows, though, it has rallied some 19%.

As a result, the Nasdaq is now higher by about 10% from its 2017 levels.

| —Recommended Link— |

| How I hacked the stock market and got away with thousands. Make $30,000 in 2 months exploiting mispriced stocks like Apple, Starbucks and other quality blue chips. Click here for the easy (and legal) secret… |

Hardly a record, but still better than money-market returns.

It Pays To Hold Fast

But stocks are risky, you might say. Yes, they are.

But investors who know their risk-taking capacity and understand their investment objectives and constraints — and allocate assets to stocks accordingly — are positioned to benefit from equities’ long-term wealth-building capabilities.

For most investors, ignoring the unique potential for long-term wealth-building and staying out of the stock markets will end up a much riskier strategy than investing in stocks. Selecting the stocks with the brightest outlook for profit growth — a strategy we employ over at Fast-Track Millionaire — my premium growth newsletter service — is one of those long-term strategies that can also generate strong short-term results. We are in a good shape here.

But let’s get back to that fourth-quarter selloff.

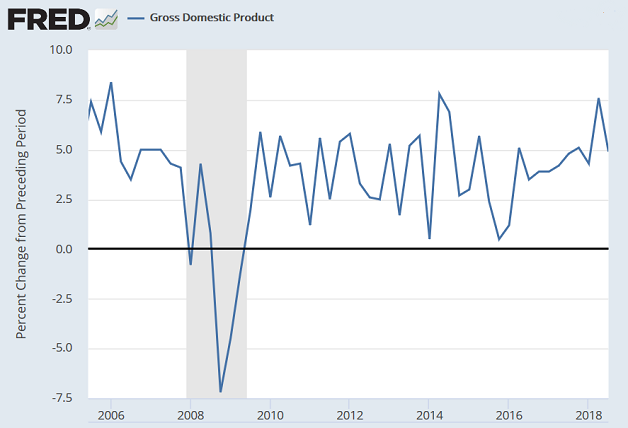

Because the U.S. economy (and, by extension, the best U.S.-based companies) has been pretty much in a non-stop growth mode since the end of the Great Recession, stocks have been enjoying strong profit and revenue growth over these past years.

Source: U.S. Bureau of Economic Analysis

As a result, with the market rallying, valuations have gotten more expensive, but not by that much.

Overvalued Market? Not Really…

At the market’s low in December 2018, the price for the S&P 500 index was kicked back to summer-2017 levels. At the same time, valuations — the esteemed price-earnings (P/E) metric — reverted to the levels of 2013. This has created a bargain and served as the foundation for the market’s bounce.

#-ad_banner-#Could the market have declined more at that time? Of course!

The market is a grand-total of many things, and nobody can tell you for sure when this great aggregate is “ready” to go up or down. But, at a forward P/E of about 14 times, compared with about 19 times in February of 2018, the S&P 500 index became much more attractive in December of 2018 than just a year ago — and so buyers returned in droves.

At last check, the S&P 500 was trading at a forward P/E of 16 — still relatively attractive, valuation-wise.

I’m Still Focused On Growth

Many analysts stress that strong growth just cannot go on forever and that, for now at least, the earning’s growth rate has likely peaked. As of the end of last week, the fourth quarter of 2018 had delivered a 13.3% earnings growth for the S&P 500 companies, according to FactSet. (If 13.3% turns out to be the actual growth rate for the three months, it will mark the fifth-straight quarter of double-digit earnings growth for the index.)

Tech and health-care sectors have continued beating estimates. That’s great news. These particular stocks, with a few exceptions, fit perfectly the goal of Fast-Track Millionaire — finding special opportunities that can appreciate multifold over the life of the investment.

In a nutshell, here’s why adding carefully selected tech stocks to a portfolio can be a valuable proposition in this market… It’s the growth names — like you’ll find in tech — that offer the best chance around for the strongest sales and profit growth — and, therefore, the best chances for accumulating market-beating stock-price gains.

Action To Take

Look, most of you already know that the U.S. economy has been putting on a good show lately (the government shutdown notwithstanding). But the latest quarter’s 4.2% annualized growth — which is basically the average of how everything in the economy grows — pales in comparison with the rate of growth you’ll find at an innovative company (tech or otherwise).

Simply put, the right tech stocks can easily outgrow everything else in the economy. For instance, the average expected profit growth for the companies in our Emerging Tech Leaders portfolio over at Fast-Track Millionaire is 20.9%.

You’ll be hard-pressed to find that kind of growth anywhere else in the market.

My advice: The market is still offering reasonable value, but who knows for sure what will happen next. And if you want true growth that outpaces the market, then you’re going to have to find truly innovative companies to invest in — just like the ones we own over at Fast-Track Millionaire. We’re not going to get every pick right, and neither are you. But we’re seeing some fantastic opportunities in areas like artificial intelligence, the cloud, biotech, and more. I’m convinced that if you do your homework and stay disciplined, this is the area you want to be in the months and years to come.

P.S. If you’d like to learn more about our research — including what could be the biggest profit opportunity of my career, then I invite you to learn more here.